Payroll is one of the most time-consuming and high-risk functions accountants handle for their clients. From processing payslips to ensuring compliance with HMRC’s Real Time Information (RTI) rules, the workload is demanding. Errors can lead to fines, unhappy employees, and reputational damage.

This is why more UK accounting firms are now outsourcing payroll. It saves time, reduces costs, and allows practices to focus on bookkeeping, advisory services and growth. But one of the most common questions accountants ask is: “What is the payroll outsourcing cost in the UK?”

In this guide, we’ll break down payroll outsourcing pricing, the factors that influence costs, and how to choose the right partner. We’ll also explain why outsourcing payroll to Equallto helps accountants deliver Big 4-level quality at a fraction of the cost.

What Does Payroll Outsourcing Cost in the UK?

Payroll outsourcing cost in the UK can vary depending on the provider and level of service. On average:

- Per employee per month: £4–£10 per payslip.

- Flat monthly fee for small businesses: £50–£200.

- Additional services (pensions, HR, compliance): May add 10–20% to the base cost.

For small and mid-sized accounting firms, this model is flexible. You only pay for what you need, and the cost often comes in lower than hiring in-house payroll staff. At Equallto, our payroll outsourcing services are tailored to your firm’s size and your clients’ requirements, ensuring cost-effectiveness without compromising on quality.

Payroll Outsourcing Pricing Models

Understanding the different pricing models is essential when evaluating payroll outsourcing cost:

1.Per Payslip Pricing: A set fee for every payslip processed. Common for small firms with fluctuating staff numbers.

2.Per Employee Per Month (PEPM): A monthly charge per active employee. Ideal for firms with stable payroll.

3.Fixed Monthly Fee: A flat cost covering all payroll runs for a set period. Best for practices managing multiple small clients.

4.Tiered Pricing: The more employees you have, the lower your cost per employee. This model is ideal for growing firms that are adding new clients.

5.Custom Pricing: Designed for more complex needs, like businesses with multiple locations, pension auto-enrolment, or international teams.

At Equallto, we make sure our pricing works for everyone. Whether you’re a small accounting firm running a few payrolls or a mid-sized practice managing many clients.

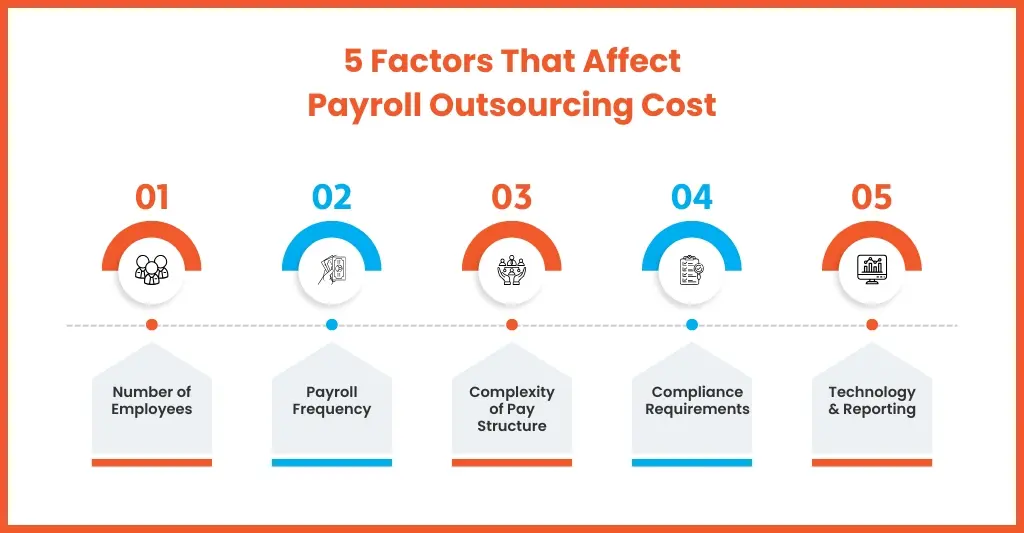

Factors That Influence Payroll Outsourcing Cost

When you outsource your payroll, the price can vary depending on a few key factors. Here’s what usually affects the cost:

1. Number of Employees

The more employees you have, the higher your total payroll cost will be. However, many providers offer lower rates per employee as your team grows, so you might save more per payslip with scale.

2. Payroll Complexity

If your business has different pay rates, overtime, bonuses, or shift patterns, your payroll will be more complex, and that usually means higher fees.

3. Payroll Frequency

Running payroll every week costs more than doing it once a month. That’s because weekly processing means more frequent calculations and submissions.

4. Compliance Requirements

Extra compliance tasks—like handling pension auto-enrolment, student loans, or statutory payments can add to the provider’s workload and slightly raise your costs.

5. Additional Services

Some payroll companies charge extra for year-end accounting tasks such as preparing P60s, P45s, or P11Ds. It’s worth checking if these are included in your package.

6. Technology and Reporting

Modern tools like cloud-based portals, automated reports, and system integrations offer more convenience, but they can come with an added price.

At Equallto, we ensure transparent pricing so you know exactly what you’re paying for, no hidden costs.

Payroll Outsourcing Cost vs In-House Payroll

| In-House Payroll Costs | Outsourced Payroll Costs |

| Hiring payroll staff or training existing accountants | A clear, fixed monthly or per-payslip fee |

| Payroll software subscriptions | Compliance guaranteed by experts |

| Time spent on HMRC submissions and error corrections | Time freed up for client advisory and growth |

| Risk of penalties for late or incorrect filings | Reduced risk with expert handling |

For most small and mid-sized firms, outsourced payroll is 20–40% cheaper than in-house payroll when you include staff salaries, software, and compliance risks. With Equallto, the savings go further thanks to our AI-driven automation plus expert accountants working together to maximise efficiency.

Benefits of Payroll Outsourcing for UK Accountants

Outsourcing payroll delivers more than just cost savings. It transforms how firms serve their clients.

1.Save Time: No more late nights processing payslips or managing HMRC submissions.

2.Stay Compliant: Avoid penalties with up-to-date compliance and accurate RTI reporting.

3.Reduce Costs: Eliminate the overheads of hiring staff or paying for expensive payroll software.

4.Increase Accuracy: With automation and quality checks, errors are minimised.

5.Peace of Mind: You know your clients’ payroll is handled securely and professionally.

At Equallto, our payroll outsourcing services give accountants the freedom to focus on advisory roles while we manage the routine payroll process.

Tips for Choosing the Right Payroll Outsourcing Partner in the UK

Choosing the wrong partner can cost more in the long run. Here’s what to look for:

Experience with UK Accountants: Does the provider specialise in supporting accounting firms, not just businesses?

Compliance Expertise: Ensure they are up to date with HMRC, RTI, pensions, and GDPR.

Transparent Pricing: Avoid hidden costs; ask for a breakdown of payroll outsourcing cost upfront.

Scalability: Can they handle more payrolls as your practice grows?

Data Security: Ensure robust protection of sensitive employee information in line with GDPR compliance guidelines.

Equallto meets all these requirements, providing UK accountants with a reliable partner they can trust.

FAQs on Payroll Outsourcing Cost

1.Is payroll outsourcing cost-effective for small UK accounting firms?

Yes. It reduces overheads, saves time, and avoids compliance penalties, making it cost-effective for small practices.

2.What hidden costs should I check before outsourcing payroll?

Look out for charges on year-end filings (P60s, P45s, P11Ds), pension enrolment, or setup fees.

3.What is payroll outsourcing?

It’s when a third-party provider like Equallto manages payroll tasks, from payslips to HMRC submissions, on your behalf.

4.What are the common outsourcing mistakes?

Choosing a low-cost provider without checking compliance expertise, or not ensuring data security, are common mistakes.

5.What happens when you outsource payroll?

Your provider takes over payroll processing, manages HMRC submissions, and ensures employees are paid accurately and on time.

Conclusion

Payroll outsourcing costs are a big factor for many UK accountants thinking about handing over payroll tasks. The good news is that outsourcing is usually more affordable, accurate, and hassle-free than managing payroll on your own.

With Equallto’s payroll outsourcing services, you get clear pricing, expert help with compliance, and flexible solutions that grow with your firm, all designed to make payroll simple and stress-free. By combining smart automation with professional oversight, we deliver Big 4-level payroll quality at a cost small accounting firms can afford.

Ready to Save 40% on Payroll Costs?

Talk to Equallto’s payroll experts today — schedule your free consultation.