Did you know that Seven out of ten small accounting firms in the UK struggle to keep up with client demands — not because they lack expertise, but because they lack resources? Small accountants and solo practitioners are a crucial part of the UK business world, helping new startups get set up and support local businesses with compliance and everyday finance. But while your role is essential, most of the attention and resources go to the Big 4 firms.

The challenge is that clients now expect the same speed, advice, and compliance expertise from small firms as they would from the big players. Without the same tools, systems, or large teams, meeting those expectations is tough. This often leaves small practices overworked and under pressure to keep up with growing demands.

That’s exactly why small accountants deserve Big 4-level support. In this blog, we’ll explore what that means, the barriers that hold smaller firms back, and how Equallto helps bridge the gap with affordable, outsourced solutions.

What Does “Accounting Support for Small Firms” Mean in a Big 4 Context?

When we think of Big 4 firms, we think of global reach, cutting-edge systems, and expertise across every industry. “Big 4-level support” is not just about scale — it’s about the quality and consistency of service delivered.

For smaller firms, Big 4-level support doesn’t mean huge budgets or massive teams. It’s about having access to the same tools and standards that make the big firms successful. In practice, this looks like:

- Advanced technology that automates bookkeeping, reporting, and compliance so you spend less time on manual work.

- Specialist compliance knowledge that helps you protect clients from HMRC penalties.

- Flexible back-office support that scales up during busy periods and keeps workloads under control.

- Advisory insights that turn financial data into strategies clients can act on.

- Robust quality checks that maintain accuracy and safeguard your reputation.

Big 4 firms may have entire departments for each of these pillars. Small accountants need a partner who can deliver the same outcomes — cost-effectively and flexibly.

Key Pillars of Big 4-Level Support for Small Accountants

Advanced Technology & Automation

The Big 4 firms rely on powerful technology to get work done faster, cut down on mistakes, and give clients instant insights. The good news is small firms don’t need huge budgets to keep up. With outsourced support, you can use cloud accounting software, smart automation tools, and strong tech stack — giving you the same advantages without the heavy costs.

Expert Compliance and Regulatory Knowledge

UK tax rules are always changing. From Making Tax Digital (MTD) to VAT Returns and corporation tax updates, it’s easy to miss something important. For small firms, this can lead to mistakes or even penalties. By working with outsourced experts, you don’t need to worry — they keep track of every change so you can focus on your clients while staying fully compliant.

Scalable Back-Office Support

Workloads aren’t the same all year. During busy times like year-end accounts or tax season, small teams can quickly feel stretched. Instead of hiring full-time staff, outsourced support lets you scale up when needed and scale back when things are quieter. This way, you can manage more clients, meet deadlines with confidence, and keep service quality high.

Strategic Insights and Advisory Support

Clients no longer want accountants to simply “do the books.” They expect forward-looking advice. With the right support, you can provide management accounts, forecasts, and performance analysis that rival the insights of larger firms.

Quality Control and Risk Management

Errors in accounting damage trust. Big 4 firms maintain robust review systems to minimise risks. Outsourced support gives small accountants access to similar layers of review, ensuring accuracy and protecting your firm’s reputation.

Why Small Accountants Rarely Achieve Big 4 Standards

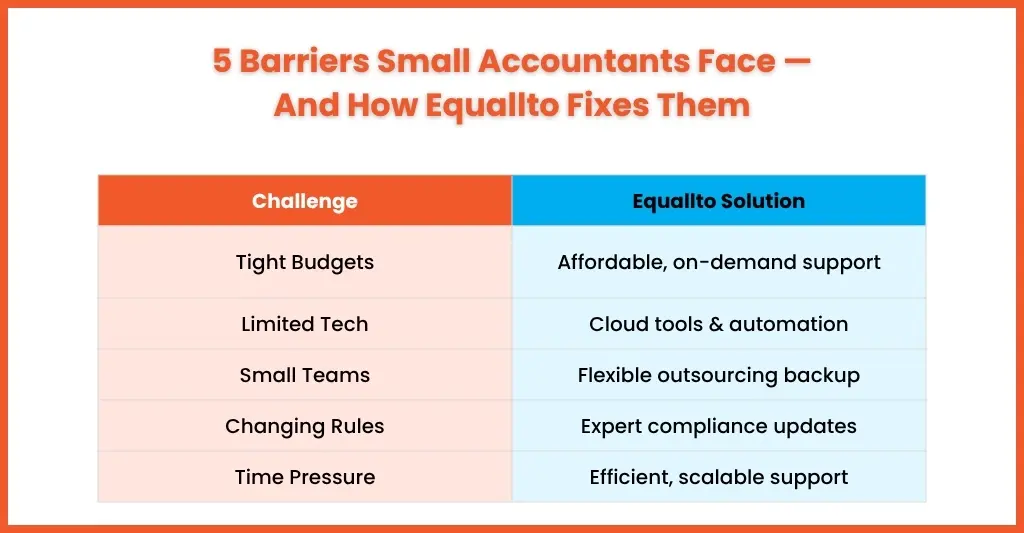

Even the most dedicated small accountants run into real challenges that stop them from working at “Big 4” level.

Tight budgets – The latest tools, software, and training cost a lot, making them hard for smaller firms to afford. This often forces small practices to make do with outdated systems or manual processes.

Limited technology – Small practices often don’t have access to the advanced systems that bigger firms use daily. This can slow down work and make it harder to keep up with client expectations.

Small teams – With only a few people, it’s difficult to manage extra work when deadlines pile up. The pressure can affect both accuracy and turnaround times.

Keeping up with rules – Regulations change quickly, and staying updated means constant learning and training. Without dedicated resources, small accountants can easily fall behind on compliance.

No time to step back – Most accountants are so busy serving clients that they rarely get the chance to focus on strategy or growing the business.

These barriers aren’t about capability. Small accountants have the expertise — they just need the right support to match client expectations.

How Equallto Enables Big 4-Style Support for Small Accountants

This is where Equallto steps in. We give small accounting firms the kind of support normally reserved for the Big 4 — but shaped around your size, your clients, and your budget.

Compliance made easy: We keep up with HMRC rules so you don’t have to worry about missing updates.

Flexible support: Need regular help or just an extra hand during busy periods? Our services scale with you.

Affordable expertise: You get Big 4-level results without paying Big 4 prices.

Tailored to you: No two firms are the same, so we adapt our support to fit your needs and your goals.

Reliable quality: With strict checks in place, you can trust us to deliver accurate results every time.

With Equallto, you’re not just outsourcing — you’re levelling up your firm. We help you compete, grow, and give your clients the top-quality service they expect.

People Also Ask

1.What does outsourced accounting support mean, and how is it different from in-house staff?

It means a firm like Equallto handles tasks such as bookkeeping, payroll, or tax for you. You get expert help when you need it, without the cost of hiring full-time staff.

2.When is the right time to outsource?

It’s a good idea when you’re too busy in peak seasons, turning down new work, or want to grow without adding more employees.

3.How can I choose the right outsourcing partner?

Look for experience, compliance knowledge, clear pricing, and a team that feels like an extension of your own.

4.Can outsourcing deliver Big 4-level quality?

Yes. With the right partner, you get access to advanced technology, expert compliance knowledge, and strict quality checks — but sized for smaller firms.

5. Is outsourcing expensive for small accountants?

No. You only pay for what you need, and it often costs less than hiring staff. It also saves time and helps you avoid costly mistakes.

Conclusion

Small accountants deserve the same level of quality and support as the Big 4. Your clients expect speed, accuracy, compliance, and insights — and with the right partner, you can deliver all of this without the cost of building a Big 4-style infrastructure yourself.

Equallto is here to help you close that gap. Our team provides advanced technology, compliance expertise, and scalable back-office support for your business to grow confidently, serve clients better, and compete at the highest level.

Now is the time to level the playing field. Don’t let size hold you back. Explore how Equallto can provide Big 4-level support for your firm today.