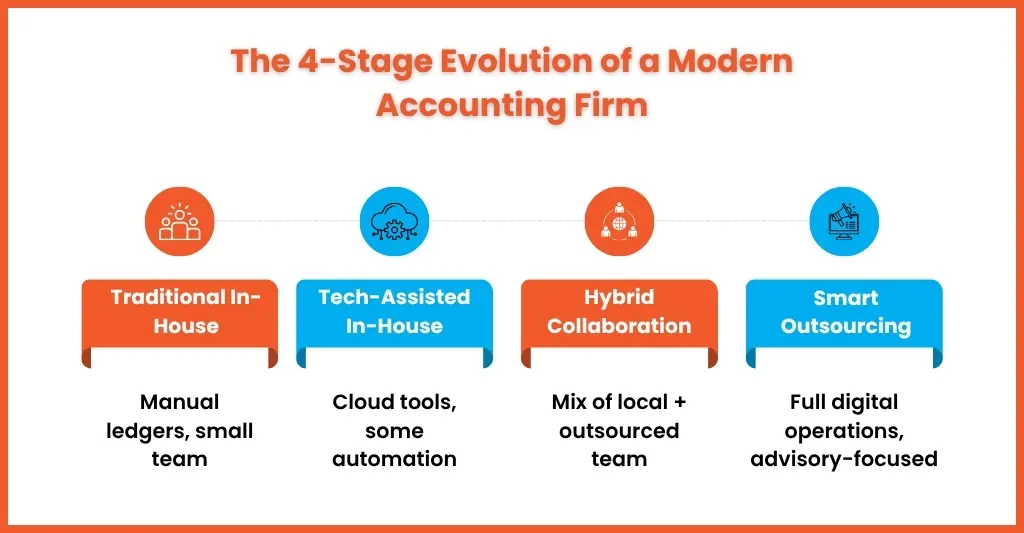

The world of accounting is changing fast. With cloud software, automation and remote working the norm, technology has turned everything on its head when it comes to managing your finances and being compliant. Because of this many UK accounting firms and business owners are rethinking how they run their business, especially when it comes to accounting tasks.

The question of in house accounting vs outsourcing has never been more relevant. Do you hire your own full-time team, work with external experts or find a mix of both?

In this blog we explain what each model means, the pros and cons and help you decide which approach works best for your firm in the in house accounting vs outsourcing debate. Whether you run a growing UK accounting practice, work as an individual or manage a small business you’ll find practical insights to make the right decision.

What is In House Accounting?

In-house accounting means having your own team handle all financial and accounting tasks from within your firm. This includes bookkeeping, payroll, VAT filing (in line with HMRC requirements), tax returns, and management accounts.

It’s a model that offers direct control and close collaboration. Your accountants work closely with your partners, understand your firm’s processes, and are available for quick discussions when needed.

However, keeping an in-house team also means higher costs from salaries and training to software and office space. It’s a good choice for firms that prefer oversight and consistent day-to-day contact but may not suit those looking to scale quickly.

What is Outsourced Accounting?

Outsourced accounting is hiring an external partner or specialist firm to do some or all of your accounting. It could be as simple as bookkeeping or as strategic as having a full finance function outsourced.

This model has grown fast across the UK accounting industry as firms look for cost savings, access to skilled professionals and modern accounting tools. Outsourcing allows you to focus on your clients and business growth while experts handle the routine accounting work accurately and in line with HMRC compliance.

Many firms now combine in-house and outsourced support to get the best of both, keeping control while staying flexible. This approach is becoming more common when comparing in house accounting vs outsourcing.

In House Accounting vs Outsourcing: A Detailed Comparison

Here’s a clear breakdown of the in house accounting vs outsourcing models to help you understand their key differences.

| Factor | In-House Accounting | Outsourced Accounting |

| Cost | Higher, includes salaries, benefits, and office costs. | Lower, pay only for what you use. |

| Expertise | Limited to your team’s skills and experience. | Access to a wide pool of experts and specialisations. |

| Scalability | Harder to expand quickly during busy periods. | Easily scalable based on workload. |

| Technology | You buy and maintain software yourself. | Outsourcing partners provide modern, ready-to-use tech. |

| Control | You manage everything directly. | Shared control, with structured updates and reporting. |

| Compliance | Requires ongoing training for your staff to keep up with HMRC guidelines | Managed by specialists who stay current with HMRC rules. |

| Flexibility | Fixed costs and staff levels. | Flexible, affordable, and easy to adjust. |

In House Accounting Pros and Cons

Running your accounting in-house gives you full control and close connection with your team. It can help you maintain consistency and quick decision-making, but it also comes with higher costs and limits when it comes to flexibility and expertise. Let’s look at the main pros and cons.

Pros

Control: You can see everything and make decisions instantly.

Team Connection: The team knows your firm’s culture and works with leadership.

Access: Easy to talk about issues or make changes on the fly.

Cons

Cost: Salaries, benefits and software subscriptions can be expensive.

Limited Expertise: A small team may struggle with complex or specialised accounting areas.

Scaling Issues: Managing peak workloads like year-end can be stressful without extra help.

Outsourced Accounting Pros and Cons

Outsourcing your accounting can be a smart way to save time, cut costs, and access specialised skills. However, like any business decision, it has both benefits and challenges. Here’s a simple breakdown to help you understand what to expect.

Pros

Cost Savings: You only pay for what you need, no hiring or training costs.

Specialised Knowledge: Outsourced accountants work across industries, bringing more experience and insight.

Flexible and Scalable: You can scale up for busy periods or special projects.

Better Tools: Outsourcing firms use advanced accounting technology that keeps data secure and up to date.

More Time for Growth: Less admin means you can focus on clients and business development.

Cons

Less Direct Oversight: You rely on structured communication rather than face to face management.

Coordination Delays: Different time zones or communication gaps can sometimes slow responses.

Quality Depends on Partner: Choosing the wrong firm can impact consistency and trust.

When you choose the right outsourcing partner, these challenges become minimal. It can quickly turn into one of the best strategic decisions your firm makes.

Which is Better for Your Business: In House Accounting or Outsourcing?

The truth is, there’s no single answer when choosing between in house accounting vs outsourcing. Every firm has different needs, but for many small and mid-sized UK practices, outsourcing offers clear advantages. It helps reduce costs, gives access to skilled accountants, and makes it easier to manage extra work during busy times without worrying about hiring or training new staff.

Outsourced accounting support also gives firms more flexibility. You can choose the level of help you need, scale up during peak periods, and scale down when things are quieter. This keeps your operations efficient and your team focused on clients and business growth.

Many firms today are adopting a hybrid accounting model. They keep client-facing roles in-house while outsourcing routine and time-consuming tasks like bookkeeping, VAT returns, and management reporting. This way, they get the best of both worlds—personal client relationships combined with the speed, accuracy, and cost efficiency of outsourcing.

FAQs: In House Accounting vs Outsourcing

1. Is outsourcing cheaper than in-house?

Yes, most of the time. Outsourcing means no fixed costs like salaries, pensions and software licenses. You only pay for what you use and that keeps budgets flexible.

2. When should you outsource accounting?

When your workload is growing but your internal team can’t keep up or when you need expert help without full time staff.

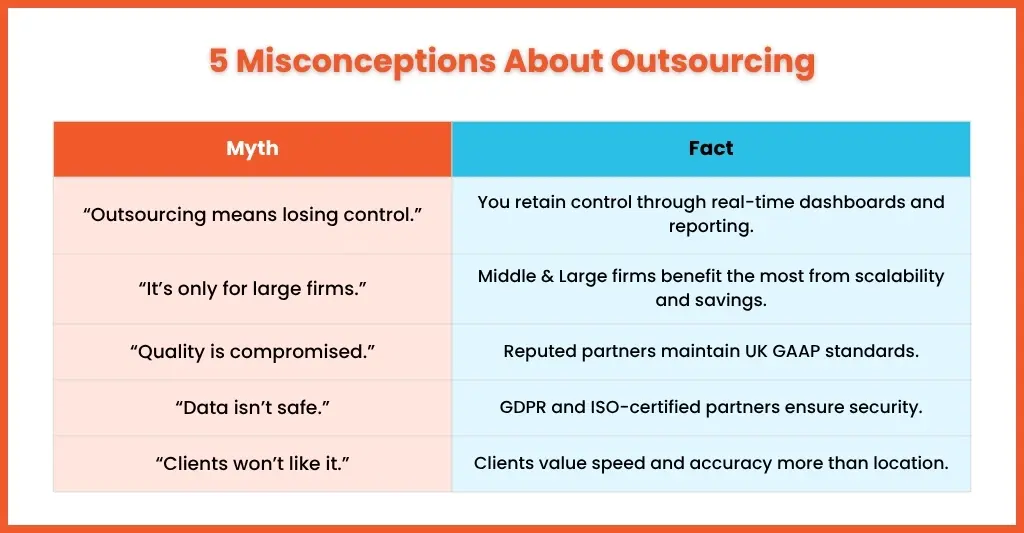

3. What are the risks of outsourcing accounting services?

Poor communication, lack of transparency or weak data protection. These can be avoided by choosing a trusted, GDPR– and HMRC-compliant partner.

4. What should I consider when deciding to do in-house or outsource?

Cost, expertise, time and technology. If you want flexibility and efficiency, outsourcing usually delivers better results.

5. What are the 4 key things to consider before outsourcing?

Cost savings, data security, reliability and communication with your outsourcing partner.

Conclusion: Finding the Balance That Works for You

Choosing between in house accounting vs outsourcing isn’t always a clear-cut decision. Each option has its own strengths — in-house teams offer control and familiarity, while outsourcing brings flexibility, scalability, and cost savings.

For many growing UK accounting firms, outsourcing can be the smarter choice. It helps reduce expenses, boost efficiency, and free up time to focus on clients and growth.

At Equallto, we help firms find that perfect balance with modern, tech-enabled accounting support designed to make operations simpler, smarter, and more effective.

Discover how outsourcing can help your practice grow with confidence.

Book Your Free Consultation with Equallto Today.