Bookkeeping might not be the most exciting part of running a business, but it’s the part that keeps everything together. For sole proprietors and small accounting practices, it means staying on top of payments, invoices, and tax deadlines. It’s also the difference between making smart decisions and flying blind.

But here’s the challenge: bookkeeping takes time. And when you’re juggling clients, admin, and growth, that time quickly disappears. That’s why many small firms and business owners across the UK now look at outsourcing bookkeeping as a smarter, more cost-effective option.

In this blog, we’ll look at the real outsource bookkeeping services cost in the UK, what affects pricing, and how to choose the right partner to suit your budget and workload.

Why More UK Sole Proprietors Are Turning to Outsourced Bookkeeping

If you’re a sole proprietor or a micro-accountant, every hour counts. Handling your own bookkeeping often means spending evenings on spreadsheets or chasing old invoices. It’s easy to lose focus on clients or new business opportunities.

Hiring in-house help might sound ideal, but once you add salaries, NI contributions, and software costs, it becomes a heavy expense for a small setup.

That’s where outsourced bookkeeping UK firms step in. You can hand over the repetitive work — reconciliations, expense tracking, VAT prep, and pay only for the service you need. Many firms offer flexible plans: weekly, monthly, quarterly, or even project-based.

In short, you get professional support without fixed employment costs. You can also scale up or down depending on how busy the season gets. The key to affordability is matching the right package to your actual needs while staying compliant with HMRC bookkeeping requirements.

How Much Does It Cost to Outsource Bookkeeping in the UK?

The Outsource Bookkeeping Services Cost in the UK can vary depending on your needs, the size of your business, and the firm’s experience. However, here are some realistic cost ranges:

- Basic bookkeeping: £15 to £45 per hour

- Monthly packages for sole traders: £100 to £250 per month

- Comprehensive bookkeeping for micro-accountants or VAT-registered firms: £400 to £800+ per month

These figures are a good starting point for understanding bookkeeping pricing in the UK. Let’s look at the main factors that affect cost.

1. Scope of Work

Basic bookkeeping covers transaction entries and reconciliations. Add VAT returns, payroll, or management reports, and the price goes up.

2. Frequency of Work

Daily or weekly updates take more time than monthly or quarterly bookkeeping. The more frequent the service, the higher the cost.

3. Experience of the Provider

A UK-based team with qualified accountants or industry experience may charge slightly more, but you get better accuracy, familiarity with HMRC reporting, and faster turnaround.

4. Technology Used

If your partner uses cloud bookkeeping UK tools such as Xero or QuickBooks, you’ll often save money. Automation cuts down manual hours and makes collaboration easier.

5. Billing Model

Some firms charge hourly, others offer fixed monthly packages. Monthly retainers are usually more predictable for small businesses.

Your outsourced bookkeeping services cost depends on how complex your records are and the level of involvement you need.

Key Benefits of Outsourcing Bookkeeping for Micro-Accountants

Outsourcing isn’t only about saving money. It’s about gaining back control of your time and having confidence that your books are handled correctly.

Here’s why micro-accountants find outsourcing worthwhile:

1. Less Admin, More Focus

Outsourcing takes care of the repetitive work — freeing you to focus on client service, growth, and advisory work.

2. Skilled Support

You get access to experienced bookkeepers who understand UK regulations and use the right tools from day one.

3. Predictable Costs

With clear pricing and defined scopes, you know exactly what you’re paying each month — no surprises.

4. Accuracy and Compliance

Good outsourcing firms follow consistent processes, helping you stay HMRC-compliant without the last-minute stress.

5. Capacity to Grow

By outsourcing, micro-accountants can reduce their outsource bookkeeping services cost per client while maintaining accuracy. This makes it easier to take on more clients without increasing overheads.

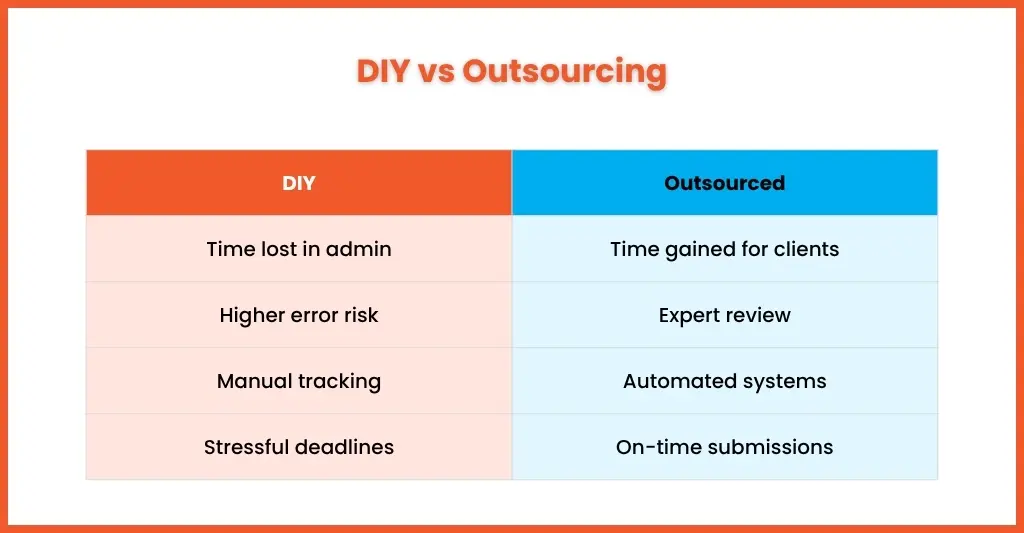

Why Outsourcing is Smarter than DIY Bookkeeping

Handling your own bookkeeping might seem like a good way to save money at first, but it often ends up costing more in lost time, errors, and penalties. Common DIY pitfalls include:

- Inaccurate entries or duplicated transactions

- Lost receipts and incomplete records

- Missed VAT or filing deadlines

- Spending billable hours on admin

When you outsource, professionals handle these tasks efficiently using the right software and systems. You get timely reports and cleaner data to make decisions faster.

Outsourcing also reduces the mental load. Instead of worrying about reconciling accounts every month, you simply review summaries and focus on growth.

Equallto follows a tech-plus-team model, combining automation with expert oversight — so your bookkeeping stays reliable and cost-effective without adding to your to-do list.

How to Choose the Right Outsourced Bookkeeping Partner in the UK

Finding the right outsourcing partner makes all the difference. A good provider will fit into your workflow instead of forcing you to change it.

Here’s what to look for:

Experience

Choose a firm familiar with UK accounting standards and tools like Xero, QuickBooks, or Sage. Experience with similar-sized clients helps speed up onboarding.

Data Security

Financial data is sensitive, so check how your provider stores and protects it. They should comply with UK data protection and GDPR requirements.

Transparent Pricing

Avoid vague quotes. Look for bookkeeping packages UK that clearly list what’s included and how add-ons are priced.

Software Compatibility

Cloud tools make remote bookkeeping simple. Your partner should already use your preferred platform to avoid conversion costs.

Communication and Support

Check response times and whether you’ll have a dedicated contact. Clear communication avoids delays and confusion.

Equallto ticks all these boxes. We support UK accountants and small firms withoutsourced bookkeeping UK services built around flexibility, accuracy, and clear communication. No jargon, no hidden extras — just reliable support that grows with you.

FAQs on Outsource Bookkeeping Services Cost in the UK

1. What is the cheapest outsource bookkeeping services cost in the UK?

Basic packages start from £15–£20 per hour or around £100 a month. This usually includes simple transaction recording and reconciliations. Cheaper options often come with limited support or slower turnaround.

2. Can I outsource bookkeeping if I’m a sole trader using Xero or QuickBooks?

Yes. Most outsourcing bookkeeping firms in the UK use cloud tools like Xero, QuickBooks, and FreeAgent. This makes collaboration easy and reduces manual work, which helps keep costs low.

3. How do I calculate outsource bookkeeping services cost for my practice?

Estimate the number of transactions, how often you need updates (weekly, monthly, or quarterly), and whether you need VAT or payroll added. Multiply that by the average hourly rate or pick a fixed monthly plan that matches your workload.

4. What are the hidden costs to watch out for when outsourcing bookkeeping?

Look out for one-off setup charges, software subscriptions, or fees for VAT or payroll add-ons. A reliable provider will explain these upfront before you start.

5. How often should I review or update my outsourced bookkeeping plan?

Most businesses review their plans every6–12 months, especially after major growth, software changes, or updates in HMRC regulations.

Key Takeaways on Outsource Bookkeeping Services Cost

1. Typical Costs in the UK

Most UK firms pay between £15 and £45 per houror£100–£800 a month depending on their size, complexity, and service level.

2. Efficiency and Value

Outsourcing is often more efficient than in-house or DIY bookkeeping. You save time, reduce admin, and gain access to trained professionals.

3. Choosing the Right Partner

The best results come from a partner that offers transparent pricing, cloud integration, and responsive communication.

At Equallto, we help small firms and accountants simplify their bookkeeping through flexible, clear, and affordable outsourcing models.

We will handle the books — so you can handle the growth.

Get a free quote from Equallto today!