Most accountants know how bookkeeping can take over the day. You sit down to do reviews or client work and before you know it, you’re chasing missing invoices, fixing reconciliations or trying to get the month end done on time. It’s necessary work but it can quickly overwhelm a small team.

For small and mid-sized firms, the pressure is even higher. Staff shortages, tight deadlines and increasing HMRC and MTD requirements mean there’s no room to breathe. Clients want faster reports and more regular updates, which pushes the routine bookkeeping even higher up the list.

That’s why many UK accounting firms are now outsourcing bookkeeping. Instead of hiring more staff or juggling workloads, firms are using trained external bookkeepers to do the day-to-day entries, reconciliations and routine tasks. You stay in control of the client relationship while the outsourced team do the background work.

Quick Summary: Outsourcing bookkeeping work helps mid to small-sized accounting firms reduce workload, improve accuracy and grow without stretching their team.

In this blog, we’ll explain what outsourcing bookkeeping work means, why more accounting firms are doing it, when to outsource and how to get started with a trusted partner.

What Does Outsourcing Bookkeeping Work Mean?

In simple terms, outsourcing bookkeeping work means working with an external team that handles your day-to-day bookkeeping tasks. This normally includes:

- Recording daily income and expenses

- Reconciling bank and card accounts

- Posting journals

- Managing accounts payable and receivable

- Preparing month-end reports

- Supporting year-end schedules

The key point is this: outsourcing doesn’t take control away from you. You decide what needs to be done, you approve the work and you remain the main point of contact for clients. The outsourced team just does the heavy lifting so your internal team can focus on reviews and advisory.

Providers like Equallto work directly with UK accountants using the same accounting software you already use. Whether your firm uses Xero, QuickBooks or Sage the setup fits around your workflow. It’s like an extension of your internal team, without the hiring and training costs.

Why Outsourcing Bookkeeping Work Is on the Rise

More and more small to mid-sized accountancy practices across the UK are outsourcing bookkeeping because of a combination of practical and economic reasons. Here are some of the most common ones accountants mention:

Shortage of experienced bookkeepers

Recruiting the right people is hard and expensive. Many firms spend months trying to fill roles. Outsourcing gives you instant access to trained professionals.

Flexible support during busy periods

Workloads peak in January, April and year end. Outsourcing allows you to upsize during busy periods and downsize when things slow down.

Growing compliance pressure

MTD, VAT updates, payroll changes — everything seems to require more attention than it used to. Outsourced teams stay on top of these changes and keep books updated.

Easy access to better technology

Cloud accounting tools and automation software now make remote working seamless. Outsourcing partners already use these systems daily so your firm gets the benefit without paying extra licence fees.

Together, these factors explain why outsourcing bookkeeping work has become a natural fit for modern accounting firms looking to stay efficient and competitive.

When Should You Consider Outsourcing Bookkeeping Work?

Outsourcing can help almost any practice, but certain signs make it especially clear that the time is right:

1. Your team spends more time entering data than advising clients

If bookkeeping eats most of the week, your internal skills are not being used where they bring the most value.

2. Deadlines are getting harder to manage

During tax season, VAT peaks, and year-end, even strong teams can fall behind. Outsourcing helps keep turnaround steady.

3. Hiring bookkeepers is becoming difficult

Recruitment delays often hold small to mid-sized accounting firms back from taking on more work. Outsourcing fills that gap instantly.

4. You want to grow without taking on more overheads

If you want to grow without adding staff, software or office space, outsourcing bookkeeping work is a solution.

5. Workload is becoming an issue

If delivery varies depending on how busy the week is, a stable external team can help maintain standards.

When these issues arise, outsourcing becomes less of a backup plan and more of the next step.

Key Steps to Start Outsourcing Bookkeeping Work

It’s easier to start than you think. Here’s how to do it:

1. Identify what to outsource

Start with the most time-consuming tasks such as reconciliations, posting entries or month end routines.

2. Choose the right outsourcing partner

Look for experience with UK accounting standards, secure systems and familiarity with the software you use.

3. Set communication standards early

Agree on turnaround times, review cycles, and how queries will be handled. Clear communication avoids delays.

4. Use technology to support collaboration

Cloud accounting systems, shared folders and secure file sharing tools make the workflow smooth and predictable.

5. Review performance regularly

Check accuracy, speed, and how much time your internal team is saving. This helps refine the partnership as it grows.

Most firms start with a few clients or a small batch of tasks, then expand once they see the results.

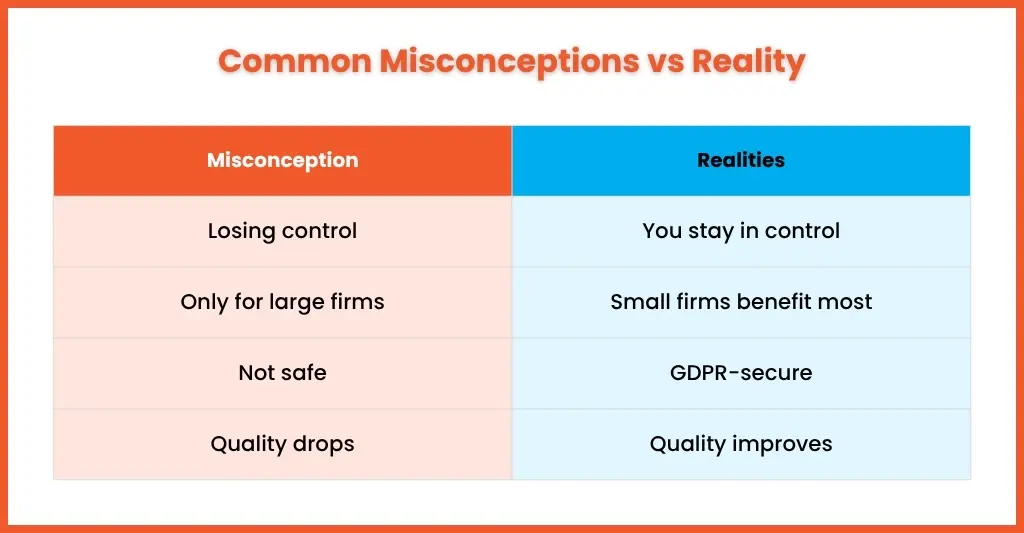

Common Misconceptions About Outsourcing Bookkeeping

Some accounting firms hesitate because of old assumptions. Here are the ones that come up most often:

“We will lose control.”

You keep control of everything. Outsourcing supports your workflow but does not replace your authority.

“It’s only for large firms.”

Smaller firms often benefit the most because outsourcing gives them the extra capacity they cannot afford to hire.

“It’s not safe or secure.”

Trusted partners use encrypted systems, GDPR compliant processes and restricted access, often more strict than internal setups.

“Quality will drop.”

In reality, trained outsourcing teams follow structured processes and often improve accuracy than rushed in-house work.

FAQs

Why outsource bookkeeping instead of doing it in-house?

It reduces pressure on your internal team, improves accuracy and frees up time for advisory, tax work and client relationships.

How much does outsourcing bookkeeping cost?

Costs depend on workload and the complexity. Firms like Equallto offer flexible pricing so you only pay for the work completed.

Can small accounting firms benefit from outsourcing bookkeeping work?

Yes. Smaller firms see the most considerable benefits as it allows them to scale without adding fixed costs.

Is outsourcing bookkeeping work secure and GDPR compliant?

Yes. Reputable outsourcing partners follow strict GDPR rules and use encrypted, secure systems.

Can I outsource only part of my bookkeeping work?

Yes. Many smaller accounting firms outsource reconciliations, AP, VAT tasks, or full monthly bookkeeping depending on their needs.

Conclusion

Outsourcing bookkeeping is becoming one of the most reliable ways for accounting firms to manage increased workloads, keep accuracy high and create space for growth without taking on more overheads. It’s not about replacing your team. It’s about giving them the support they need to focus on the work that moves your firm forward.

For UK accounting firms looking for back-office support, Equallto offers trained professionals, secure systems and a partnership model that fits into your existing workflow.

If you want to take some pressure off your team and build more capacity for growth, outsourcing bookkeeping could be the next step for your firm to move into the next phase. Get in touch with Equallto for a quick, no-pressure chat.