If you run a small to mid-sized accounting firm in the UK & you’ve got a few clients on your books, you probably know about having a “payroll-heavy week” too well. One client will be contacting you at the eleventh hour to update their hours, another will be sending you a query about a pension that they can’t actually remember, and then there’s someone else who’s suddenly realised they need an emergency payslip at the crack of dawn.

By the time you finally get a chance to sit back and enjoy a cup of coffee, half the day has just vanished in a cloud of paperwork. Admin tasks like this are a fact of life, but they all too often cut into the review time, billable work, and high-level advice you want to be offering your clients.

In house payroll vs outsourcing is basically a choice between handling everything yourself or sharing the workload with a specialist partner. In house payroll gives full control. Outsourcing offers support, accuracy, and time savings. The best option depends on your team size, workload, and growth plans.

Payroll has become more demanding for UK accountants because of constant compliance updates, changing HMRC rules, pension duties, and rising client expectations. With tight deadlines and limited staff capacity, many small accounting firms are now reassessing how they manage payroll. Both in house payroll and outsourcing have strengths, but the right option depends on how your practice operates.

This blog will be looking at the main differences between in house payroll and outsourcing, along with the key factors to think about when picking which path to take.

What is In House Payroll?

In house payroll means your small accounting firm handles the entire payroll process internally. Your team is responsible for setting up employees, updating records, calculating pay, processing pensions, and submitting reports to HMRC. Everything from weekly or monthly runs to handling client queries stays within your firm.

Most UK practices use software like BrightPay, Moneysoft, Xero, or QuickBooks to manage payroll in house. Some mid-sized accounting firms have a dedicated payroll clerk, while others divide the work across staff depending on availability. This setup works well when you have a smaller payroll portfolio or when your clients rarely request changes.

The strength of in house payroll is control. You oversee every detail, see every figure, and handle every client directly. But with that also comes full responsibility. Any errors, late submissions, software issues, or sudden changes from clients must be resolved internally. During busy seasons, this can easily add pressure to an already stretched team.

What is Payroll Outsourcing?

Payroll outsourcing basically means partnering with a specialist who can handle some or all of the payroll work for you, instead of having to deal with it all yourself. This basically lets the outside team handle all the nitty gritty behind the scenes, while you are free to keep on building those relationships with your clients.

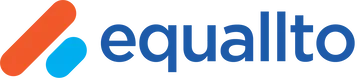

A payroll outsourcing partner will handle all the grunt work like calculations, running payroll on time, sorting out payslips, managing new hires and departures, handling pensions and RTI submissions, preparing journals, and administering the filing for year-end like P60s and P11Ds.

For loads of accounting firms, outsourcing payroll is just like having an extra bit of staff to handle it without the extra financial headache. You get to keep overall control, and run the show when it comes to client communication, while they deal with the day-to-day jobs and deadlines, and ensure that everything you send off is accurate. This can make a big difference to the levels of stress the team and improve consistency in all payroll activity.

Key Differences Between In House Payroll vs Outsourcing

Below is a clear comparison to help you understand how both options differ in daily practice.

| Category | In House Payroll | Outsourcing Payroll |

| Cost | Staff salaries, software licences, training | Pay per client or per payroll cycle |

| Time Demand | High. Daily admin and tight deadlines | Low. Provider handles the workload |

| Accuracy | Depends on team capacity and skill | High. Specialists handle calculations |

| Compliance Risk | Higher. You manage all updates | Lower. Provider tracks HMRC changes |

| Technology | You buy, update, and manage tools | Included as part of the service |

| Data Security | Depends on internal systems | Encrypted, GDPR-level protections |

| Scalability | Limited by team size | Easy to scale up or down |

| Control vs Convenience | More control, more effort | Shared control, smoother workflow |

This comparison highlights why many UK small accounting firms assess in house payroll vs outsourcing when evaluating capacity and future growth.

When In House Payroll Makes Sense for a UK Accounting Practice

In house payroll can work well depending on the type of clients you manage and the structure of your team. It’s often the best option when:

You have a small payroll portfolio

If you only run payroll for a handful of clients, keeping it in house may be simpler.

You want full control

If your clients have unusual payroll needs, in house processing may offer more flexibility.

You already have trained payroll staff

A knowledgeable payroll clerk who knows your clients well can keep things running smoothly.

Your clients have very specific requirements

Niche or bespoke payroll setups sometimes require close internal oversight.

Your internal workflow is strong

If your practice has structured processes, in house payroll can continue working effectively.

When Outsourcing Payroll is the Better Option for Your Practice

For many small accounting firms, outsourcing becomes the better choice once the workload increases or payroll starts affecting the rest of the practice. Outsourcing payroll is usually the smarter option when:

Your workload is growing faster than your team can handle

Busy periods can overwhelm even efficient teams.

You have limited staff capacity

If staff split payroll with other duties, errors become more likely.

Compliance pressure is rising

Payroll rules, pensions, RTI, and HMRC requirements are updated often.

You want more time for advisory and client work

Outsourcing frees up hours that can be used for higher-value services.

You prefer predictable monthly costs

Outsourcing turns payroll into a manageable, planned expense.

You need scalable support

When your client base grows, outsourced teams expand easily with you.

This is where Equallto fits naturally. Our payroll specialists support accounting firms that want accurate, reliable, and flexible payroll services without recruiting or training extra staff.

Practical Tips for Moving from In House Payroll to Outsourced Payroll

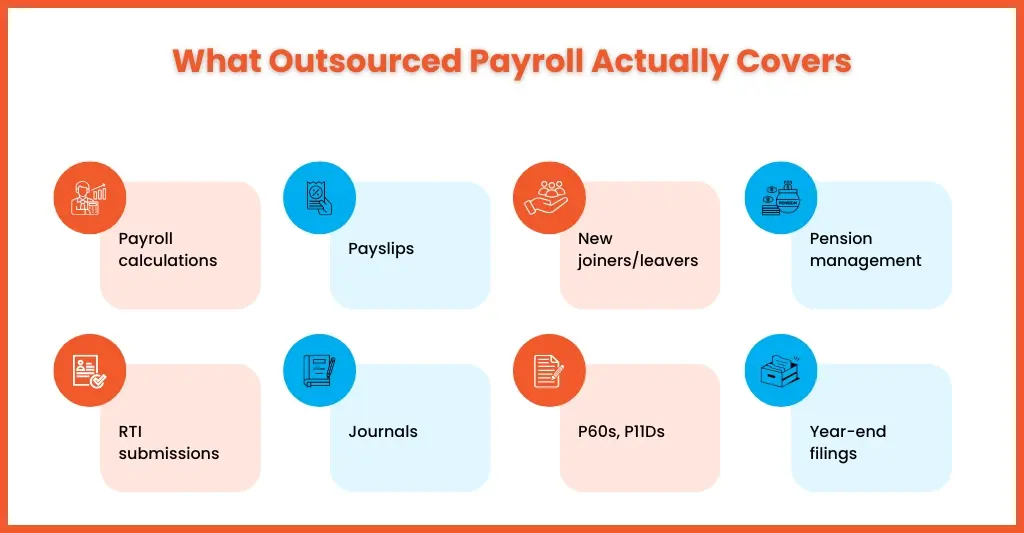

If you decide to move your payroll from in house to outsourced, it can be as smooth as you like as long as you take it one step at a time.

1. Identify what’s causing the problems now

Start by looking the parts of payroll that slow your team down. Is it constant deadline pressure, last minute client changes or the time spent fixing mistakes?

2. Be clear about why you want to outsource

Think about what matters most to your small to mid-sized accounting practices. Is it time, stress, accuracy or a smoother workflow? Clear goals help you set the right expectations.

3. Choose the right outsourcing partner

Choose a provider with UK payroll experience, GDPR compliant and a communication style that fits your accounting business. They should also be happy to work with the software you already use.

4. Get your data ready

Make sure employee details, payroll history, and opening balances are tidy and up to date. Clean data makes the handover much easier.

5. Make the switch slowly

There’s no need to move every client at once. Start with a small group of simple payrolls and add more once you are satisfied with the process.

6. Keep everyone informed

Let your team know how outsourcing will reduce their workload. Inform clients only about what they need to know so they understand that the process will stay the same.

7. Monitor progress

Once everything is running, review accuracy, turnaround times, and feedback from your team or clients. Make small adjustments as needed to keep the workflow smooth.

People Also Ask

1. What are the hidden costs of managing in house payroll?

Software fees, licence renewals, staff training, time spent fixing errors, and delays caused by missing information all add up.

2. What impact does in house payroll vs outsourcing have on compliance risk?

Outsourcing often reduces compliance risk because specialist payroll teams stay updated on PAYE, pensions, statutory changes, and HMRC deadlines.

3. How secure is outsourced payroll for UK accountants?

Reliable providers use encrypted systems, strict access controls, and GDPR-level protection to keep data safe.

4. Does outsourcing payroll reduce workload for accounting firms?

Yes. Outsourcing removes daily admin and processing tasks leaving your team more time for reviews and advisory.

5. Can outsourced payroll handle seasonal or high-volume periods?

Yes. Outsourcing is perfect for tax season, year-end, or onboarding new clients.

Conclusion

Choosing between in house payroll and outsourcing really comes down to how your accounting firm works day to day. If you have the time, staff, and systems to manage everything internally, in house payroll can still fit well. But it also demands constant attention and can take up a lot of time that could be spent on client work.

Outsourcing gives you reliable support, steady turnaround and fewer bottlenecks during busy periods. It’s often the easier option for small accounting firms that want more capacity without hiring more staff.

For many UK accounting practices, outsourcing is becoming a practical way to keep payroll accurate, organised, and stress-free. If you want to see how payroll outsourcing could work for your accounting firm, the team at Equallto can walk you through it and help you decide what suits your workload best.