Ever felt that payroll somehow takes longer than the work itself? You clear one deadline, only for another batch of calculations, changes, starters and leavers to land on your desk the very next morning. For many small and mid-sized practices, payroll is the task that refuses to stay neat and tidy.

This is exactly why more UK accountants are turning to Affordable Payroll Services. Not to pass work away but to remove the draining, repetitive parts and free up time for what actually moves a firm forward. When payroll is handled with accuracy, speed and a calm rhythm, the entire month becomes lighter.

Payroll mistakes lead to unhappy clients. Slow processing leads to late nights. But the right provider removes both problems at once. It is simple, structured and far more cost-effective than building an in-house payroll setup from scratch.

In this blog, you will see what Affordable Payroll Services usually cover, who the leading providers are, the features that matter and why thousands of growing UK firms are switching to smarter support in 2026.

What Affordable Payroll Services Actually Include

Affordable Payroll Services in the UK have changed a lot in the last few years. They are no longer basic, low-cost processing lines. Today they give small and mid-sized practices access to the kind of structured payroll support that used to be available only to large organisations. And most importantly, everything is handled with speed and accuracy.

First, you get end-to-end processing. This means employee setup, leavers, statutory payments, pension contributions, real-time information submissions, payslips and year-end support. Instead of juggling spreadsheets and HMRC uploads, your provider completes the full cycle and keeps the workflow smooth. It removes that constant pressure to double-check numbers late at night.

Second, Affordable Payroll Services often include cloud-based tracking. You receive updates, reports and confirmation files without chasing. Many providers now use smart tools to reduce manual work. Even better, the quality of output stays consistent, which is something many small and mid-sized practices struggle with when payroll work spikes during peak months.

Finally, these services include compliance support. Payroll rules shift every April. Rates change, calculations change, and clients expect you to update everything instantly. A good provider keeps you aligned with HMRC requirements, pension regulations and reporting deadlines. This is one of the biggest advantages of outsourcing payroll because it removes the stress of monitoring constant updates.

Top Affordable Payroll Service Providers in the UK — Who Leads the Market?

There are several options when choosing Affordable Payroll Services, but five names are frequently mentioned by UK accountants. Here is a clear, simple comparison.

1. Equallto

Equallto is becoming the preferred choice for many small and mid-sized accounting practices. The focus is on accurate, reliable and cost-friendly payroll support that integrates with your wider workflows. What makes Equallto stand out is the mix of expert talent and smart tools. You get payroll processed at speed, consistent reporting and a dedicated team that feels like part of your own firm. Turnaround is fast, pricing is flexible and communication is always human. For firms looking for accuracy without stress, Equallto leads the field.

2. Corient Business Solutions

Corient offers a range of outsourced accounting services including payroll. They support practice with RTI filing, pension calculations and monthly processing. Their model suits firms wanting a structured but traditional outsourcing option.

3. PayEscape

PayEscape provides tech-driven payroll solutions for UK practices. Their cloud platform gives clients access to payslips, documents and reports. They combine software with support teams to cover monthly processing.

4. Moorepay

Moorepay is one of the older payroll brands in the UK. They offer software, HR tools and payroll processing. They are often chosen by larger teams but still support smaller accounting practices.

5. BrightPay Bureau Services

BrightPay’s outsourcing arm helps firms who already use their payroll software but want help with processing. They are well-known for user-friendly features and clear reporting.

Essential Features to Expect from Top Affordable Payroll Service Providers

Before choosing a provider, it helps to know what a strong payroll partner should deliver. The right Affordable Payroll Services will remove pressure instead of adding more steps.

A good provider should offer:

Fast turnaround

Payroll needs consistency. Delays cause client stress. A top provider keeps the month flowing smoothly.

RTI submissions and HMRC compliance support

This includes accurate filings, smooth submissions and no last-minute panic.

Pension calculations and auto-enrolment support

Mistakes here can lead to major issues later. Your provider should handle it with clarity.

Secure cloud-based sharing

You should be able to access files, reports and payslips without long email threads.

Dedicated support team

Payroll is time-sensitive. You deserve a real person who understands your clients.

Flexible pricing models

Costs should suit the size of your firm and the number of payrolls you manage.

Error reduction tools

Many modern providers use smart checks or automation to keep work clean and accurate.

Clear documentation and workflow tracking

This keeps communication simple and avoids repeated follow-ups.

When these features are in place, the entire payroll cycle feels stable and predictable. It also frees up your internal capacity to focus on client relationships, advisory work and firm growth.

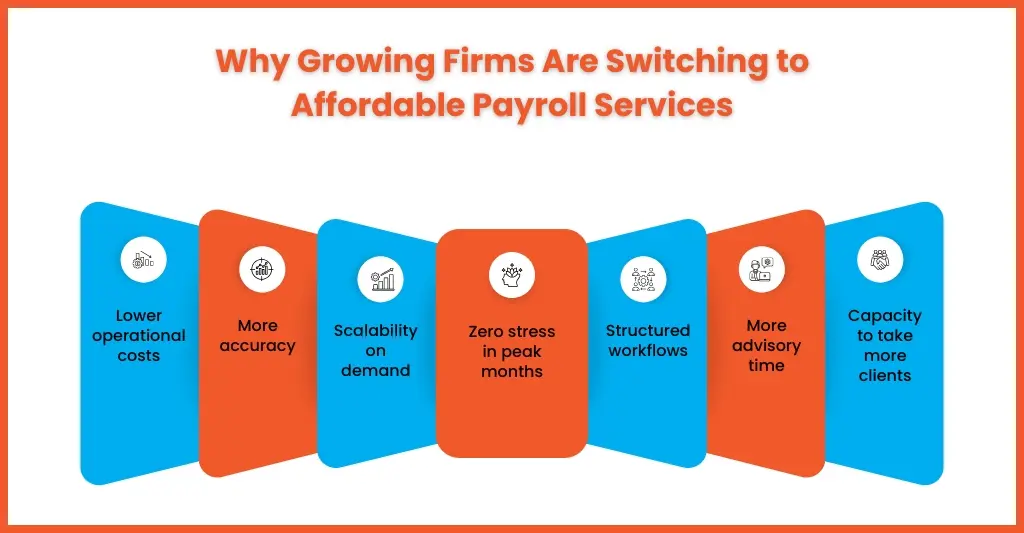

Why Affordable Payroll Services Are a Smart Move for Growing Companies

Running payroll internally can drain time, tools and people. For small and mid-sized practices, capacity is already tight. This is why Affordable Payroll Services are such an effective solution for growing firms. You free up time by letting go of repetitive tasks, giving you more room to focus on the important stuff.

Here’s why outsourcing payroll makes sense:

Save on costs

Hiring payroll staff, training them, and paying for software can add up quickly. Outsourcing helps you keep costs steady and predictable.

More accuracy

Payroll errors damage client trust. Providers specialising in payroll deliver reliability every month.

Scalability

Whether you add five clients or fifty, your provider adjusts without needing new staff or new tools.

Zero stress during peak months

Year-end and April changes do not become chaos. Your provider handles the heavy lifting.

Better workflow structure

Processing becomes consistent and deadline-friendly instead of rushed and reactive.

More time for advisory work

Instead of crunching numbers, you get time to focus on client relationships and future planning.

A stronger, more stable service offering

Firms that outsource payroll often take on more clients because they finally have the capacity.

When the payroll load becomes manageable, your diary instantly feels lighter. Firms that switch to Affordable Payroll Services do it for one simple reason. Growth becomes possible again.

Frequently Asked Questions (FAQ)

1. Is outsourced payroll cheaper than hiring in-house?

For most small and mid-sized practices, yes. Outsourcing removes recruitment costs, training costs, software expenses, and the pressure of covering staff absence. You only pay for the payrolls you need.

2. What is the cheapest payroll service provider in the UK?

Costs vary based on the number of employees and payroll cycles. Many firms consider Affordable Payroll Services from providers like Equallto as the best balance of price and accuracy.

3. Are affordable payroll service providers GDPR compliant?

Yes. A reputable provider follows GDPR rules, uses secure systems for data sharing and keeps employee information protected at every stage.

4. How fast can payroll be processed when using an external provider?

Most reliable providers complete payroll within agreed turnaround times, often within one or two working days, depending on volume and complexity.

5. Do small firms lose control when outsourcing payroll?

Not at all. You stay fully in charge of client communication and decision making. The provider handles calculations and submissions while you keep oversight.

Conclusion — Affordable Payroll Services That Deliver Accuracy, Speed and Savings

Choosing the right partner for Affordable Payroll Services can completely reshape how your firm handles the month. When payroll is accurate, timely and stress-free, everything else in your workflow feels more manageable. Clients stay happy, your team stays focused and your firm finally gains room to grow.

Equallto supports small and mid-sized UK accounting firms with reliable, modern and cost friendly payroll support that gives you back control of your time. If you want to reduce workload, improve accuracy and scale without burnout, Equallto is ready to help.

Ready to lighten your payroll load?

Drop Equallto a message and see how much smoother your month can become.