Most small to mid-sized accounting practices in the UK feel stretched. Deadlines never really stop. Month-end blends into year-end. Evenings disappear faster than planned.

Many accountants say the same thing. They enjoy the client work, but the routine tasks take over. Bookkeeping clean-ups, reconciliations, payroll checks, VAT reviews. Important work, but time-consuming.

This is where Outsourced Accounting and Bookkeeping Services come in. Not as a replacement, but as support. Used properly, outsourcing helps accountants stay in control while easing pressure. In this blog, we look at how outsourcing works, the real benefits, the risks to watch for, and why more UK small accounting firms are choosing this route.

What Are Outsourced Accounting and Bookkeeping Services?

Outsourced Accounting and Bookkeeping Services mean sharing part of your accounting workload with an external team. You remain responsible for clients. The outsourced team supports the work behind the scenes.

This usually includes bookkeeping, reconciliations, payroll processing, VAT preparation, management accounts, and year-end support. The work follows your processes, deadlines, and standards. These services also help mid to small-sized accounting firms stay aligned with HMRC record-keeping requirements, which outline how long accounting records must be kept and what needs to be maintained for VAT and tax purposes.

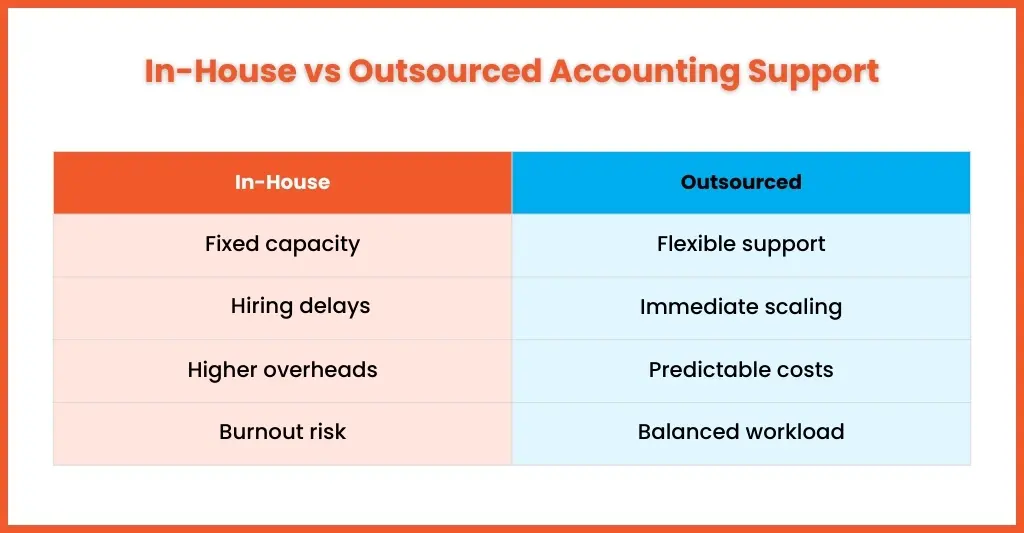

For many small to mid-sized accounting businesses, outsourcing is simply a way to cope better. It allows firms to handle more work without hiring full-time staff or working longer hours.

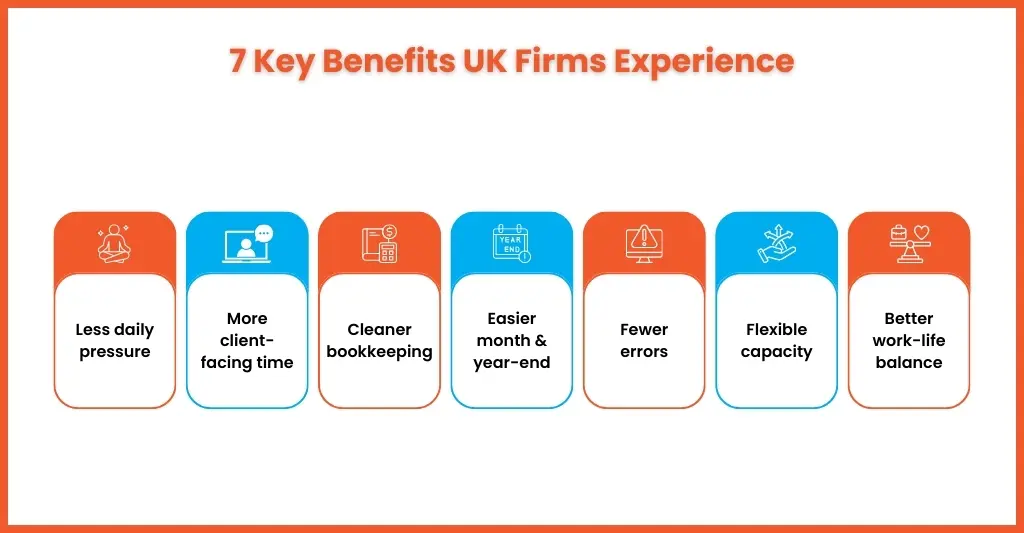

Key Benefits of Outsourcing Accounting and Bookkeeping

Outsourcing works best when it feels quiet and reliable. For many UK accountants, Outsourced Accounting and Bookkeeping Services are not about changing how they work, but about reducing the daily load. These are the main benefits accountants notice.

1. Less daily pressure

Routine work is shared, which reduces stress during busy weeks.

2. More time for clients

Accountants spend less time fixing records and more time advising clients.

3. Cleaner bookkeeping

Regular support keeps ledgers up to date instead of fixing issues later.

4. Easier month-end and year-end

Work is spread out, so deadlines feel manageable.

5. Fewer errors

Specialist teams handle accounting tasks every day, which improves accuracy.

6. Flexible capacity

You can scale support up or down without changing your team.

7. Better work-life balance

Evenings and weekends are not always taken up by catch-up work.

When outsourcing works well, it feels like extra hands inside your firm.

How to Choose the Right Outsourced Accounting Provider

Choosing the right partner makes a big difference. The right fit removes pressure. The wrong one adds it.

1. They should work with accountants

Avoid providers who try to replace your role. You stay in charge.

2. Strong UK knowledge

They must understand UK accounting rules, VAT, payroll, and deadlines.

3. Clear communication

You should know what is being worked on and when it will be finished.

4. Secure data handling

Client information must be protected at all times.

5. Simple processes

Clear workflows reduce mistakes and rework.

6. Ability to grow with you

Your needs will change. Your partner should adapt easily.

When outsourcing feels like a partnership rather than a service contract, it delivers real value. This is how Equallto works alongside small to mid-sized accounting practices.

Common Challenges and How to Overcome Them

Risks and Challenges to Be Aware Of

Outsourcing can cause issues if not set up properly.

- Work quality may drop

- Communication may slow down

- Data security can be a concern

Example:

A firm outsourced bookkeeping without clear instructions. The work came back late and needed rechecking.

Example:

Another firm faced VAT errors because the provider lacked UK experience.

How to Overcome These Challenges

These risks can be reduced with the right approach.

1. Agree on processes early

Clear instructions prevent confusion later.

2. Keep regular check-ins

Short weekly updates avoid surprises.

3. Use shared systems

Cloud tools improve visibility and control.

4. Start small

Test outsourcing on limited tasks first.

5. Choose a partner who understands accountants

This avoids constant explaining.

Example:

One firm started with reconciliations only, then expanded to payroll.

Example:

Another firm used shared dashboards to track progress in real time.

Cost Expectations for Outsourced Accounting Services

Costs for Outsourced Accounting and Bookkeeping Services in the UK vary widely. Basic bookkeeping support may start from a few hundred pounds per month. More complex work costs more.

Pricing depends on transaction volume, payroll size, reporting needs, and deadlines. There is no one-size-fits-all figure.

Outsourcing bookkeeping is often cheaper than hiring an in-house accountant once salary, training, software, and management time are considered.

Outsourcing is especially useful when:

- You do not need a full-time accountant

- Work peaks at month-end

- You want cloud accounting without managing it

- You need better reports

- You want to reduce compliance risk

Many small accounting firms choose to outsource routine work to reduce the risk of errors that can lead to penalties under HMRC compliance requirements, especially around VAT submissions and payroll reporting.

Future of Outsourcing Accounting and Bookkeeping Services

More UK small accounting firms are now treating Outsourced Accounting and Bookkeeping Services as a normal part of how their practice runs. What started as a way to handle overflow work has become a long-term approach to managing workload and capacity. Small to mid-sized accounting businesses are realising that doing everything in-house is no longer the only way to stay competitive.

The future of Outsourced Accounting and Bookkeeping Services is less about cost saving and more about stability. Shared teams allow work to continue smoothly during busy periods without putting constant pressure on internal staff. Better systems mean work is visible, tracked, and easier to review. Calmer workflows reduce last-minute fixes and long working hours. When outsourcing is used thoughtfully, it supports growth without exhausting the people doing the work.

Over time, firms that build outsourcing into their operating model are likely to be more resilient. They can take on new clients without rushing recruitment, adapt to changes in demand, and maintain consistent service quality. For many UK accountants, Outsourced Accounting and Bookkeeping Services are becoming less of a temporary solution and more of a foundation for sustainable growth.

People Also Ask

How do I choose the right outsourcing provider?

Choose a provider that understands UK accounting and works alongside your firm.

What are the main benefits of outsourcing accounting services?

Reduced workload, better balance, and more time for clients.

How much does outsourcing accounting services cost?

Costs depend on workload, but it is often cheaper than hiring.

Is outsourcing suitable for small accounting firms?

Yes. It helps small firms grow without adding pressure.

Will I lose control of my clients?

No. You remain the main contact and decision-maker.

Conclusion

Outsourced Accounting and Bookkeeping Services help UK accountants manage workload without losing control. They allow small to mid-sized accounting practices to focus on clients while routine work runs smoothly.

Outsourcing works best when it supports accountants rather than replaces them. When done right, it brings balance, consistency, and space to grow.

Equallto works inside small to mid-sized accounting practices in the UK as a long-term partner. By combining structured workflows with human support, Equallto helps accountants reclaim time, reduce pressure, and build sustainable practices.