Are you plagued with taxpayer clients who often miss out or forget to register for self assessment before the deadline? It’s a story familiar to all small accounting practices. Of course, your clients are not doing it on purpose; instead, they did not know that they were required to register.

Certainly, the responsibilities fall on your accounting practice to educate your clients, who can be new sole traders, landlords, side-hustlers, or company directors, that HMRC will not come personally to register for self assessment.

According to HMRC, 11.5 million taxpayers filed their self-assessment by 31 January 2025, and late registration has been found to be one of the common mistakes. Such a mistake leads to penalties and puts your clients in panic, and must be avoided at all costs.

To avoid your clients suffering from these penalties, we have prepared this self-assessment guide, which will explain:

- Who must register for Self Assessment?

- When and how registration should happen

- What mistakes to help clients avoid

- How your practice can streamline the process

Let’s simplify the world of self-assessment.

What Is Self Assessment and Why HMRC Requires It

Self-assessment is a process developed by HMRC for individuals to pay their taxes on the income which is not taxed at the source through PAYE. Once your client crosses a certain threshold, they are liable to make self-assessment returns, and HMRC has mandated that they need to register for self assessment.

In self-assessment, HMRC will require your clients to:

- Declare income

- Calculate tax due

- Submit a tax return

- Pay any outstanding tax

HMRC is emphasising that liable people register for self assessment because of the growing population of:

- Self-employed individuals

- Landlords

- Freelancers and contractors

- Directors with dividend income

According to the Office of National Statistics, 13.5% of the workforce in the UK is self-employed, making self-assessment more relevant.

Who Needs to Register for Self Assessment in the UK?

Your clients are required to register for self assessment if they are found to be fulfilling any one of the conditions mentioned below:

- The client is self-employed, and the income was over £1,000 per annum.

- Partner in a business partnership

- Freelancers or those with side jobs, earning additional income

- Money from renting out a property

- Tips and commission

- Income from savings, investments and dividends

- Foreign income

- Your client had to pay Capital Gains Tax when they sold or “disposed of” something that increased in value.

Here’s where the confusion begins. Usually, clients assume that they are not liable for self-assessment for side income, and accounting practices often struggle to explain that even their side income makes them liable for self-assessment.

When Should You Register for Self Assessment?

First and foremost, get the deadline to register for self assessment right. If your client is liable for filing a self-assessment tax return for the tax year, it must be registered by 5 October following the end of that tax year.

For example:

- Income earned in tax year 2024–25

- Registration deadline: 5 October 2025

Miss the deadline to register for self assessment, and your client will have to face penalties. It’s a deadline that has become a source of pressure on accounting practices, especially when a client is onboarded late.

How to Register for Self Assessment Step by Step

The process of registration for self-assessment will be as follows:

Step 1: Create or Access a Government Gateway Account

To get access to HMRC online self-assessment services, you will need to go to GOV.UK and set up a Government Gateway account.

To create a Government User ID, you will require your client’s name, email address, a password and recovery word. Once the User ID is generated, you can register your client for self-assessment via the tax account.

Step 2: Choose the Right Registration Route

If your client is self-employed, such as a sole trader, then register as self-employed. If your client is not self-employed, then register for self assessment only.

Step 3: Fill Up Your Client’s Personal and Business Details

Add the required details during registration, such as:

- National Insurance number

- Date business started

- Type of income

Step 4: Receive the UTR (Unique Taxpayer Reference)

After the registration is done, your client will receive the Unique Taxpayer Reference (UTR) by post within 15 working days. This UTR is a ten-digit code that enables HMRC to identify your client as a taxpayer.

What Happens After You Register for Self Assessment?

Once you have set up an HMRC online self-assessment account, you can sign in on behalf of your client.

Each year, on behalf of your client, you will need to submit a self-assessment tax return, which must contain your client’s taxable income from all sources and tax expenses.

Missing the filing deadline will automatically trigger a £100 fine, and once the filing is done, HMRC will tell you how much tax your client owes.

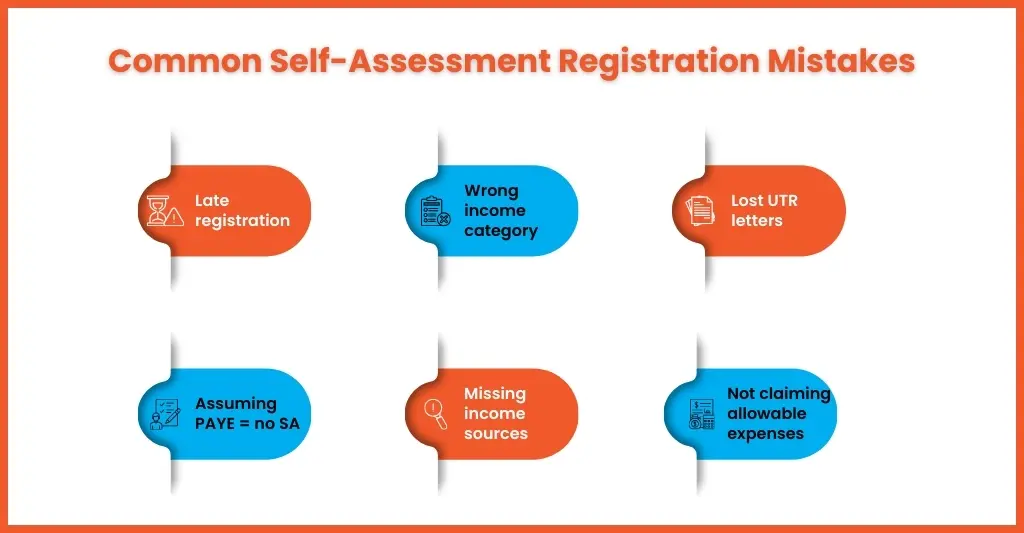

Common Mistakes to Avoid When Registering for Self-Assessment

Mistakes under self-assessment for practices do not start during the tax return stage; they start right from the registration. These mistakes can snowball into penalties, additional HMRC scrutiny, and frustrate your clients.

Let’s understand some of the common mistakes practices often make.

Delayed Registration

It is a frequent mistake that you have to face, especially when your client approaches you in January. Unaware that they are required to register for Self Assessment by 5 October following the end of the tax year. By the time it is realised, it’s time up.

Late registration can cause:

- Automatic late filing penalties from HMRC

- Interest on unpaid tax

- Tense conversations with HMRC

For practice, it means you will be doing unnecessary firefighting instead of planned self assessment work, which your client expects from you.

Registering Under the Wrong Category

HMRC strictly specifies that all self assessment registrations are not the same. For example:

- Landlords registering as sole traders

- Directors registering as self-employed

- Side-income earners choosing the wrong income type

Registering under the wrong category can lead to:

- Incorrect tax obligations

- HMRC correspondence asking for clarification

- Delays in issuing the correct UTR

Sorting this issue later will consume unnecessary time in phone calls, writing explanations, and admin work.

Error in UTR Letters

HMRC is still sending UTRs via post, and the chances are of it getting lost or, even worse, being lost:

- Misplacing the letter

- Client forgot they received it

- Or they assume the accountant already has it

Without a correct UTR, filing cannot be done, and self assessment gets delayed, bringing your client dangerously close to the deadlines. Reissuing the UTR code will take days, and time will be in short supply for you in January.

Failing To Declare All Income Sources

All taxable income of your client, not just self-employment earnings must be reported. This includes wages from employment (PAYE), rental income, dividends, savings interest, and capital gains.

Assuming PAYE Income Means No Registration Is Needed

Many of your clients still assume that they do not need to register for self assessment because they believe that they are on PAYE.

However, PAYE doesn’t cover:

- Rental income

- Dividend income above allowances

- Freelance or side-hustle income

- Foreign income

When registration is skipped based on this assumption, the issue crops up when HMRC issues a notice to file, leaving little room for your clients to manoeuvre.

Overlooking Allowable Expenses

Many clients fail to show their business costs accurately, which can be used for deducting their income and lowering their tax bill. Failure to claim expenses like office costs and professional fees means your clients will have to overpay tax.

How Accountants Can Help with Self-Assessment Registration

Many of your clients find it confusing and complicated to register for self assessment. That’s where they ask small accounting practices to assist them in it. By supporting your clients in the registration, you are not only handling the form filing, but you are also making the entire process smooth and stress-free.

Here’s how you will help your clients in self-assessment.

Evaluating Whether Registration Is Actually Required

Sometimes it’s unclear whether self-assessment registration is required. You can assist your clients in clearly addressing this doubt by:

- Reviewing income sources properly

- Identifying hidden triggers such as rental income, dividends, or side work

- Preventing unnecessary registrations that create future admin

Such crucial assessments save your clients from getting unnecessarily pulled into self assessment when it is not required.

Choosing the Correct Registration Category

Getting the registration done in the wrong category will cause avoidable delays and HMRC queries. Your accounting practice can ensure:

- Your clients are currently identified and registered as sole traders, landlords, and directors

- Multiple income streams are handled properly

- HMRC records reflect the client’s real circumstances

Getting the registration right will save you and your clients from rework and a lot of HMRC correspondence.

Managing the Registration Process End to End

You can manage the entire show for your clients, from Government Gateway setup to submitting registration details, if you have the resources.

By managing the entire show, we mean:

- Handling online registration

- Tracking HMRC confirmations

- Monitoring UTR issuance

- Following up when delays occur

Such service will remove a lot of uncertainties for your clients, but for a small accounting practice, doing this in-house is not possible. However, through year-end outsourcing services for outsourcing providers, you can offer such services to your clients.

Acting as the Point of Contact with HMRC

One of the major reasons for accounting practices handling self assessment is the inability of your clients to handle HMRC communications.

Your accounting practice can do the following:

- Deal directly with HMRC

- Respond to queries promptly

- Keep records of communication

This will protect your clients from any misunderstanding and keep the entire process moving, especially during peak periods.

Setting Expectations and Deadlines Early

Once the registration is done, you will need to prepare your clients for what comes next.

You can help by:

- Explaining filing and payment deadlines clearly

- Preparing clients for payments on account

- Avoiding last-minute surprises in January

Such a proactive approach will generate trust among your clients and reduce their stress.

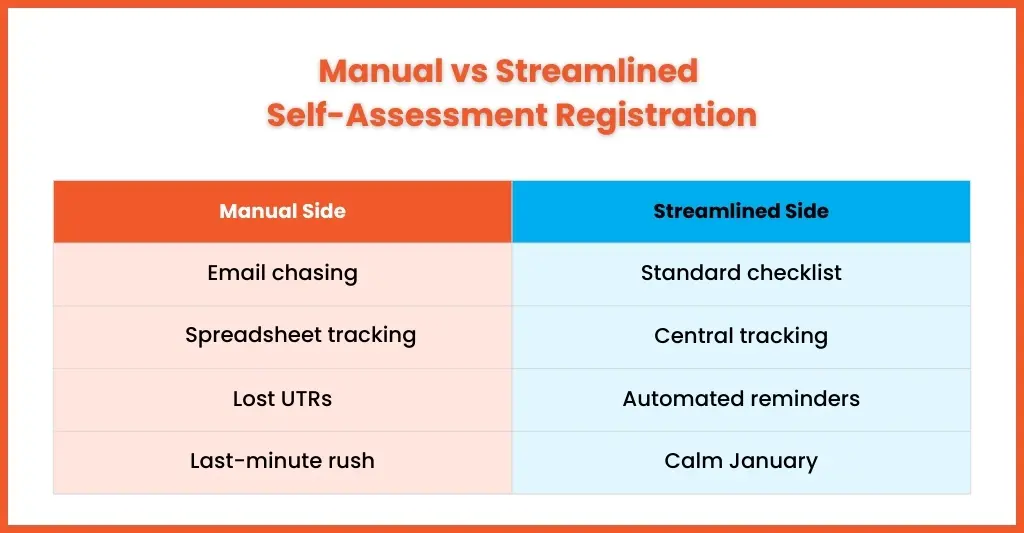

Creating a Scalable, Repeatable Process

If the practice is small in size, then self assessment registration can become a bottleneck, especially when the volume increases.

By standardising the process, you can:

- Reduce manual follow-ups

- Onboard clients faster

- Handle peak-season demand without chaos

Achieving this requires investments in technology and human resources, which are not possible for your small accounting practice. However, through year-end outsourcing services, you can dare to achieve standardisation in the registration process.

Self-Assessment Registration Deadlines You Must Know

There is multiple deadlines associated with self-assessment, and missing them will be costly for your clients. Therefore, don’t miss the deadlines listed below.

- 5 October – Deadline to register for Self Assessment if it’s your first time filing

- 31 October – Deadline for paper tax returns

- 31 January – Final deadline for online Self-Assessment submission

- 31 January – Deadline to pay tax owed for the previous tax year

- 31 July – Second payment on account (if applicable)

Missing the 31st January deadline will trigger instant penalties. These penalties can be avoided by preparing and filing on time.

FAQ: Register for Self Assessment

Can I register for Self Assessment if I missed the deadline?

While it’s possible to do a late registration but your clients will have to shell out penalties depending on the circumstances.

How long does it take to get a UTR after registering for Self-Assessment?

Ideally, it takes 10 to 15 working days but it can get delayed, specially during peak periods.

Can an accountant register for Self-Assessment on my behalf?

An accountant or an accounting practice can handle the self-assessment on behalf of their client from registration, filing, to communications with HMRC.

Do you have to register for self assessment every year?

Once your client is registered for self assessment, HMRC will continue to send a notice to file a tax return each year until your client leave self assessment. You do not need to register every year.

Can you do a self-assessment without an accountant?

You can complete Self-Assessment tax return yourself if your financial situation is straightforward, saving on accountant fees. However, you must hire an accountant for complex returns or if you need expert guidance on financial matters.

Conclusion: Register for Self Assessment Without Stress

The job to register for self assessment should be an easy task, but many clients claim it is like navigating a maze. That’s why many depend on accounting practice to get their registration done. However, these small accounting practices are facing multiple challenges in registration.

These challenges include:

- Time taken in registration due to compliance

- High volumes and errors due to incorrect data from clients

- Creates unnecessary admin pressure

Equallto has built its reputation by supporting small accounting practices in self-assessment, from registration to filing, using the latest technology and without adding more complexity. We strive to offer you a compliant, smooth self-assessment workflow that enables you to deliver a seamless experience to your clients. Because when registration is done right, everything else becomes easier.

Are you finding your self-assessment job increasingly difficult to manage? Use our contact form to request assistance and see the turnaround time for yourself.