According to recent UK accounting surveys, over 60% of small to medium-sized accounting firms now outsource at least some of their bookkeeping. And it’s not hard to see why this is the case – bookkeeping is pretty much essential for every accounting business after all. However, it’s one of the most time-consuming and detail-heavy tasks out there.

You’d be surprised how easily hours can just disappear staring at receipts, updating ledgers and going over reconciliations for instance. Many an accountant has confessed to spending more than a little too long on data entry and not enough time helping the people who actually need their expertise. That’s where outsourcing comes in.

The advantages of outsourcing bookkeeping go beyond just convenience. It helps small to mid-sized accounting firms save time, lower costs, reduce errors, and remain compliant without losing control of their financial records. It has become a reliable and cost-effective choice for accountants who want to focus on strategy instead of spreadsheets.

In this blog, we will explore the benefits of outsourcing bookkeeping, what it really means, why so many UK accounting firms are choosing it, and how to select the right partner to make it work for your business.

What Is Outsourced Bookkeeping?

Outsourced bookkeeping simply means getting an external team to handle your bookkeeping work for you. Instead of doing every entry and reconciliation in-house, you share your financial data securely with trained professionals who manage it on your behalf.

A typical outsourcing partner will take care of:

- Recording income and expenses

- Reconciling bank and credit card accounts

- Managing accounts payable and receivable

- Preparing monthly summaries and financial statements

The biggest misconception is that outsourcing means losing control. It doesn’t. You still review the reports, approve the data, and see every figure. The only difference is that an expert team handles the routine work quickly and accurately — often using advanced tools like Xero, QuickBooks, or Sage.

For many accountants, it’s like adding extra hands to the team without hiring anyone new. You keep the control, and they handle the heavy lifting.

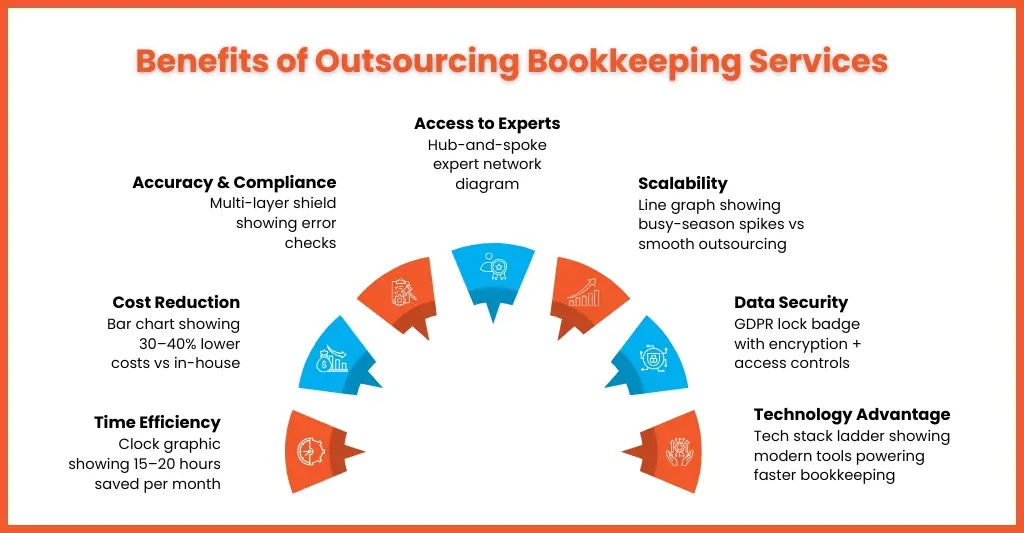

Benefits of Outsourcing Bookkeeping Services

So, what exactly makes outsourcing bookkeeping worth it? Let’s go through the most practical benefits of outsourcing bookkeeping that UK small and mid-sized accounting firms are seeing every day.

1. Time Efficiency

Let’s face it — bookkeeping takes time. Between chasing invoices and balancing ledgers, it’s easy to lose track of the hours. When you outsource, that time comes straight back.

The provider takes care of the day-to-day recording, reconciliations, and reports, while you get to focus on your clients or advisory work.

For example, a small accounting firm spending 15–20 hours a month on bookkeeping could save nearly half a working week through outsourcing — freeing up time to take on more clients or improve service quality.

2. Cost Reduction

Hiring full-time bookkeeping staff isn’t cheap. You have salaries, software, training, and system maintenance to think about. Add to that the cost of keeping up with updates and compliance changes — and it adds up fast.

Outsourcing flips that model. You only pay for what you need – literally. No more recruiting new staff or signing on for lengthy contracts that just end up weighing you down. And forget about having to shell out on expensive software that you then have to keep track of and update.

For small to mid-sized accounting firms, outsourcing can cut bookkeeping costs by anywhere from 30 to 40%. That’s a pretty sizeable benefit right there – and one of the main reasons you might want to consider handing over your bookkeeping to the pros – it’s simple, its predictable & budget-friendly.

3. Accuracy & Compliance

Mistakes with bookkeeping can be a lot more trouble than they’re worth. A single slip up could find you with an incorrect VAT return, riled up clients, or even a fine from HMRC. That’s why it’s good to have an outsourced team keeping an eye on things – they’re trained to catch errors as soon as they happen.

An outsourcing firm follow tried & tested review procedures & use systems you can rely on to keep your books spot on and ready for inspection, so you don’t have to spend your time double checking every little detail.

4. Access to Skilled Experts

With outsourcing, you’re not relying on one person — you’re tapping into a pool of experts. These professionals handle bookkeeping for multiple firms, so they’ve seen it all from complex reconciliations to multi-currency accounts.

You get the same quality of work you’d expect from a large internal team, but without the extra cost or management time. For small and mid-sized accounting firms, this access to skill and experience is one of the most valuable benefits of outsourcing bookkeeping.

5. Scalability

Workload in accounting is never consistent. One month is quiet, the next is chaos, especially around tax season or year-end.

Outsourcing gives you flexibility. You can easily scale the work up or down depending on client demand. Your provider adjusts with you, so you never pay for idle time or scramble for extra hands when it gets busy.

For accounting firms that handle multiple clients, this ability to scale is a real game-changer.

6. Data Security

Bookkeeping data is sensitive, and protecting it is non-negotiable. Reputable outsourcing partners invest heavily in data protection. They use encrypted file sharing, password-protected systems, and access controls that meet GDPR standards.

That means both your firm’s and your clients’ data stay secure without you needing to manage IT or software updates yourself.

Working with a trusted provider gives peace of mind — your data stays confidential, and your compliance boxes stay ticked.

7. Technology Advantage

Modern bookkeeping is powered by technology. Outsourced partners often use the latest tools for automation and reporting — things that smaller accounting firms may not have access to.

By outsourcing, you instantly benefit from these tools without paying for them directly. You get faster processing, real-time insights, and cleaner reports.

It’s one of the quieter benefits of outsourcing bookkeeping, but one that makes a huge difference to how efficiently your firm operates.

How to Choose the Right Bookkeeping Outsourcing Partner

Finding the right partner makes all the difference. A good outsourcing firm should feel like an extension of your team — reliable, transparent, and easy to work with.

Here’s what to look for:

Experience and UK compliance knowledge:

They should understand UK accounting standards, tax laws, and HMRC rules.

Data protection:

Always ask about GDPR compliance, encryption, and who has access to your data.

Clear communication:

You want easy contact, regular updates, and no hidden surprises in pricing.

Flexibility:

Whether you need help for one client or fifty, they should adapt to your needs.

Proven reputation:

Look for reviews or testimonials from other accounting firms like yours.

At Equallto, we tick all those boxes. We specialise in outsourced bookkeeping for mid to small-sized accounting firms and accountants across the UK. Our team works closely with accountants to handle the numbers in the background, so you can focus on delivering results for your clients.

We combine reliable technology, trained professionals, and secure systems to make bookkeeping simple, accurate, and worry-free.

People Also Ask

What is outsourced bookkeeping and how does it work?

Outsourced bookkeeping is all about hiring a team of bookkeepers from outside to take care of those daily record-keeping and reporting tasks. You hand over your financial data to them securely, they get to work on it and when it’s all done, they send you regular updates and some pretty useful reports to boot.

Is outsourcing bookkeeping safe and GDPR-compliant though?

Well yes, it definitely is. Even a company like Equallto, who provide this kind of service, use pretty top-notch, encrypted systems and limited access controls, all on top of using GDPR compliant platforms to keep your financial data locked down tight.

Can you just outsource part of your bookkeeping tasks too?

Absolutely, you can outsource just one bit of it, like bank reconciliation or vat returns or even just accounts payable, to free up some of your time and reduce the workload.

How much does outsourcing bookkeeping cost in the UK anyway?

To be honest it depends on a few bits and bobs like the number of transactions you’ve got and how many clients you’re dealing with, but generally it works out to be heaps cheaper than hiring someone to do it in-house, because you only pay for what you need.

Does it work for accounting firms as well then?

Yeah, it does. Lots of accountants do it to get through those super busy seasons without having to take on any extra staff, or just to get on top of a growing client list without having to hire any more people.

What software do outsource bookkeeping firms use anyway?

Most of them use cloud-based tools like Xero, Quickbooks, or Sage which are pretty easy to integrate with what’s already in place and make collaboration much smoother.

Can outsourcing bookkeeping help with giving better client service?

Definitely – when you’ve got less time spent on the day-to-day admin, you can focus on actually giving advice and helping your clients grow their business rather than doing endless paperwork.

Final Thoughts

Bookkeeping is vital, but it doesn’t have to consume your time. The benefits of outsourcing bookkeeping are clear: you save hours, reduce costs, improve accuracy, and get access to skilled professionals and modern tools — all without losing control.

For accountants and small accounting firms, outsourcing isn’t about handing over control. It’s about gaining freedom. Freedom to focus on strategy, client work, and growth.

At Equallto, we support accountants and small accounting businesses who want that balance. Our outsourced bookkeeping services are flexible, secure, and designed for real-world accounting needs. Whether you need ongoing support or help during peak seasons, our team makes bookkeeping simpler and more efficient.

If you’re ready to spend less time managing books and more time growing your practice, get in touch with Equallto today — and experience the real benefits of outsourcing bookkeeping.