Ask any accountants what stresses them most at the end of the month, and payroll will likely top the list. Paying staff sounds simple, but anyone who’s done it knows how complicated it really is. Changing tax codes, bonuses, pensions, and holiday pay — one mistake can cause a big problem.

For small and mid-sized accounting firms, payroll often takes up hours that could be used to assist clients, grow the business, or handle other priorities. Even accountants struggle to balance payroll tasks with reporting deadlines. That’s why many UK accounting firms now choose to outsource payroll.

Outsourcing payroll means giving your payroll responsibilities to experts who handle everything from payslips to HMRC filings. It helps UK accounting firms save time, cut costs, and lessen mistakes while remaining compliant with tax and employment laws. For many firms, it’s the easiest way to keep payroll accurate, secure, and free of stress.

In this blog, we’ll explain what payroll outsourcing is, how it works, and the main benefits of outsourcing payroll for accountants and small to mid-sized accounting firms in the UK.

What is Outsourcing Payroll

Outsourcing payroll means hiring a specialist company to handle everything related to staff pay. This includes preparing payslips, calculating taxes and National Insurance, managing pensions, and filing reports with HMRC.

Instead of running payroll yourself, you simply share employee and pay details with your provider. They use secure systems and up-to-date knowledge to process everything correctly and on time.

For accounting firms in the UK, it’s an easy way to stay accurate, compliant, and stress-free every month.

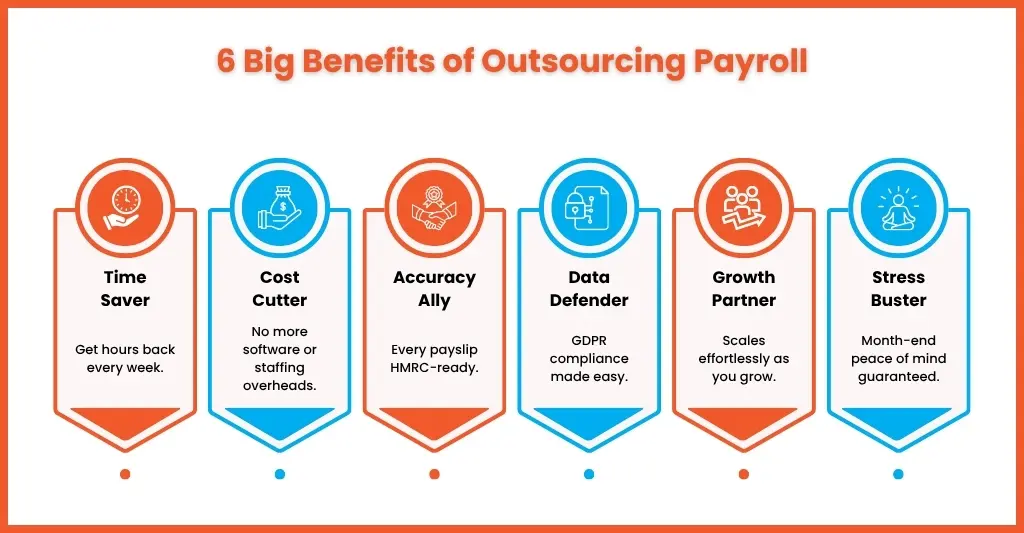

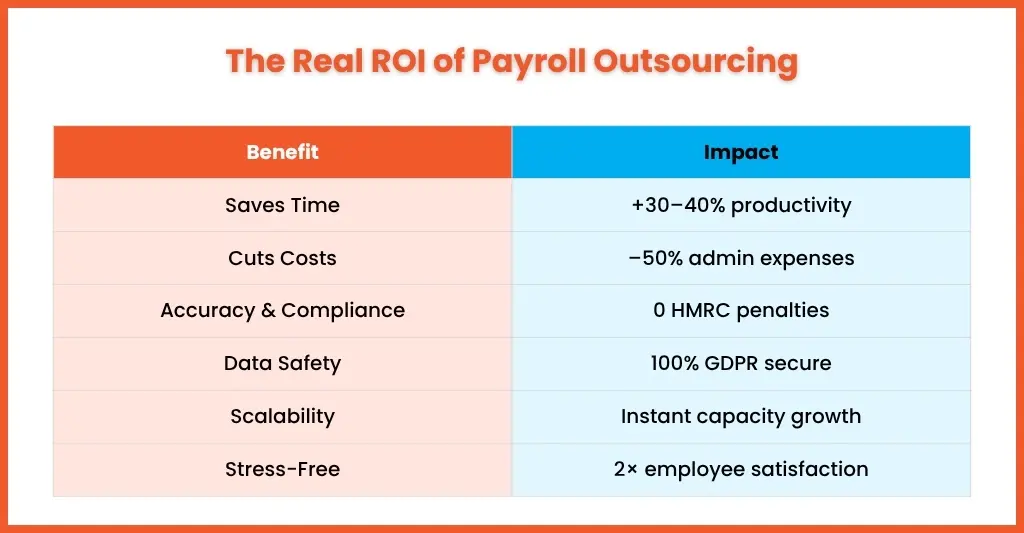

What Are the Benefits of Outsourcing Payroll?

There are many good reasons why accounting firms outsource. Here are the most important benefits of outsourcing payroll.

1. It Saves Time

Payroll can take hours every week, especially when you manage several employees or clients. Outsourcing gives that time back. Your team no longer needs to calculate pay or file returns — leaving more time for clients, planning, and business growth.

2. It Helps Keep Costs Down

Running payroll in-house is a real money pit. You’re looking at hiring staff, buying software, and on top of that keep up with all the regular updates – it can be a real headache. But with outsourcing, you pay just for what you use – and it’s a no-brainer for small to mid-sized accounting firms and ones that are still growing.

3. It Helps Get Accuracy and Compliance

Payroll mistakes can be costly in more ways than one – from fines to unhappy employees. A provider that’s good at payroll will use reliable systems to get things like pay, tax and pensions spot on. They’ll keep up with all the HMRC rules, so you don’t have to worry about a thing – everything is sorted from the word go.

4. It Keeps Your Data Safe

Payroll data is super private and needs to be looked after properly. By outsourcing, you can stash your info in secure, encrypted systems that are compliant with GDPR – that way you and your employees’ details stay safe from any risk

5. It Grows with Your Business

As your firm expands, payroll gets more complex. Outsourcing makes growth easier. Whether you hire one person or twenty, your provider can handle it all without adding more pressure on your team.

6. It Makes Busy Periods Easier

Month-end and year-end deadlines can be stressful. Outsourcing takes away that extra workload. Everything is managed and submitted on time, so you can focus on your clients and daily operations.

These benefits of payroll outsourcing make it a smart move for both accountants and small to mid-sized accounting businesses across the UK.

How Payroll Outsourcing Works — Step by Step

Setting up outsourced payroll is simple. Here’s how it usually works:

1. Data Setup and Sharing

You share employee details, pay rates, and schedules. The provider checks everything and sets up your payroll in their system.

2. Processing Pay Information

They calculate pay, tax, and pension contributions for each employee accurately and on time.

3. Tax and Compliance Work

All reports and submissions are sent to HMRC through RTI, and pension duties are handled properly.

4. Review and Approval

You review payroll reports, confirm details, and approve payments.

5. Final Payment and Reporting

Employees receive payslips, payments are processed, and you get final reports for your records.

This process keeps UK payroll outsourcing services smooth, accurate, and worry-free — without you having to manage every detail.

Why Choose Equallto for Payroll Outsourcing

At Equallto, we help accounting firms and UK accountants simplify their payroll process. Our goal is to make each pay run fast, accurate, and completely stress-free.

Here’s why many firms trust us:

1. Knowledge of UK Payroll Rules

Our team understands HMRC standards and pension laws, so every report and filing are correct.

2. Smart and Reliable Systems

We use simple, efficient tools that save time and reduce manual work.

3. Friendly, Dedicated Support

You get direct support from our team — people who know your business and respond quickly.

4. Strong Data Security

Your data is kept safe through encrypted, GDPR-compliant systems.

5. Flexible and Scalable Service

Whether you manage one payroll or hundreds, our services adjust easily to your needs.

With Equallto, you get more than a service provider — you gain a payroll partner who helps you work smarter, not harder.

Key Takeaways – Payroll Outsourcing as a Growth Strategy

The benefits of outsourcing payroll go way beyond just saving time and money. It’s actually a great way to reduce stress, get more organised and work alot more efficiently.

Outsourcing payroll means your team can focus on the important stuff – high-value work, not just admin tasks. And it’s a pretty simple way to boost performance and keep up with all the ever-changing payroll rules.

For loads of UK accounting businesses, outsourcing payroll is now a key part of their growth plans – helping them stay flexible, accurate and competitive.

FAQs on Payroll Outsourcing

Is payroll outsourcing secure and GDPR compliant?

Yeah. A good provider will use secure systems that are all encrypted and follow the GDPR rules to keep your data safe and sound.

What are the main benefits of outsourcing payroll for small accountants?

It saves time, lowers costs and means you don’t have to worry about managing the payroll software or hiring staff to do it.

How much does outsourcing payroll cost in the UK?

Well, it’s usually cheaper than doing it in-house, but the cost will depend on the size of your business and how often you do your payroll.

Can outsourced payroll handle pensions and HMRC stuff?

Yes, it can. Most payroll providers will manage pension auto enrolment, HMRC submissions and end of year reporting.

How does outsourcing payroll save time for accountants?

It takes care of all the boring, repetitive tasks so accountants can focus on what they do best – looking after clients, producing reports and strategy.

What should you check before choosing a payroll provider?

Look for a provider with loads of UK payroll experience, secure systems, clear and transparent pricing, and responsive support.

Conclusion

Understanding the benefits of outsourcing payroll is one of the most painless ways for accountants and accounting firms in the UK to save time, cut costs and stay compliant with all the changing regulations. It keeps your payroll accurate, secure and stress-free – month in, month out.

At Equallto, we support accountants and accounting business owners by taking care of the whole payroll process from start to finish. Our team has got the experience, technology and care to make payroll nice and simple and actually pretty reliable. If you want to make your payroll life easier, just give Equallto a shout.