Every year, as January approaches, accountants across the UK face the same familiar rush. Clients who promised to be “early this time” suddenly remember their paperwork. Last minute panics, missing documents and endless follow-ups quickly take over the month. If you support clients with tax filing, you already know how demanding the Self Assessment season can be.

This is where understanding HMRC Self Assessment becomes essential. When you know the rules, dates and processes inside out, the work becomes far easier to manage. It also helps your clients feel more confident and prepared, which takes a huge load off your plate.

Self Assessment exists so individuals can report untaxed income to HMRC. Each client’s situation is slightly different, which means accountants need a clear process to keep everything accurate. In this blog, you will find a simple, structured guide to HMRC Self Assessment, key deadlines for 2026, payment rules, penalties, tips and how outsourcing can support small to mid-sized accounting firms.

What is Self Assessment

Self Assessment is HMRC’s method for collecting income tax from individuals whose tax is not fully handled through PAYE. Instead of tax being deducted at source, taxpayers report their income themselves through a Self Assessment tax return. This includes self-employed individuals, landlords, company directors and anyone who receives untaxed income.

For small to mid-sized accounting firms, Self Assessment work often becomes a large portion of January workloads. Many clients do not always understand how much goes into completing a tax return. They look to you to collect their income details, confirm what expenses they can claim, work out the tax they owe and make sure everything meets HMRC requirements. Without a good process in place, the job can become stressful very quickly.

Self Assessment matters because it helps people pay the correct amount of tax based on their income. If income is not declared, HMRC can charge penalties and interest. This is why accountants play such a vital role. You help clients avoid late filing charges, submit accurate figures and stay ahead of HMRC Self Assessment deadlines. When managed early and with the right tools, Self Assessment season can run smoothly.

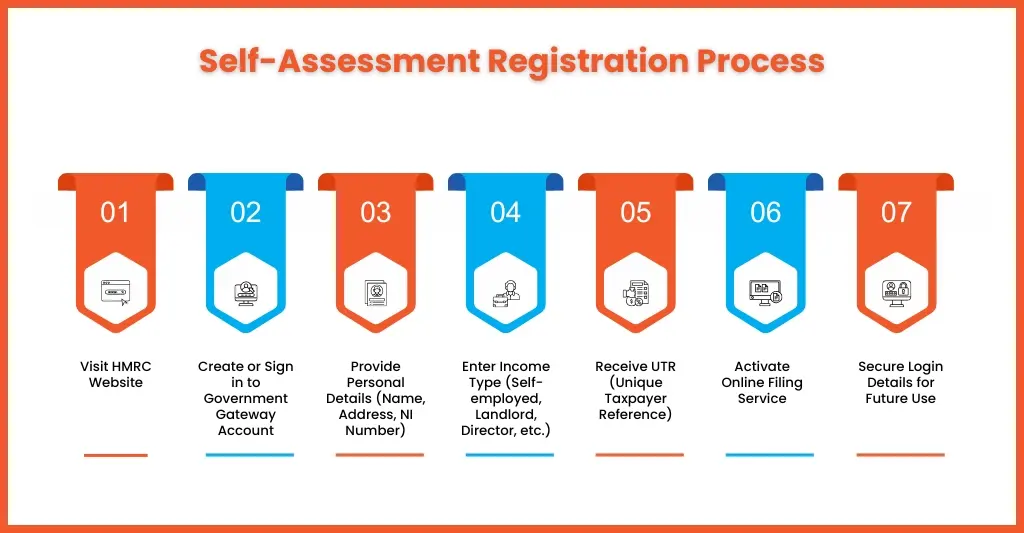

How to Register for Self Assessment — UK Registration Process

Clients who have never filed a Self Assessment before must register with HMRC. Here is a simple breakdown of the process.

How to register:

Visit the HMRC website

Select the option to register for Self Assessment. The process differs slightly for self-employed individuals and non self-employed individuals.

Create or sign in to a Government Gateway account

A Government Gateway account is needed for all online tax filing. Clients who don’t have one must create it during registration.

Provide personal details

HMRC will ask for name, address, date of birth and National Insurance number.

Provide details about income type

HMRC must know whether the client is self-employed, a landlord, a director or receiving other untaxed income.

Receive the Unique Taxpayer Reference (UTR)

HMRC will post a ten-digit UTR to the client. This code is essential for all future Self Assessment tax return submissions.

Enrol for the Self Assessment online service

After receiving the UTR, clients must activate online filing using a code sent separately.

Keep login details and UTR safe

Your client will need both every year at tax return time.

Registering early avoids stress and gives accountants more time to collect documents and prepare the Self Assessment return.

Self Assessment Payment Deadline — Key UK Dates & Payment Structure

Self Assessment has a clear payment structure that accountants must explain to clients. Missing these dates leads to penalties, interest and unnecessary worry.

Key Payment Dates

| Payment Type | What It Covers | Due Date |

| Online filing deadline | Submission of the Self Assessment tax return | 31 January 2026 |

| Balancing payment | The remaining tax owed for the 2024 to 2025 tax year | 31 January 2026 |

| First payment on account | Advance tax payment toward the 2025 to 2026 tax bill | 31 January 2026 |

| Second payment on account | Second advance payment toward the 2025 to 2026 tax bill | 31 July 2026 |

Payments on account apply when a client’s tax bill is more than £1,000 and not mostly paid through PAYE.

Understanding these dates helps you plan workloads and keep clients informed. When clients know what a balancing payment is or when their Self Assessment payment deadline falls, the process becomes smoother for both sides.

Completing the Self Assessment Return — What to Include

A complete Self Assessment return covers all sources of untaxed income. Accountants must gather accurate information for HMRC.

Here is what to include:

Income records and documentation

Employment income, dividends, rental income, pension income and any other untaxed income.

Self-employed income details

Turnover, expenses and records needed for a self-employed tax return.

Allowable expenses

Costs that can be deducted from income. These must be clearly supported with receipts or accurate records.

Payments on account information

If payments on account were made in the previous year, these must be included.

Tax reliefs and adjustments

Includes pension contributions, charitable donations and other tax relief options.

Supporting evidence

Bank statements, invoices, P60s, P45s, interest statements and records of benefits.

When all the information is accurate, the final tax bill calculation becomes much easier. A clear set of documents speeds up processing and reduces risk of HMRC queries.

Penalties, Interest & What Happens If You Miss Deadlines

Missing the HMRC Self Assessment deadline will trigger penalties straight away. HMRC will still charge a late filing fee even if no tax is due.

Consequences of missing deadlines:

- Initial £100 penalty for filing after 31 January.

- Daily penalties after three months up to a set limit.

- Further penalties at six and twelve months based on tax owed.

- Interest charges applied to outstanding tax.

- Possible late payment penalties if payments are missed.

- HMRC compliance checks if returns are regularly late.

- Risk of Time to Pay arrangement rejection for repeat late filers.

A Time to Pay arrangement can help clients pay in instalments, but HMRC may ask for financial details before agreeing. Accountants must help clients keep filings on time to avoid unnecessary complications.

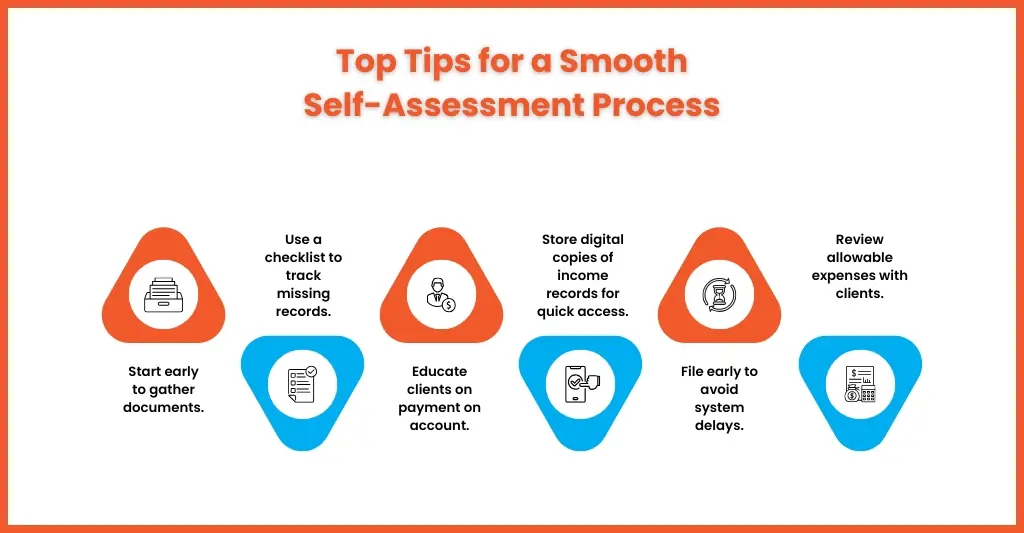

Best Practices & Tips for a Smooth Self Assessment in the UK

Here are practical tips to help accountants manage HMRC Self Assessment work efficiently:

- Encourage clients to start gathering documents early.

- Use a checklist to track missing records and avoid repeated follow-ups.

- Educate clients about payment on account to prevent confusion.

- Store digital copies of income records for quick access.

- Keep communication simple and avoid technical language.

- Review allowable expenses with clients to prevent errors.

- File online well before the deadline to avoid system delays.

- Track deadlines for all clients to prevent late filing charges.

These practices help small to mid-sized accounting firms reduce January pressure and keep tax season organised.

How Outsourcing Self Assessment Support Can Help

Handling Self Assessment inside your own team can take its toll on small to mid-sized accounting firms. The busy season often means long days, tight cut-offs and a constant flow of client queries. Outsourcing helps ease that pressure by giving you extra support when the workload peaks.

When you outsource, your Self Assessment work is handled by people who deal with these returns every day. This helps reduce errors, speeds up the work and takes a lot of strain off your team. It also means clients get their returns completed on time, which keeps your firm’s reputation strong and your relationships steady.

Equallto supports small accounting firms by taking on Self Assessment preparation, review, documentation checks and filing support. This reduces pressure on your team and brings more consistency to your workflow. When a reliable partner handles the heavy lifting, you gain time to focus on client advisory and firm growth.

People Also Ask

What is the standard Self-Assessment payment deadline in the UK?

The payment deadline for balancing payments and the first payment on account is 31 January. The second payment on account is due on 31 July.

What counts as “income” that must be reported under Self-Assessment?

This includes self-employed earnings, rental income, dividends, savings interest, foreign income, pension income and any other untaxed income.

What happens if I already pay tax under PAYE, do I still need to file?

Yes, if you receive untaxed income or fall into specific categories such as being a landlord or company director, you still need to file.

How long should clients keep their Self-Assessment records?

HMRC requires records to be kept for at least five years after the 31 January deadline.

Can HMRC remove someone from Self-Assessment if they no longer need to file?

Yes, but the taxpayer must contact HMRC to confirm they no longer meet filing requirements.

Conclusion

HMRC Self-Assessment does not have to be stressful. When deadlines, income records, payments and HMRC rules are managed properly, the process becomes predictable and far easier for both accountants and clients. Small to mid-sized firms benefit greatly from a clear system, early preparation and structured support.

Equallto helps small accounting firms handle Self-Assessment workloads with accuracy and reliability. If you want a smoother tax season, quicker turnaround times and more time to focus on client advisory work, Equallto is here to support you.

Looking to lighten your Self-Assessment workload?

Reach out to Equallto and discover how effortless tax season can feel with the right partner.