Do you feel that your small accounting practice is outdated while running payroll operations for your clients in the UK? It’s a feeling shared by the majority of practices, and the reason is simple: the increased influence of AI in payroll.

Payroll is one of the most essential functions that your practice has to handle for your business clients. Without a robust payroll, mistakes can creep up, and your clients’ employees get paid late, leading to distrust. No wonder that every research point shows that 1 in 5 employees have left a job due to payroll issues, which drives the inability of the employer to rectify the error.

That’s why AI has become a buzzword among accounting practices. It has evolved into an arrow that has neutralised multiple payroll challenges, including HMRC scrutiny, auto-enrolment complexity, staff shortages, and growing client volumes. It’s a practical response to very real challenges faced by small accounting practices today.

This guide explains what AI in payroll actually is, how it’s being used in the UK right now, and how practices can adopt it safely without losing control, accuracy, or the human touch.

What Is AI in Payroll?

AI in payroll means the use of artificial intelligence tools such as machine learning, automation, and pattern learning in streamlining and making payroll processes more accurate.

It means that AI can help you in:

- Analysing payroll data for anomalies

- Flagging potential errors before submission

- Automating repetitive checks and validations

- Supporting compliance monitoring

- Improving speed and consistency

It’s incorrect to even think that AI in payroll is going to completely replace payroll professionals. Instead, it will reduce the manual efforts of your payroll team and highlight risks that your payroll specialist might miss, especially when you are working at scale. In the long run, AI will work in synch with your payroll team in an integrated fashion.

The Key Benefits of AI in Payroll

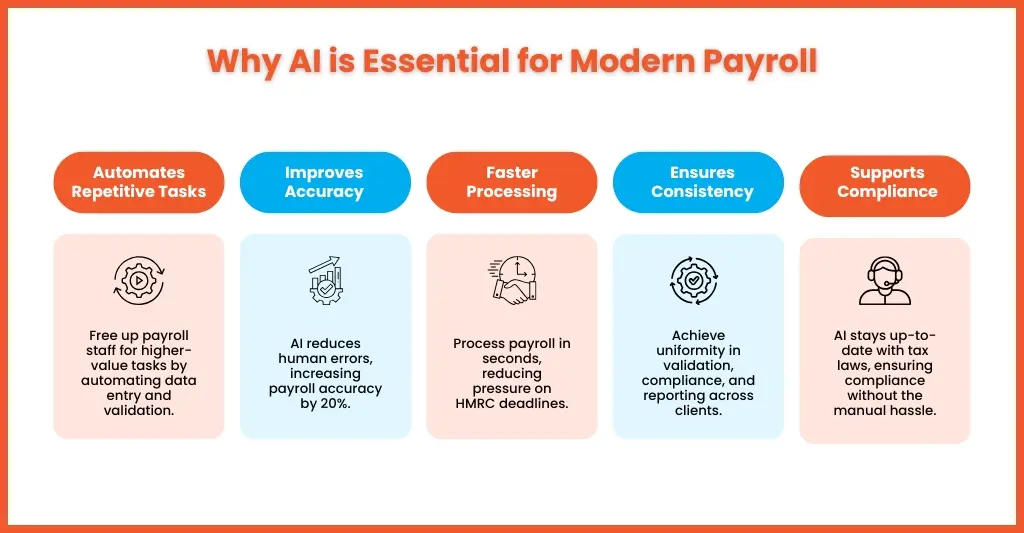

What makes AI in accounting and payroll to be specific popular among accounting practices? The answer is simple: the clear benefits it presents to them. Some of the significant benefits of AI in payroll are:

Automating Lower-Level Tasks

AI-enabled payroll software has become successful in automating repetitive payroll tasks, thus streamlining payroll operations for many. With automation of tasks, your payroll professionals can free themselves from data entry, validation, and reconciliation. Now, they can dedicate more time towards high-value strategic advisory services. That’s the future of accounting and payroll.

Improving Accuracy

AI-enabled payroll software has considerably reduced human errors, which were endemic in payroll, leading to a lot of stress for your clients and you. According to a report by McKinsey, organisations using AI-driven payroll software have observed a 20% improvement in payroll accuracy. No wonder it has created a whole new level of trust and satisfaction between practices and clients.

Faster Processing Without Rushing

What takes hours for even an experienced payroll specialist to analyse, AI can handle in seconds. For practices, this means:

- Less HMRC deadline pressures

- Earlier payroll completion

- More time for review and advisory input

Speed without shortcuts is one of the most significant advantages of AI in payroll.

Consistency Across Multiple Clients

When you have to handle huge payroll volumes of multiple clients, maintaining consistency becomes very difficult. However, using AI, you can achieve perfect standardisation in:

- Validation rules

- Compliance checks

- Reporting formats

This makes payroll delivery more predictable and scalable. To get more predictability you must explore the option of payroll outsourcing. Here some benefits of outsourcing payroll which will be interesting for you.

How to Use AI in Payroll – Practical Steps for UK Practices

Another piece of misleading information about AI is that it will handle everything, and your payroll specialist can take a back seat and relax. It’s very untrue because AI cannot replace your payroll specialist completely; it’s not designed for that.

To get the maximum benefits out of AI in payroll, you will need to know how to use it.

Step 1: Use AI for Validation, Not Decision-Making

AI can never make decisions on your behalf, nor can it handle unique and complex payroll questions. Both require human thinking and decision-making. Therefore, use AI for what it’s best at: flagging issues at speed.

Step 2: Automate Repetitive Checks

The primary tasks of AI in payroll are to automate repetitive and time-consuming payroll tasks. These tasks include:

- Searching for missing data

- Highlighting abnormal pays

- Validating pension and statutory calculations

Step 3: Integrate with Existing Payroll Workflows

To get the best out of AI, you will need to integrate it with the existing payroll processes. This will avoid making the process lengthy and make the existing payroll process more streamlined and quicker.

Step 4: Train Teams to Work With AI

Getting AI tools or AI-enabled payroll software is one thing, and training your payroll teams on them is another. You can gain the full benefits of AI only when your payroll team knows how to use it and what to expect from it.

Make it clear to your payroll team that AI will not make tough decisions on their behalf; it will only highlight the risks. The ball is in the court of your professionals for making balanced judgments.

If training or following the above steps is too much on your small accounting practice then explore the option of outsourcing. Take a look at our guide on payroll outsourcing cost for better decision making.

Real-World Use Cases of AI in Payroll

There are many accounting practices who are ahead of the curve when it comes to AI incorporation in payroll. As you read, there are many professional practices who are using AI in payroll for:

- Detecting payroll fraud or duplicate payments

- Identifying incorrect employee classifications

- Monitoring changes in compliance automatically

- Improving payroll forecasting and reporting

Hopefully, this will reduce your stress and improve confidence, especially during busy payroll periods.

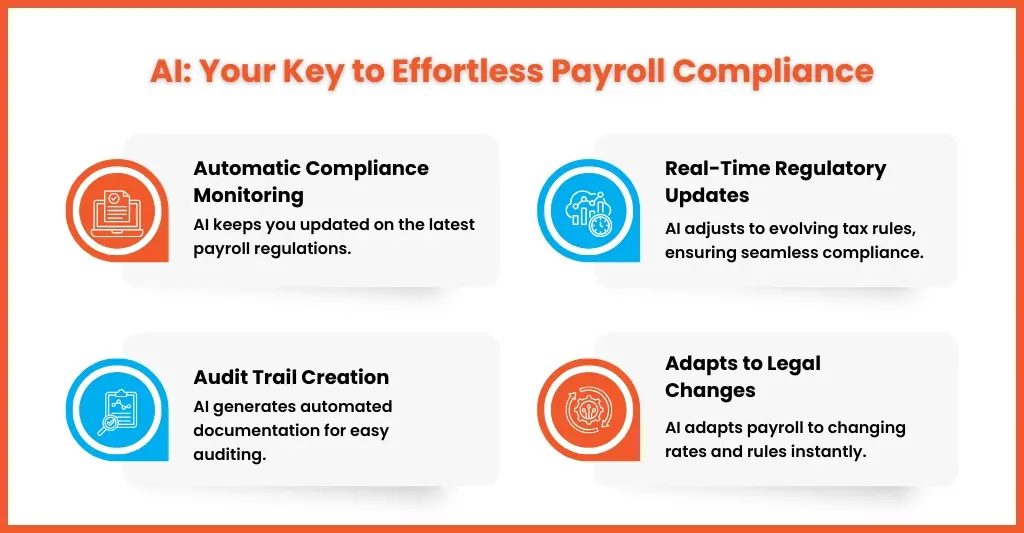

AI & Payroll Compliance – Staying Accurate and Audit-Ready

Navigating the complex web of UK payroll regulations is a serious impediment towards your goal of streamlining payroll operations for your clients. And this complexity has been successfully tackled by AI.

AI-enabled payroll software will keep you updated on the latest UK legislative changes and payroll regulatory requirements, such as rates of Statutory Sick Pay from day one of sickness, will increase from April 2026. Using ML algorithms, you can adapt to evolving compliance standards, ensure adherence to local tax laws and avoid risks.

AI tools help in creating audit trails and documentation, in which HMRC is interested, thus keeping you accurate, defensible, and audit-ready, without increasing manual workload.

The Human Role in an AI-Powered Payroll Workflow

Despite the increasing role of AI in streamlining payroll, it is unrealistic to say that human touch is not required. In fact, it has become more critical now than ever, and this status is going to remain for a long time.

Let’s be clear, you cannot under any circumstances expect AI to:

- Explain payroll outcomes to clients

- Handle sensitive employee queries

- Apply professional judgement to edge cases

In an AI-powered payroll workflow:

- AI handles detection and validation

- The payroll specialist will only handle decision-making, communication, and accountability

The secret of accounting practices that are successfully operating AI-enabled payroll services is that they have ensured AI assists and enhances the capability of their payroll teams, not replaces them. Even more successful practices approach payroll providers for AI-enabled payroll outsourcing services.

Future Trends – What’s Next for AI in Payroll?

Except for evolution, nothing is constant in AI, and it is hard to imagine what capabilities it is going to possess in the next 5 to 10 years. Therefore, for survival’s sake, keep an eye on technologies like natural language processing and advanced machine learning and how they integrate.

Smarter Predictive Analytics

AI has already started a venture into payroll predictive analysis, where it will study the trends of payroll data and make specific, actionable recommendations.

Contributing Towards Data Security

Payroll handles a lot of sensitive data, and its security must be your top priority. AI is excellent at identifying unusual or unexpected activity, enabling it to address data security concerns quickly before they escalate.

FAQs: Frequently Asked Questions

How does AI improve compliance in payroll?

AI identifies anomalies, validates data continuously, and flags risks before submissions, reducing late filings and errors.

What are the benefits of using AI in payroll?

Greater accuracy, faster processing, reduced stress, and improved scalability for accounting practices.

Are there risks associated with AI in payroll?

Yes, when used without oversight. AI should support human review, not replace it.

What is the role of AI in payroll?

AI in payroll will focus on predictive analysis, automated payroll processing (including data entry) and fraud prevention.

How is AI changing payroll?

AI is beginning to reframe payroll from a reactive service into a strategic capability, moving it beyond simple automation.

Conclusion

AI is turning the UK payroll world upside down by simplifying processes, ensuring payroll data is accurate, and making compliance easier. Whether your payroll team is interested in AI or not, AI is undoubtedly interested in payroll. Adopting AI in payroll operations will help unlock greater efficiencies, cost savings and employee satisfaction. So, embrace the future of payroll with AI today.

Yes, there will be challenges in adopting AI in payroll, but they can be mitigated if you partner with a professional payroll outsourcing service provider, and Equallto is one you must go with.

Equallto is well-known among small accounting practices for its support with modern, structured payroll workflows that blend intelligent automation with human expertise. The future of payroll isn’t AI alone.

It’s AI + accountants, working smarter together. Are you interested in making your payroll services AI-ready? Share your needs on our contact form, and we will make you AI + future-ready.