Payroll looks simple only till you put your hands on it. We are saying this because nowadays payroll is more complicated than before. The situation is such that even for a small accounting practice, payroll has turned from a simple add-on to one of the most time-consuming, high-risk services on the books.

Some of the reasons for such a situation are tight HMRC deadlines, auto-enrolment rules, changing tax codes, statutory payments, and higher client expectations. Such a situation has given rise to a question that many practitioners have avoided for long: how much does it cost to outsource payroll, and is it actually worth it?

This guide breaks down how much it costs to Outsource Payroll, what drives those costs, and why many UK practices are moving payroll out of-house, not as a shortcut, but to regain control.

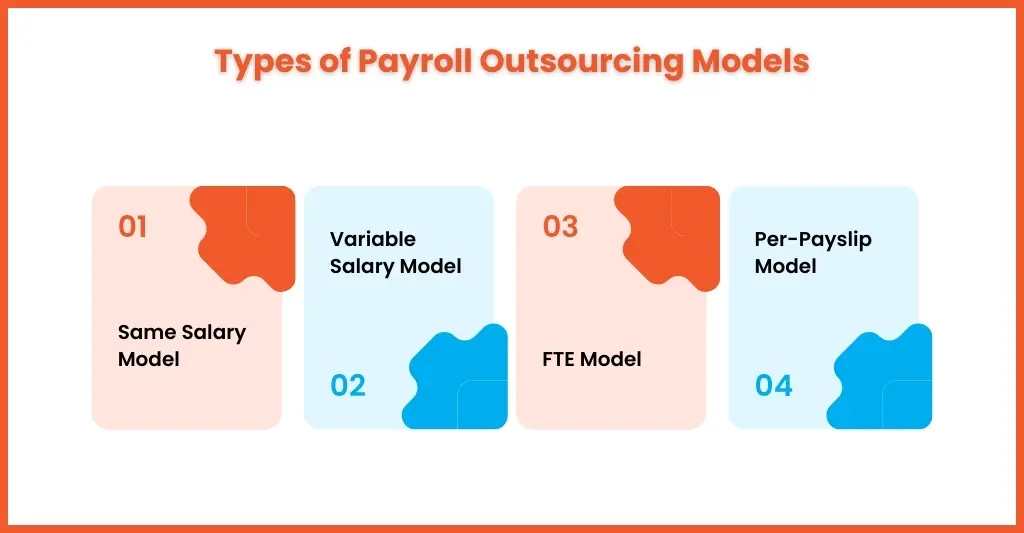

Types of Payroll Outsourcing Models Explained

There are several types of payroll outsourcing models that outsourcing firms commonly offer. The pricing for payroll varies depending on the kind of client payroll you are outsourcing. Generally, there are two pricing models:

Professional outsourcing service providers offer several types of payroll outsourcing models. Let’s understand each of these models in detail:

1. Same Salary Model

It is ideal if you are handling simple payroll, meaning the same salary and other details every month.

2. Variable Salary Model

Ideal for handling more complex payroll requirements of your clients. These requirements can be handling different types of employees (part-time and full-time), frequent changes in pay frequency (weekly and fortnightly), or variable pay amounts.

3. FTE Model

Under this model, your practice will get a dedicated accountant working only on your payroll work, making it ideal for practices that prefer a long-term association.

4. Per-Payslip Model

In this model, an outsourcing service provider will charge you for each payslip they process. Its pricing is based on the volume you will provide and is ideal for addressing your short-term or urgent payroll requirements.

How Much Does Payroll Outsourcing Cost?

Affordable payroll outsourcing depends on several important factors. Let’s understand each of those factors in detail.

Cost of Setup

The cost of setting up payroll will vary depending on the size of your accounting firm and your requirements.

Per Payslip Costs

Another essential factor that adds to the payroll outsourcing price is the per-payslip cost. Most payroll outsourcing providers prefer it, and the cost will depend on how many payslips you process. Providers also offer discounts when the volume of payslips per month is high.

Auto Enrolment

Several professional service providers offer auto-enrolment services to accounting practices. Some of them include the auto-enrolment into the monthly per-employee charges.

Additional Services

A lot of professional payroll providers have started offering additional services and tools, such as HR and recruitment, to stand out in the market. The prices of these extra services will depend on the type of add-ons you need and the size of your practice.

For a small accounting practice like yours, outsourcing payroll turns out to be a cheaper option than in-house, especially when you consider hidden operational costs.

Payroll Outsourcing vs In-House Payroll – Cost Comparison

On paper, it seems that in-house payroll cost is manageable, or you can control the cost. However, the reality is quite different.

In-House Payroll Costs Include:

- Payroll staff salaries

- Training and upskilling

- Payroll software licences

- Holiday and sick cover

- HMRC error risk

- Time spent on payroll queries

Outsourced Payroll Costs Include:

- Predictable monthly fees

- Specialist payroll expertise

- Software, compliance, and updates included

- Reduced risk of HMRC penalties

Here’s a side-by-side cost comparison

| Cost Area | In-House Payroll | Payroll Outsourcing |

| Staff salaries | High, fixed | None |

| Software & updates | Paid separately | Included |

| Training & compliance | Ongoing | Included |

| HMRC error risk | Higher | Lower |

| Scalability | Limited | Easy to scale |

| Predictability | Variable | Fixed monthly costs |

When you calculate the costs of both, you will conclude that outsourcing payroll will be light on your pocket, less stressful, and scalable. Hence, the question should not be just “how much does it cost to Outsource Payroll,” but “how much does it cost not to outsource?”

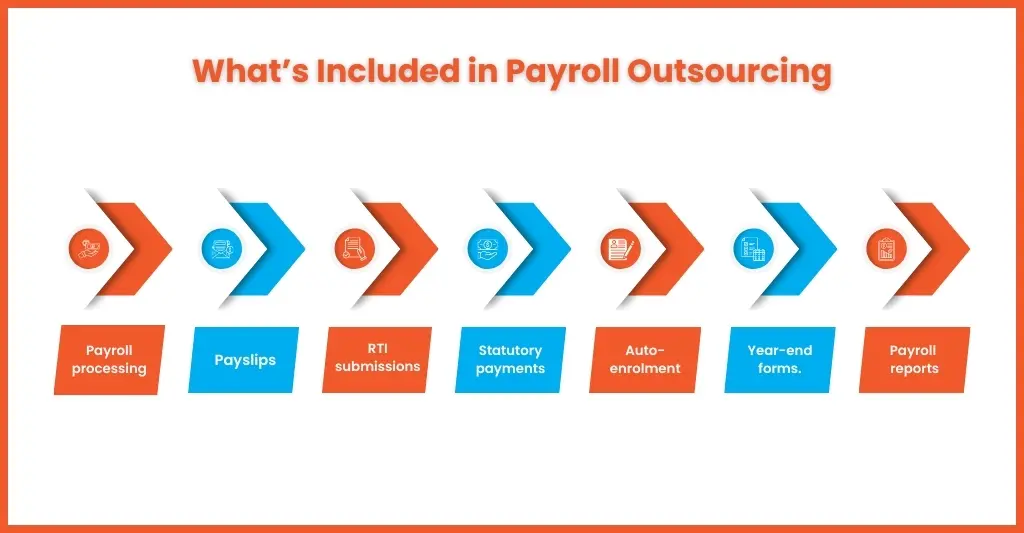

What’s Included in Payroll Outsourcing Pricing?

Well-known payroll outsourcing service providers design their payroll service to cover the entire payroll lifecycle. Here’s what you should expect from a professional payroll outsourcing provider:

- Payroll processing and payslip generation

- RTI submissions to HMRC

- Statutory payments (SSP, SMP, etc.)

- Auto-enrolment assessments

- Year-end processing (P60s, P11Ds where applicable)

- Payroll reports for employers

Hidden Costs to Watch Out for When Outsourcing Payroll

The pricing of payroll outsourcing services is mostly transparent, but that does not mean you should let your guard down. There is a potential of being charged extra or in a hidden way, especially when you ask for extra services.

Some of those hidden costs are:

- Extra charges for statutory calculations

- Additional fees for weekly payrolls

- Separate costs for auto-enrolment

- Charges for HMRC queries or amendments

- Setup fees not disclosed upfront

To avoid being surprised by these hidden costs, understand the whole pricing structure offered by the provider and ask, “How much does it cost to Outsource Payroll?” Very clearly.

Why UK Accounting Practices Are Moving to Outsourced Payroll Services

Credit the complex UK payroll regulations that have made payroll from a simple routine back-office task into anything but routine. Rules are changing constantly, HMRC is enforcing deadlines tightly, and the tolerance for mistakes has shrunk considerably.

As a result, many accounting practices are shifting to outsourced payroll services. There are multiple benefits of outsourcing payroll, but for now, let’s focus on why practices are moving toward payroll outsourcing.

HMRC Penalties Are Increasing and More Automated

HMRC systems are increasingly being automated, and late submissions, incorrect RTI filings, or missing information are highlighted faster, resulting in penalties.

What does this mean for practices?

- Less flexibility when mistakes happen

- More financial risk from minor errors

- Increased scrutiny of payroll data

Payroll outsourcing providers are well-equipped to deal with strict compliance requirements and, through the use of AI and experienced accountants, can reduce penalty risk significantly.

Auto-Enrolment Compliance Is Non-Negotiable

Workplace pension duties are no longer a “set and forget” exercise.

Every pay run requires:

- Employee assessments

- Contribution calculations

- Accurate reporting to pension providers

- Ongoing record keeping

All small practices are required to stay compliant, but without specialist knowledge, it will be challenging. Through payroll outsourcing, you can meet your auto-enrolment obligations consistently, without last-minute hassles.

Payroll Expertise Is Hard to Retain In-House

Payroll specialists are expensive to hire, in high demand and even harder to find in the UK market.

When you go looking for a payroll specialist, you will face:

- Rising salary expectations

- Staff turnover risks

- Knowledge gaps when key payroll staff leave

- Dependency on one or two individuals

Such reliance can be overcome through outsourcing. Instead of hiring one specialist, a payroll outsourcing provider will give you access to a team of payroll specialists at a reasonable price. They will keep you up to date with the latest payroll regulations.

Payroll Errors Are Costly

Payroll work will not generate revenues like high-value advisory work, but any payroll error can have a profound impact on your growth.

These severe impacts are:

- Damage employee trust

- Trigger HMRC penalties

- Create reputational risk

- Consume management time

Payroll outsourcing can mitigate these risks by controlling payroll errors without needing to divert internal resources away from growth-focused activities.

How to Choose the Right Payroll Outsourcing Partner in the UK

By now, you must have made up your mind to select a payroll outsourcing partner, but in haste, mistakes are made. Many practices make the mistake of focusing only on service pricing during selection, but if you are interested in gaining the maximum benefits from payroll outsourcing, you will need to consider multiple aspects.

Consider the following aspects while selecting your payroll outsourcing partner:

- UK payroll expertise and HMRC knowledge

- Clear SLAs and turnaround times

- Scalable pricing and services as your workload and practice grow

- Secure data handling by complying with UK GDPR and the Data Protection Act

- Ability to work as an extension of your in-house payroll team

FAQs: Frequently Asked Questions

Can outsourcing payroll reduce HMRC penalties and errors?

Professional payroll providers employ payroll specialist who adhere to strict compliance frameworks, reducing errors, and late submissions.

Which payroll outsourcing model is the most cost-effective?

For small accounting practices, back-office payroll outsourcing often delivers the best balance of cost, control, and scalability.

Are payroll outsourcing costs tax-deductible in the UK?

Yes. Payroll outsourcing costs are generally allowable business expenses.

How much does outsourced payroll cost?

Typical outsourcing of payroll in the UK costs about £4 to £10 per employee per month for standard services. For fully managed, comprehensive services it can go up to £12 to £25 per employee/month.

Is it cheaper to outsource payroll?

Payroll providers charge fees, but when compared to the cost of the fines and penalties that can result from mistakes, outsourcing payroll may actually save a lot of your money.

Conclusion

In the year 2026, the question that small accounting practices should ask is not how much outsourcing payroll will cost, but whether managing payroll in-house makes sense.

We say this because rising compliance demands from HMRC, its tight scrutiny, and your limited resources make it impossible to handle payroll alone. Those who did had to waste considerable time, money, and effort.

Therefore, payroll outsourcing is your only hope, and for small accounting practices, Equallto fits the bill naturally.

Equallto supports small accounting practices with structured payroll outsourcing solutions that are scalable, compliant, and cost-predictable, allowing you to confidently offer payroll without carrying the operational burden.

Are you bogged down with multiple payroll tasks for your clients? Share your requirements on our contact form and see how we will transform your operations like a magician.