It’s common for you to get a panic call from a client saying, “Something’s wrong. Our bank balance doesn’t match our book, and we have VAT due next week.” When you look at their books, you get a rude shock; transactions have been entered, but not properly balanced. purchases recorded without credits, payments entered twice, and sales captured without linking to bank receipts. To put it bluntly, it’s a financial mess, and only double entry bookkeeping can save the day.

It doesn’t matter if you are a small accounting practice managing multiple clients or handling tighter HMRC scrutiny under MTD, you will have to get the bookkeeping right. After all, it is the base of accurate reporting and compliance.

Therefore, it will be wise to go through this blog and understand what Is double entry bookkeeping, how it works, and why accountants still rely on it today. Let’s break it down in the simplest way possible.

Understanding Double Entry Bookkeeping

Double entry bookkeeping is an accounting method in which each transaction is recorded in two accounts, debit and credit. The motive for this is to ensure numbers stay accurate and balanced: Assets = Liabilities + Equity.

Let’s understand it even better through an example: your client buys new equipment for their business for £1,000. It credits the clients’ technology expense account for £1,000 and debits its cash account for £1,000. This is because the clients’ technology expense assets are now worth £1,000 more and £1,000 less in cash.

Rules of Double Entry Bookkeeping

Rules of double entry bookkeeping consist of 3 important components. These components are:

- Each transaction must be recorded in two accounts in the books.

- For each transaction, the total debits recorded must equal the total credits recorded.

- Total assets must always equal total liabilities plus equity (net worth or capital) of a business. Both sides of this equation must be the same (they must balance).

Different Types of Accounts in Double Entry Bookkeeping

There are 5 different types of accounts used in double entry bookkeeping. These are:

- Asset Accounts: Under it, the monetary value of what your client owns is recorded, such as the money in its checking account, tools/equipment, and buildings.

- Liability Accounts: This account records all that your client owes, like lines of credit or a mortgage.

- Equity: It contains the difference between assets and liabilities. No wonder it is called the book value of the business.

- Income accounts: It record money coming in, like revenue.

- Expense accounts: This account record what money your client has spent on, such as payroll and advertising.

This classification is critical for accurate bookkeeping and clean reporting, especially when submitting VAT returns under MTD.

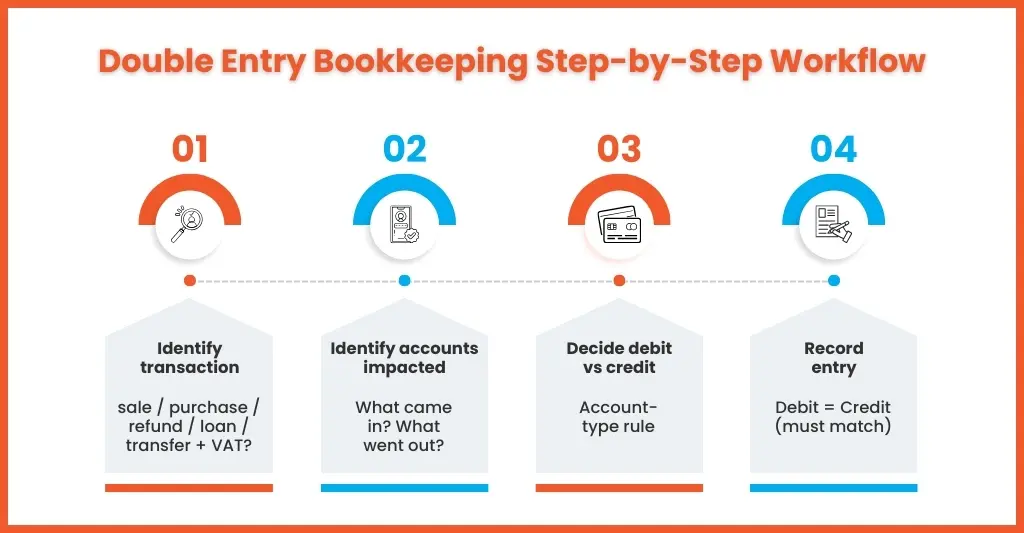

How to Do Double Entry Bookkeeping Step by Step

For newcomers, the double entry bookkeeping name might seem complex, but in reality, it’s very logical. It’s important to remember that in it, every transaction has two sides — where the money came from and where it went. No wonder it is so reliable and forces transactions to balance, making mistakes easier to spot.

Here’s the step-by-step method your team can use every time.

Step 1: Identify the Transaction

Before you even start the bookkeeping or open your bookkeeping software. Ask some important questions.

- Was money received or paid?

- Was it a purchase, a sale, a refund, a loan, or a transfer?

- Does VAT apply?

Let’s understand it through an example transaction:

- Your client just paid £120 for office supplies.

It’s a simple transaction but it can lead to multiple bookkeeping errors if it is misunderstood. For instance, is it office supplies or equipment? Was it paid from a bank or a card? Was it reimbursed later? Therefore, getting a clear understanding is very important.

Step 2: Identify the Accounts Impacted

By now, you must know that double-entry affects two accounts, and it is important to identify it by using a checklist.

- What did your client’s business receive? (expense/asset)

- What did the business give up? (bank/cash/payable)

For example:

- If your client received office supplies, then it’s an expense

- If your client’s business has paid money to the bank, then it reduces its assets.

Step 3: Decide Debit vs Credit

Debit and credit must not be taken as good or bad. They only mean the increase and decrease based on the account type.

It is simple to understand:

- If expenses increase on the debit side

- Assets will decrease on the credit side

In our example:

- Office supplies expense increased → Debit

- Bank balance decreased → Credit

Step 4: Record the Entry and Make Sure Both Sides Match

Now record the transaction with equal amounts on both sides.

Double-entry record:

- Debit: office supplies expense: £120

- Credit: bank: £120

Double Entry Bookkeeping Examples

Let’s see some double entry bookkeeping examples in:

Example 1: Using Credit to Make a Business Purchase

A business made a purchase of inventory worth £780 on credit. When the payment is made, the accounts payable will decrease by £780, and cash will decrease by £780. So, in the general ledger, it will be debited the accounts payable account (a liability account) and credited the cash account (an asset account).

When the business received the £780 worth of inventory, its inventory increased by £780, and its accounts payable increased by £780. In the ledger, it will be recorded as a debit to the inventory (asset) account and a credit to the accounts payable (liability) account.

Example 2: Receiving a Business Loan

A business applies for a loan of £9,000, and it receives the money. Its cash increases by £9,000, and its loan liability increases by £9,000. In the ledger, it will be recorded as a debit to the cash (asset) account and a credit to the loan payable (liability) account.

Why Double Entry Bookkeeping Is Important for Small Accounting Practices

Double entry bookkeeping offers some strong advantages for practices when they work on accounts. These advantages are:

Accuracy of Accounting Records

One of the major advantages of double-entry is making accurate records. Through double-entry, you can get all the data required for making financial statements and reports. Due to the availability of records, you will be in a position to identify how much your client owes and how much they owe themselves.

Keep Track Of Your Assets And Liabilities

Single-entry bookkeeping allows you to track each transaction as an expense or income. In double entry bookkeeping, access is given to assets, liabilities, and taxes, which are the components of a balance sheet.

Establishing A Trial Balance

Another big advantage of double entry bookkeeping is the ease of generating a balance sheet and an income statement. When they are combined, it yields a trial balance of your clients’ ledger accounts.

Making Crucial Decisions is Easy

It helps in making important and well-informed decisions by providing valuable financial information. So, your practice will be in a position to help your clients in making decisions based on insights.

This makes you think about investing more resources into in-house capabilities. But compared to in-house outsourcing will do job even better.

Double Entry Bookkeeping vs Single Entry Bookkeeping

| Feature | Double Entry | Single Entry |

| Records two sides | Yes | No |

| Produces balance sheet | Yes | No |

| Best for VAT & compliance | Yes | Limited |

| More accurate | High | Medium/Low |

| Suitable for growing firms | Yes | Only micro-businesses |

If you are looking after accounts of small sole traders, then single-entry bookkeeping will be sufficient. But it will be a risky proposition if transaction volume increases. This risk can be countered by outsourcing this bookkeeping task.

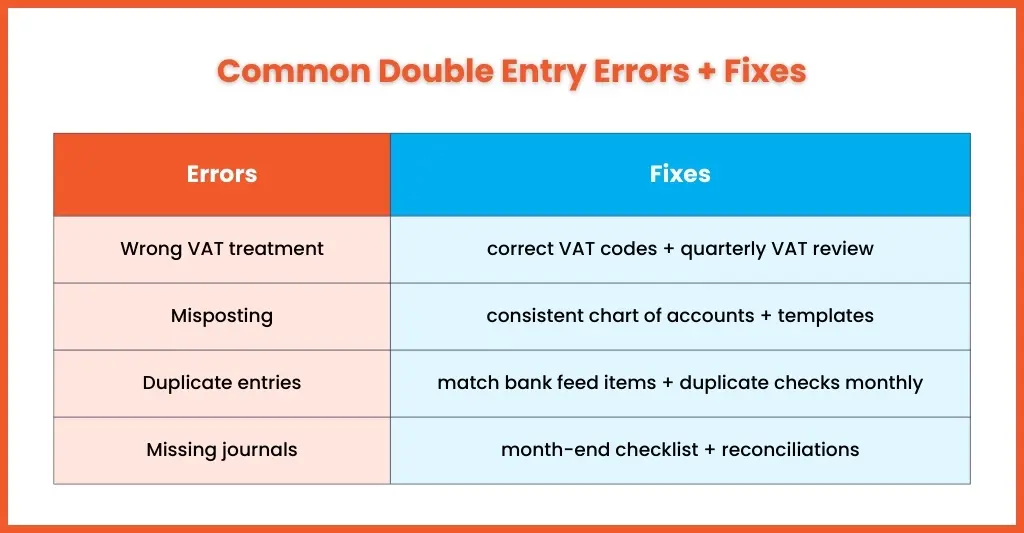

Common Errors in Double Entry Bookkeeping (and How to Avoid Them)

Yes, double entry is known for highlighting mistakes, but while working on it, mistakes can happen, especially when your teams are handling multiple clients with high volumes. These mistakes can create a lot of stress at VAT time and year-end.

Here are the most common errors and how to fix them.

Wrong VAT Treatment

This mistake occurs when the wrong VAT code (standard vs zero-rated vs exempt) is used, or the reverse charge is missed.

How to avoid it:

- Use VAT codes correctly every time

- Verify VAT transactions before filing

- Conduct a quick VAT check every quarter

Misposting to the Wrong Account

It happens when transactions are recorded in the wrong category. For example: posting equipment as an office expense.

How to avoid it:

- Use a consistent chart of accounts

- Create templates for common expenses

- Train accountants with simple examples

Duplicate Entries

This is common with bank feeds when someone posts an expense twice instead of matching it to the invoice.

How to avoid it:

- Always match bank payments instead of creating new entries

- Use bank rules carefully

- Check for duplicates monthly (same supplier + same amount)

Missing Journal Entries

These errors take place when month-end journals are forgotten (accruals, payroll journals, depreciation, etc.).

How to avoid it:

- Conduct a simple month-end checklist

- Reconcile key accounts monthly

- Do journals before final reporting

If you are unable to implement the solutions to reduce common double-entry errors completely, then get hold of a bookkeeping outsourcing service provider. Through its bookkeeping outsourcing services, you can get access to experts who will work towards eliminating these errors like your extended accounting team. To decide better know the benefits of outsourcing bookkeeping services.

People Also Ask

What is double entry bookkeeping and how does it work?

Double entry bookkeeping records every transaction twice, one debit and one credit, to keep books balanced and accurate.

Is double entry bookkeeping required for businesses?

Most limited companies and VAT-registered businesses effectively require double entry bookkeeping to maintain proper accounting records, especially under MTD expectations.

What are the main rules of double entry bookkeeping?

The main rules are: every transaction affects two accounts, and total debits must equal total credits.

What are the rules of double entry bookkeeping?

The double-entry rule is thus: if a transaction increases an asset or expense account, then the value of this increase must be recorded on the debit or left side of these accounts.

Conclusion: Why Double Entry Bookkeeping Still Matters

What is double entry bookkeeping really about? It’s a question which your clients keep asking, and you can answer them that it is the source of accurate numbers on which they can trust and make their decisions. VAT return, management report, and year-end account are based on these numbers. No wonder it is important for your small accounting practice.

Many accounting practices transitioned from single-entry to double-entry to handle the increasing volume of transactions and client growth. But it has faced challenges in streamlining the double-entry process. That’s where Equallto comes in, providing support to practices in streamlining their bookkeeping workflows, reducing errors, and keeping them compliant with UK reporting expectations without drowning in manual checks.

To streamline your double-entry process, connect with us through our contact form and get stress free.