Are your clients well-prepared for the self-assessment deadline 2026? Do they remember their login? As a small accounting practice handling self-assessment of your clients, these questions are pretty natural to come up. After all, millions of taxpayers in the United Kingdom meet the deadline for self-assessment; however, many miss it.

When they miss, it’s natural to panic and in that panic they commit errors, which take long time for you to rectify. Hence, it is important to know key self-assessment deadlines, on who it is applicable, and the penalties for missing them.

Knowing the deadline for self-assessment will enable you to maintain compliance, manage your workload, and meet your client’s expectations.

What is Self-Assessment

Self-assessment is a process developed by the HMRC for collecting income tax from individuals based in the UK. Under this process, individuals or businesses whose tax is not deducted directly through PAYE can declare their income and file a self-assessment tax return with HMRC. To put it simply, calculating tax and paying it to HMRC will be on the taxpayer.

According to HMRC, more than 11.5 million submitted their self-assessment tax returns by the 31st January deadline, and 97.36% of them were submitted online in the year 2023-24. And by October, 3.5 million people have already submitted their tax return for the year 2024-25. For registration, follow this self-assessment guide.

Key Self-Assessment Deadlines You Should Not Miss

Let’s review some key deadline for self-assessment, as missing them is common and costly for both your clients and your practice. These deadlines are:

- 5 October – Deadline to register for Self-Assessment if it’s your first time filing

- 31 October – Deadline for paper tax returns

- 31 January – Final deadline for online Self-Assessment submission

- 31 January – Deadline to pay tax owed for the previous tax year

- 31 July – Second payment on account (if applicable)

According to HMRC data, 1.1 million taxpayers missed the 31st January deadline, triggering instant penalties. These penalties can be avoided by preparing and filing on time.

Who Needs to File a Self-Assessment Tax Return

Many get their income tax deducted at source through PAYE, so they don’t need to do a self-assessment. However, many are required to do so because their income does not get taxed. Currently, the following are eligible for doing self-assessment:

- Self-employed person with income more than £1,000

- Partner in business

- Had to pay capital gain tax

- Income from renting a property

- Income from savings, investments and dividends

- Getting foreign income

What Happens If You Miss the Deadline for Self-Assessment?

It must be noted that once the deadline for self-assessment tax return is passed, HMRC will automatically apply penalties for late filing.

- The initial penalty will be £100

- Add £10 per day for 3 months, up to £900

- £300 or 5% of tax owed after 6 months

- After 12 months, add another 5% or £300 charge

The penalty must be paid within 30 days of receiving the notice.

How to Prepare Before the Self-Assessment Deadline

Your clients are required to do a self-assessment if they are self-employed or a director and have income outside of PAYE. The HMRC online tax filing deadline is 31 January, and it is wise to file it early and accurately to avoid penalties.

Here’s how you must prepare for it:

Organise Records Early

Without accurate record keeping, a smooth self-assessment process is not possible. Hence, start gathering all the records for the tax year 2024-25, which includes:

- Income records

- Invoices

- Rental income details

- Bank statements

- Business expenses

- Pension contributions

- Dividend vouchers

By keeping these records in proper order, you will reduce the risk of errors and speed up the filing process.

Know The Dates

Not knowing the deadlines will lead to missing them and penalties. Hence, keep a note of the following dates:

- 5 October: Deadline to register for Self-Assessment if it’s your first time filing

- 31 October: Deadline for paper tax returns

- 31 January: Final deadline for online Self-Assessment submission

- 31 January: Deadline to pay tax owed for the previous tax year

Claim Allowable Expenses

You reduce your clients’ tax bill by identifying and claiming allowable expenses. Under allowable expenses come:

- Office costs

- Travel costs

- Professional fees

- Expenses on marketing and advertisements

File the Self-Assessment at the Earliest

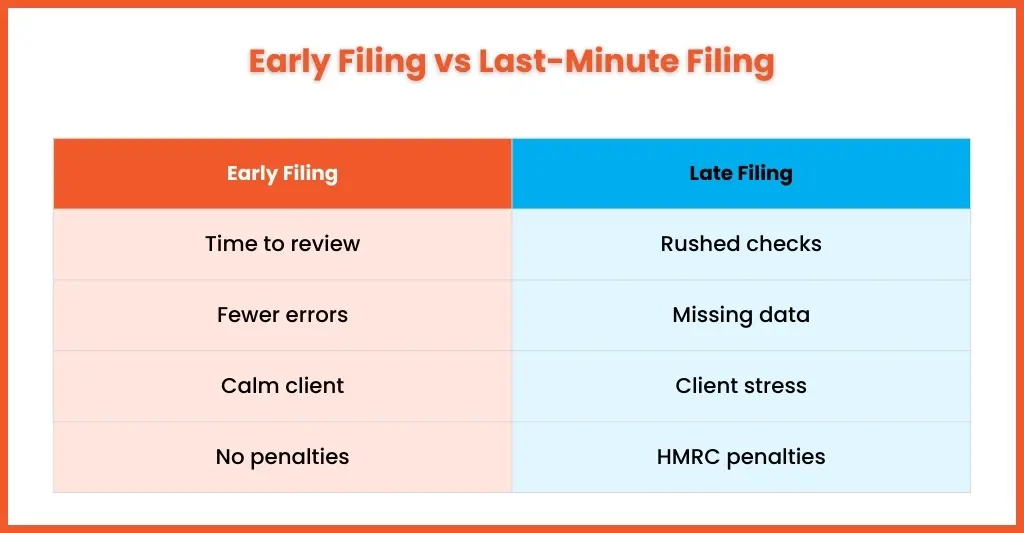

Waiting to file the self-assessment in January will increase stress for you and your clients. It will only lead to rushed work, errors, and long waiting times with HMRC. Therefore, choose to file early because it will give you time to peacefully calculate and rectify mistakes.

Common Mistakes That Cause Late or Incorrect Returns

As an accounting practice, you must have come face-to-face with a few mistakes while doing self-assessment quite often. These mistakes slow down the entire process, create doubt among your clients, and increase the risk of penalties. These common mistakes are:

Forgetting Login Details

One of the most common mistakes by clients is misplacing their Government Gateway user ID or password. It happens frequently because self-assessment occurs once a year, leading to misplacement by the client. Recovering it takes time, thus delaying the filing process.

Incomplete Records

Incomplete bookkeeping is the second most common mistake, and it occurs when clients send incomplete banking transactions and receipts. It results in a lot of back-and-forth to resolve discrepancies, causing delays.

Incorrect Income Reporting

Very often, client do not mention their income stream, such as CIS deductions, dividends, or rental income. Missing them will lead to errors and resubmission after filing.

Doing Submission Work in January

Clients often send their records at the last minute, leaving you less time to resolve discrepancies, recover missing data, or address HMRC access issues. This mistake increases the risk of errors, missing deadlines or rushed submissions.

Assuming No Tax Due Means No Return Required

It’s wrong to assume that if no tax is owed, self-assessment is not required. Late submissions will result in HMRC penalties, regardless of whether tax is due.

Misunderstanding Payments on Account

Payments on account are frequently misunderstood, particularly by self-employed individuals and new taxpayers. Clients are often caught off guard by the requirement to pay two advance payments towards the next tax year. This confusion can lead to cash flow issues, late payments, or disputes after the return has already been submitted.

How Making Tax Digital Will Change the Deadline for Self-Assessment

Making Tax Digital for VAT is already compulsory, and by 2026, it will be implemented on Income Tax in a phased manner. Indeed, it will impact how self-assessment works.

Under MTD for Income Tax (from April 2026 for many taxpayers):

- Quarterly digital updates will replace annual reporting

- Records must be kept using MTD-compatible software

- End-of-period statements and final declarations will still apply

- Deadline management will shift from annual pressure to ongoing compliance

One thing is certain: MTD will require more frequent submissions, creating tighter timelines and greater strain on your staff. To avoid such a situation, you will need to train your staff for handling MTD and upgrade your entire system. Also, explore year-end outsourcing services of a professional service provider to access MTD expertise and advanced tools.

People Also Ask

What is the final deadline for Self-Assessment in the UK?

The final deadline for online Self-Assessment tax returns is 31 January following the end of the tax year. This is also the deadline to pay any tax owed.

Can I file my Self-Assessment tax return late if I owe no tax?

Late filing is allowed, but an automatic £100 penalty is be applied, even if no tax is due.

How long do I have to pay tax after the Self-Assessment deadline?

Tax is due by 31 January. Late payment triggers daily interest charges and additional penalties after 30 days.

What happens if I don’t register for self-assessment by 5th October?

If your client fails to register for self-assessment by 5 October than the client must face penalty from HMRC for failure to comply.

Conclusion

For any small accounting practice handling multiple clients, the self-assessment deadline is one of the most important points in the UK tax calendar. However, it is becoming progressively difficult due to high volumes of complex cases and rising UK regulatory compliance requirements.

With the advent of MTD, last-minute manual submissions will become untenable and will lead to late penalties. This is where EquallTo comes in as a lifesaver for practices struggling to meet self-assessment deadlines.

With our professional and reliable outsourcing support, you will get a scalable service that is deadline-compliant even during the peak self-assessment season. To further elaborate on your requirements, use our contact form and get a peek at the services in detail.