How much has UK accounting transformed in the last few years? It will be hard for you to believe, but in the previous five years, the latest accounting technology has considerably reduced piles of paperwork. With more than 75% of accounting practices increasing their spending on technology, according to the UK Accountancy Sector Outlook Report by HSBC UK and Accountancy Age, this trend will continue in 2026. However, such a trend is a blessing and a curse for small accounting practices.

The latest accounting technology has created a level playing field for small accounting practices, making scaling up possible without quality compromise. Still, about 15% of practitioners are finding it difficult to adapt to these new advances in accounting technology. This shift isn’t about keeping up with trends; it’s about staying relevant, efficient, and profitable in an increasingly digital accounting profession.

In the blog, we will go through the benefits and challenges in adopting the latest accounting technologies.

The Rise of Accounting Technology in Modern Firms

Accounting technology is an umbrella term used for tools, software, and systems used in the accounting profession. With practices facing increasing challenges in managing tight deadlines, talent shortage, client demand for quick services and growing compliance requirements, accounting technology has turned into a lifesaver for practices with small teams.

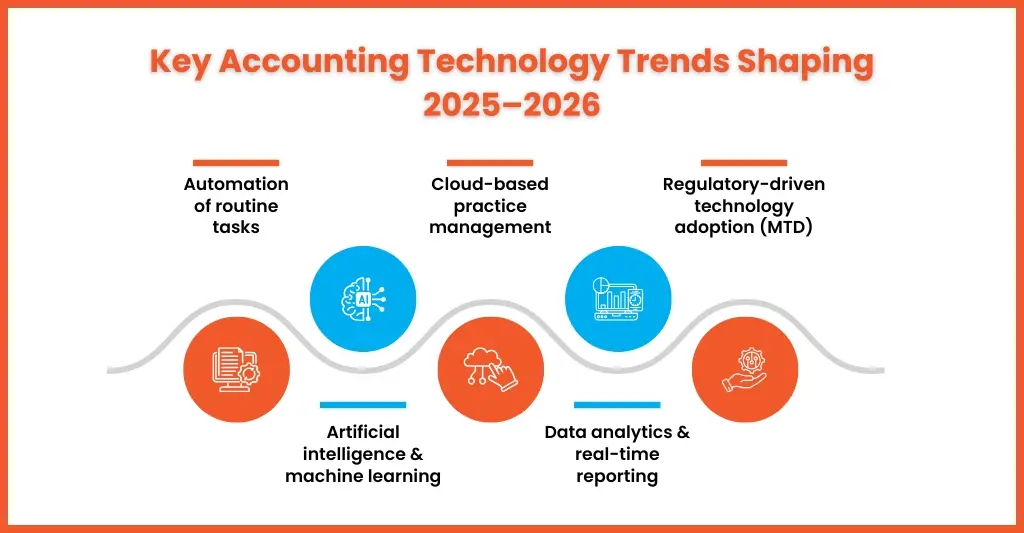

Key Accounting Technology Trends Shaping 2025–2026

As we have said above, the trend of accounting technology will continue in 2026, and some of the key trends to watch out for are:

Automation of Routine Tasks

Automation has already taken on a significant amount of accounting tasks, such as bank reconciliations, invoice processing, and data entry. Accounting firms have already reported a time saving of up to 30 to 40% and this will go up with more bookkeeping tasks being automated. Through automation, you can free up your staff for more high-value work.

Artificial Intelligence and Machine Learning

AI in accounting have taken centre stage when it comes to detecting errors, spotting fraud, and categorising transactions. Instead of the misconception gaining ground of replacing accountants, AI and ML have equipped accountants by becoming their powerful eyes for spotting errors, thus increasing accuracy and reducing risks.

Cloud-Based Practice Management

Almost all clients these days are pushing their accounting firms to adopt cloud accounting software for better real-time collaboration and transparency.

Data Analytics and Real-Time Reporting

Clients are no longer interested in just raw historical numbers; they want an analysis of what those numbers mean. Modern accounting technology has turned those numbers into insights. These insights have helped clients with future planning, making them highly relevant.

Regulatory-Driven Technology Adoption

Making Tax Digital for VAT already applicable and now MTD for Income Tax in the coming years. This makes digital record-keeping and submissions mandatory rather than optional, accelerating technology adoption across UK practices.

Benefits of Embracing Accounting Technology

Accounting technology has become increasingly relevant to many small accounting practices because it has made their work easier. It has achieved that through numerous important benefits. Some of those are:

More Efficiency and Accuracy

Traditional manual processes like manual entry and reconciliations have only consumed more time and are error-prone. However, with the help of the latest accounting technology, accounting practices are completing the task within a few minutes. Accounting tech has made it possible to save time and ensure accurate financial records are made.

Streamlined Financial Reporting

Innovation in accounting technology has made streamlining of financial reporting possible. The latest version of accounting software can gather data from multiple sources and prepare reports with a few clicks. It has allowed firms to concentrate on analysing the data and providing insights to their clients.

Increased Data Security

Many of your clients are worried about cyber attacks these days, and accounting firms have found accounting technology valuable in protecting their clients’ data. Tech innovations in this area include:

- Advanced encryption methods

- Multi-factor authentication

- Secure cloud storage solutions

All of these features provide a higher level of protection for sensitive financial information.

Financial Insights in Real-Time

Waiting for financial updates for months is now a thing of the past. With the help of technology, accounting practices are now able to get data in real-time, thus helping in providing clients with real-time insights.

Remote Collaboration and Accessibility

Remote working with your clients is possible thanks to cloud accounting software. Using cloud accounting software, you can now get access to documents and cooperate with your clients remotely. It will give you the flexibility to service your clients across geographical limits.

Challenges and How to Overcome Them

Latest accounting technology has brought immense benefits for accounting practices, but it also has its share of thorns. While these thorns are few compared to the benefits, it is important to take note of these challenges to be better prepared.

Integration Complexity

Integrating new tech with existing systems can be full of hurdles and time-consuming, leading to disruptions. However, it can be tackled by simultaneously upgrading the existing system.

Skill Gaps

New accounting tech will need new skills to operate, which your existing staff will lack. By upskilling them or by partnering with a specialised outsourcing bookkeeping services, you can bridge the skill gap.

Costs

Get ready to spend considerably for acquire the latest accounting technology to be future ready. The costs, including software licenses, hardware upgrades, and training, will strain your budget but, in the long run, give you rich dividends.

Data Security

More technology means potential vulnerabilities in data security and privacy. Only special emphasis on advanced encryption methods, multi-factor authentication and secure cloud storage solutions will protect your client’s sensitive information.

Regulatory Compliance

The accounting industry is subject to strict regulatory requirements. Your job is to ensure compliance with local regulations to avoid legal issues.

How to Implement Accounting Technology in Your Practice

To implement the latest accounting technology in your practice flawlessly, you will need to follow the steps below.

Do a Technological Assessment

Evaluate your technical capabilities and identify areas that need improvement. Also, check your practices capabilities to adopt new technologies and your client needs.

Develop a Plan

Finalise a plan that considers your goals and resources, and focus on investment in areas that are pressing for your practice and your clients.

Invest in Training

Train your accounting staff to use the latest accounting tech. This includes both technical training and soft skills development to adapt to changing workflows and client expectations.

Outsourcing with Professional Service Providers

Partner with a professional outsourcing accounting service provider who has the expertise and talent in operating these accounting tech tools and get their personalised support. Through them you will get access to the best tools and will help in streamlining the implementation process.

Maintain Strong Communication with Clients

Always keep your clients in loop about the upgradation of technology and its benefits. Such transparency will help increase trust and demonstrate your commitment towards innovation.

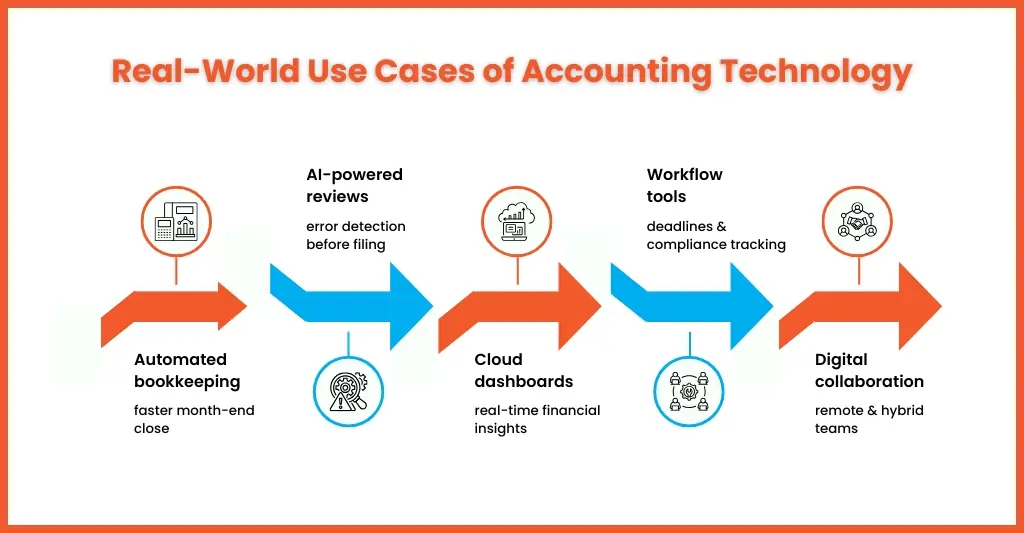

Real-World Use Cases of Accounting Technology

Here are some key real-world use cases that show how accounting technology is improving efficiency, accuracy, and client service:

Automated Bookkeeping Reducing Month-End Close Time

In the past accountants used to spend a lot of time on reconciling accounts, reviewing transactions, and ensuring that everything balances correctly. However, automation of bookkeeping has speed up the process

AI-Powered Reviews Flagging Errors Before Submission

AI has turned into a valuable tool, especially in detecting errors. AI tool can scan through multiple records in less time and pin point on discrepancies, missing data, or anomalies, which might go unnoticed. This has not only reduced the time spent on manual reviews but also ensured error-free records when filing.

Cloud Dashboards Giving Clients Real-Time Financial Insights

Cloud dashboards are providing clients with a user-friendly interface on which they can view their financial data, track their financial performance and check key metrics. This increases transparency and helps your clients in informed decision-making.

Workflow Tools Tracking Deadlines, Approvals, and Compliance

Workflow tools have helped in ensuring essential tasks are done on time, approvals are obtained, and compliance with regulations is maintained. It sends automatic reminders and task tracking to ensure nothing slips, reducing the risk of missing deadlines.

Digital Collaboration Enabling Remote and Hybrid Teams

Digital collaboration tools enable accountants to work seamlessly with clients and colleagues, regardless of location. Document-sharing, video conferencing, and real-time collaboration platforms enable teams to stay connected and collaborate on financial data.

FAQ — Accounting and Technology

What is the impact of automation on accounting?

Automation reduces manual work, improves accuracy, and allows accountants to focus on advisory services rather than data entry.

Is AI replacing accountants?

No. AI supports accountants by enhancing efficiency and accuracy, but professional judgement, compliance expertise, and client relationships remain human-led.

What is the future of accounting technology?

The future lies in intelligent automation, real-time reporting, integrated systems, and advisory-led services powered by data and digital tools.

How has technology made accounting easier?

Accounting software has reduced the need for manual data entry, thus reducing errors and saving precious time on repetitive tasks. It makes real-time financial reporting possible and enhances client service by improving response time and advisory services.

Conclusion

The influence of the latest accounting technology is the present reality of the UK accounting world and will keep shaping the future of accounting practice operations. Adopting this technology is important, but we also understand that its potential to disrupt the operations of your small practice and stretch your teams. In such situations, you can take the expert of outsourcing providers and this is where Equallto steps in.

We combined our experience in the latest accounting technology with experienced human support. The result of this combo is enabling practices in streamlining their operations, managing their compliance, and scaling up without compromising on quality or control. If you are looking to transform your practice into a future-ready one, then Equallto should be the best choice.

Get future-ready by connecting with us while staying focused on clients and growth.