Introduction: Why HMRC MTD Income Tax Changes 2026 Matter

When is the MTD for Income Tax getting implemented? It’s a question your clients have asked multiple times, and you can finally answer it. The year 2026 will be the year of MTD implementation on Income Tax, representing one of the biggest shifts in UK tax reporting since Self-Assessment became online.

According to HMRC, the HMRC MTD Income Tax Changes 2026 will impact an estimated 3 million UK taxpayers. It means a small accounting practice shouldn’t treat it as a minor compliance change; it will impact your workload and client management.

In this guide, we will explain what changes MTD for Income Tax will bring, why it is being implemented, and how it will impact your accounting practice.

Making Tax Digital Income Tax Changes UK: What’s Changing in 2026

Self-assessment is going to be a thing of the past, and that’s what the HMRC MTD Income Tax Changes 2026 is all about. The aim of HMRC is clear: to reduce errors and make the UK tax system digital.

From April 2026, affected taxpayers must:

- Keep digital records

- Submit quarterly income and expense updates

- File an End of Period Statement (EOPS)

- Submit a Final Declaration to confirm total tax liability

Why HMRC Is Expanding Making Tax Digital to Income Tax

MTD for VAT was first implemented in 2019 and, by 2022, was applied to all VAT-registered businesses (approx. 2.73 million). The results of this implementation were a 20% drop in VAT errors.

Now, HMRC wants to achieve the same success by implementing MTD for Income Tax. By implementing this initiative, HMRC want to achieve:

- Improvement in accuracy

- Reduce year-end tax shocks

- Encourage better financial habits

- Close the UK’s tax gap, which has reached £5 billion

Who Must Comply With MTD Income Tax From April 2026

Come 6 April 2026, MTD for Income Tax will come into force in a phased manner for:

- Sole traders and landlords registered for self-assessment

- If your client’s income from business and property is more than £50,000

The threshold of £50,000 will be reduced to £30,000 in April 2027. For more guidance, check our MTD guide for UK tax compliance.

How MTD for Income Tax Will Work in Practice

For your practice, the MTD Income Tax changes 2026 mean more frequent but less complicated submissions.

The new processes to be included are:

- Quarterly Updates – summary of income and expenses (not tax calculations)

- End of Period Statement (EOPS) – adjustments and reliefs

- Final Declaration – replaces the traditional Self-Assessment return

- Quarterly updates are informational, not payment demands—something many clients misunderstand.

For your practice, this means:

- More frequent client touchpoints

- Stronger bookkeeping discipline

- Clear processes and automation

MTD Income Tax Deadlines UK: Key Dates to Prepare For

Here are the key deadlines under MTD for Income Tax:

- Quarter 1: 6 April – 5 July → due by 5 August

- Quarter 2: 6 July – 5 October → due by 5 November

- Quarter 3: 6 October – 5 January → due by 5 February

- Quarter 4: 6 January – 5 April → due by 5 May

- EOPS: by 31 January

- Final Declaration & tax payment: by 31 January

The deadlines for quarterly updates will be 7 August, 7 November, 7 February and 7 May following the end of the relevant quarter.

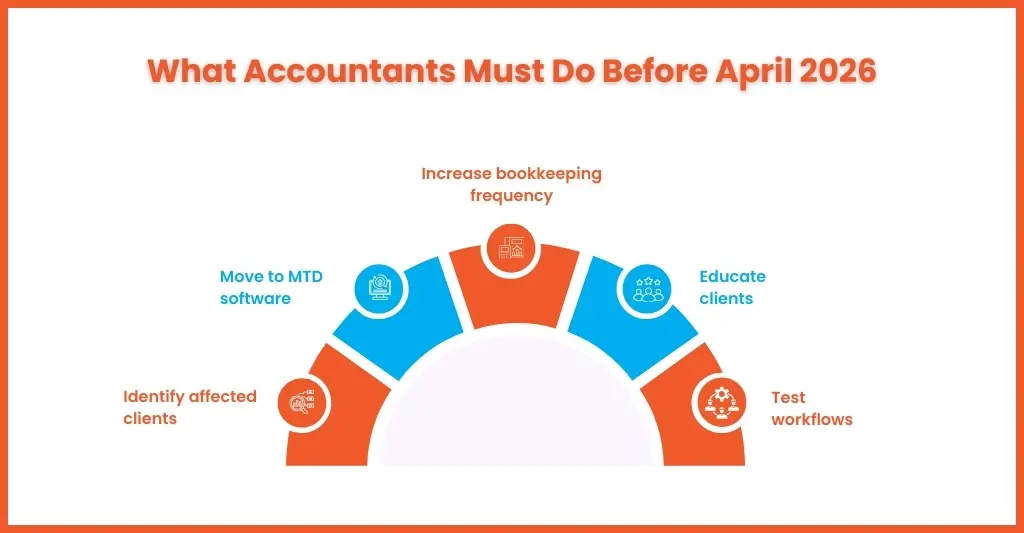

Steps UK Taxpayers Should Take to Prepare for MTD Income Tax

With April 2026 just a few months away, it’s the right time for your clients to start preparing for MTD for Income Tax. The early preparation will avoid last-minute confusion and enable a smooth transition. And you can play an important role in guiding your clients through this shift. Here are some steps you must not miss.

Identifying Affected Clients Early

First and foremost, start identifying clients (sole traders and landlords) who will come under the MTD for Income Tax, those who exceed the £50,000 threshold. Early identification will allow time for planning, communicating with clients and making the necessary changes, instead of reactive changes close to the deadline.

Moving Clients Onto MTD-Compatible Software

MTD initiative means using MTD-compliance software and storing digital records in it. If your client is still maintaining paper records, then they will need to transition before April 2026. Educating your clients about digital tools, their benefits, and their importance reduces their resistance and avoids disruptions once the quarterly reporting starts.

Improving Bookkeeping Frequency

Of course, quarterly reporting will mean more bookkeeping and not just year-end updates. Hence, inform your clients about keeping their books updated on a monthly or weekly basis. This will ensure accuracy, reduce submission time, and avoid missing transactions.

Educating Clients About Quarterly Reporting

Most of your clients will mistake quarterly updates for paying taxes four times a year, which is untrue. Hence, it must be informed to them that quarterly submissions are like an update, not final tax calculations or payment demands.

Testing Digital Workflows Well Before April 2026

MTD will fundamentally change your workflow; hence, you must test all your processes, from data capture and review to submission and client communication. Start running tests on your workflows to identify gaps, training requirements, and aspects where time is needed to fix.

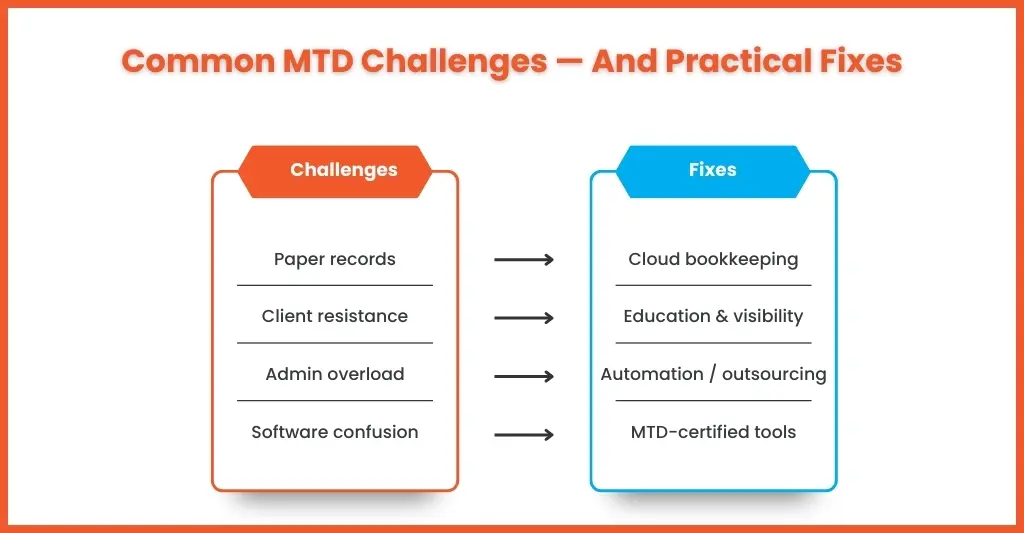

Common MTD Income Tax Challenges and How to Overcome Them

HMRC is implementing MTD for Income Tax with the objective of smoothing and digitising the UK tax system in the long run. But the road towards its implementation is littered with hurdles which are formidable if not taken care of.

Poor Digital Record-Keeping

Many of your clients still prefer paper records, which will be unsustainable under MTD. Digital record-keeping will be a must, and it has to be up to date to meet quarterly reporting requirements.

How to overcome it:

Create awareness among your clients about cloud-based accounting software at the earliest. Make them aware of its benefits and give them time to adapt to your practice.

Client Resistance to Quarterly Reporting

Many of your clients might consider quarterly reporting unnecessary and might create resistance.

How to overcome it:

Communicate with your clients about the necessity of quarterly reporting. Explain its benefits, such as greater financial visibility, improved compliance, and it will help in reducing resistance.

Increased Admin Load for Practices

Instead of one annual submission, you will be required to do five submissions for each client. Without upgrading your system, it will lead to more workload, thus putting pressure on your accounting team.

How to overcome it:

Automation will play a critical role in handling repetitive tasks, hence focus on incorporating automation tools. If that is not possible, then explore the possibility of outsourcing bookkeeping work without expanding your team.

Software Confusion

With MTD becoming the norm, you will find a growing number of MTD-compatible tools in the market. This situation has confused many practices, leading to many using multiple software or tools, leading to training challenges, inconsistency and inefficiency.

How to overcome it:

It will be wise to use certified MTD-compliant software that meets HMRC requirements and that can integrate well with your system. Some practices have chosen the route of outsourcing to a service provider that uses MTD-compliant accounting software.

Impact of MTD Income Tax Changes on Accountants and Practices

With HMRC implementing MTD for Income Tax in April 2026, you should expect some significant impact on the working of your firm.

Expected impacts include:

- Increased compliance workload

- Higher demand for bookkeeping support

- Greater reliance on automation

- Shift from annual fees to recurring models

According to ICAEW research, over 70% of UK practices will come under increased work pressure due to MTD income tax, and the small firms will be impacted the most. To cushion your practice from this workload, you must start focusing on automation by partnering with an outsourcing provider for outsourced bookkeeping services.

What Comes After 2026: Future of Making Tax Digital?

HMRC will not stop at the £50,000 threshold for MTD for Income Tax. It will be reduced to £30,000 in April 2027, forcing more taxpayers to become MTD-compliant and further to £20,000 in the near future.

One thing is clear: MTD is here to stay and will change how tax compliance works in the UK.

People Also Ask

What are the MTD Income Tax deadlines UK taxpayers should know?

Quarterly updates are due one month after each quarter end, with the Final Declaration due by 31 January following the tax year.

Can accountants submit MTD Income Tax updates on behalf of clients?

Yes. Accountants or an accounting firm can submit all MTD updates, EOPS, and Final Declarations using compatible software and agent authorisation.

What are the HMRC MTD Income Tax changes in 2026?

From April 2026, sole traders and landlords earning over £50,000 must keep digital records and submit quarterly income updates instead of annual Self-Assessment returns.

Conclusion: How EquallTo Helps Practices Stay Ahead of MTD

The HMRC MTD Income Tax Changes 2026 are not like a normal compliance update; it’s going to fundamentally change the way accounting practices handle tax filing for their clients.

To handle these changes, you will need to scale up your bookkeeping services, maintain digital workflows, and step into automation. The hard part is that making these changes requires investments in personnel and tools, which is hard, especially if you are running a practice on a small scale.

Here’s Equalto comes into the picture with excellent support for needy practices. Its experience in combining its MTD-compliant VAT outsourcing services with technology has worked in reducing its workload, and it’s capable of replicating the same for Income Tax.

Just as MTD transforms VAT, it will reshape the future of UK tax. Keep your practice one step ahead by connecting with us through our contact form. Looking forward to a meaningful association.