Have you accomplished VAT return payment without any hiccups? If so, you are very lucky, because other practices are not. Often, we have come across multiple practices, especially small ones, struggling with handling urgent client follow-ups, and missing figures. Not to forget, the MTD on VAT has added more complexity to it.

With MTD rules and their deadlines being enforced strictly by the HMRC, you cannot afford to delay payment even by a day. There are over 2.73 million VAT-registered businesses in the UK, and most of them depend on accounting practices to get their VAT done. The issue is that many practices are facing strain on their resources due to a considerable rise in VAT returns.

To address this problem, we have created this guide where we will break down what you need to know about VAT return payments and how they must be done correctly, on time, and without adding too much stress.

What is a VAT Return and Why Does It Matter?

Every VAT-registered business is required to fill out a VAT return form and submit it to the HMRC. It contains the amount of VAT it has charged on customers and the amount it has paid on business purchases over a set period, usually quarterly. Then it’s calculated whether the business owes money to the HMRC or is due a refund.

Why it matters for practices:

- Any error in the VAT returns will lead to HMRC queries and scrutiny

- Delay in VAT return payments will invite penalties for your clients

- Reoccurrence of mistakes will damage the client’s trust in your practice

VAT Payment Deadlines – UK Rules You Must Know

Here’s where the majority of the VAT issues come up. It must be remembered that according to VAT Payment Deadlines VAT returns must be submitted within one month and 7 days after the end of the VAT period.

Example:

- VAT quarter ends: 31 March

- VAT return payment deadline: 7 May

Missing this deadline will invite

- Late payment interest

- Penalty points under HMRC’s new VAT penalty system

For small practices managing dozens (or hundreds) of clients, keeping VAT return payment deadlines aligned is critical.

How to Submit a VAT Return in the UK

Currently, VAT Returns are done electronically through MTD-compliant accounting software, like Xero and QuickBooks. Ensure all the records are available in digital format and ensure VAT returns are filed before the deadline to avoid penalties. Check our Making Tax Digital for VAT guide to know in detail.

The process of VAT return submission is:

- Finalise VAT figures

- Review for errors or unusual variances

- Submit the VAT return digitally

- Confirm the VAT return payment method and amount

Your client often gets confused between submitting the VAT return and paying VAT. Hence, proper awareness must be created among them.

Different Ways to Pay Your VAT Bill

There are multiple payment methods through which VAT payment can be made, some of which are:

- Online banking: It enables direct payment to the HMRC. Payments via CHAPS usually arrive the same day.

- Debit or corporate credit card: Payments can be made online via the HMRC portal, but that only corporate credit cards are accepted.

- Direct Debit: It’s an ideal way for recurring VAT payments. However, it takes three working days to process a payment, so avoid last-minute submissions.

- Bank transfer: You can transfer funds via Bacs or a standing order. Ensure payments are made well in advance to meet deadlines.

VAT Late Payment – Penalties, Interest & What To Do

Let’s not confuse penalties under late VAT return submission with VAT late payment, as they have a different penalty system. Under VAT return, if late submissions take place, then your client will get a penalty point. Once the penalty threshold is crossed, your client will receive a £200 penalty. A further £200 penalty will be applicable for each subsequent late submission while still at the threshold.

The penalty point threshold is

| Accounting period | Penalty points threshold |

| Annually | 2 |

| Quarterly | 4 |

| Monthly | 5 |

On the other hand, VAT late payment penalties are based on the number of days the payment was delayed.

- Up to 15 days, no first and second late payment penalty is charged.

- Between 16 and 30 days overdue, the first late payment penalty is calculated at 3% on the VAT owed on day 15, and there will be no second late payment penalty.

- At 31 days or more overdue, the first late payment penalty is calculated at 3% of what was outstanding at day 15 plus 3% of what is still outstanding at day 30. The second late payment penalty is calculated at a daily rate of 10% per year on the outstanding balance. This is charged every day, from day 31 until the outstanding balance is paid in full.

What you should do immediately:

- Ensure the return is filed on time

- Confirm with your clients whether the payment was attempted or failed

- Communicate with HMRC if there are any valid issues

- Guide clients on Time to Pay arrangements where needed

Your proactive handling makes your practice stand out among your clients as a responsible professional making a significant positive difference.

Practical Case Studies: Common VAT Payment Scenarios

Scenario 1: Return Filed, Payment Forgotten

A common issue. The return is submitted on time, but the VAT return payment isn’t made.

Result: Interest charged, client confused, practice spends time explaining what went wrong.

Scenario 2: Direct Debit Set Up Too Late

Client assumes DD will cover payment, but setup missed HMRC’s cutoff.

Result: Payment doesn’t go through, penalty risk increases.

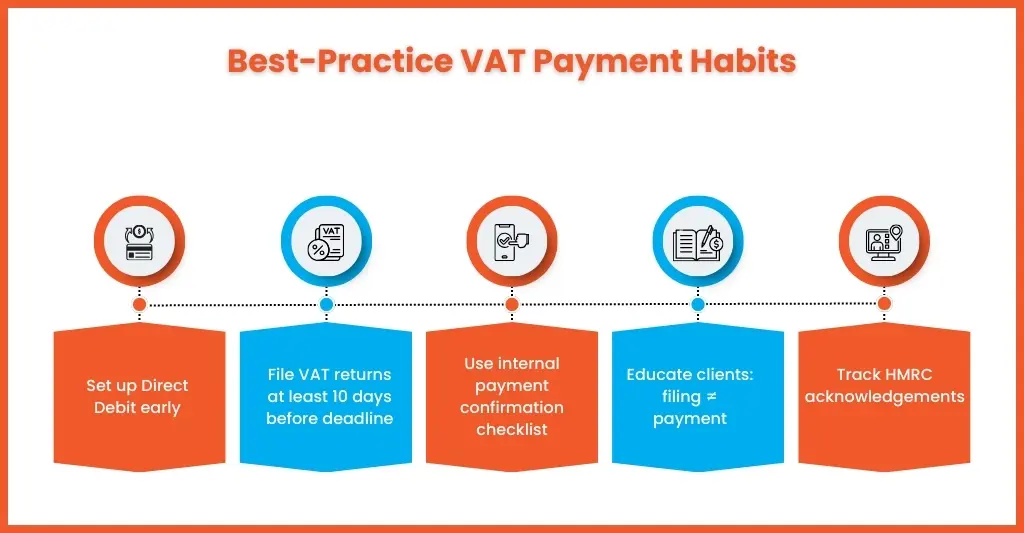

Expert Tips to Stay on Top of Your VAT Payments

For your experienced small accounting practice, handling VAT payments should not be an issue. Still, we have noticed scenarios where practices floundered due to last-minute pressure, wrong timing, and assuming things.

However, the good news is that following these tips will reduce your VAT related stress, and requirement to do firefighting.

1. Encourage Direct Debit Setup Well in Advance

Direct Debits is one of the secure ways of making VAT return payments only if it is setup early. If the setup misses HMRC’s cut-off, the payment won’t be collected, even if the VAT return is filed on time.

Best practice would be to:

- Direct your clients to set up Direct Debit at least two weeks before the VAT deadline

- Validate the bank details and authority

- Explain your clients clearly that late setup = late payment risk

Following it will significantly reduce the number of avoidable late VAT return payments.

2. File VAT Returns Early, Not on Deadline Day

Many practices and clients have the risky habit of filing VAT returns bang on the deadline day. In such a situation, if there is any error in figures, HMRC system delays, or any last queries, the VAT return payments get delayed. By filing early, you will be giving your clients breathing space to:

- Resolve discrepancies

- Confirm payment methods

- Ensure funds are available

All professional practices submit VAT returns at least 10 days before the deadline, thus turning the rush job into a controlled process.

3. Use Internal Checklists for VAT Return Payment Confirmation

Submission of VAT return is a job half done. The real risk is the payment success.

Internal checklists help practices confirm:

- The success of VAT return

- Activation of the payment method

- The correct amount is scheduled or paid

- HMRC acknowledgement has been received

These checklists will reduce to need to memorise or assume and ensure VAT return payments does not slip.

4. Educate Clients That Filing ≠ Payment

One of the greatest misconceptions about VAT return among client is they think VAT return filed is VAT return paid, which is untrue.

Clear client education is required to reduce:

- Last-minute panic

- Payment disputes

- Blame placed on the practice

Therefore, while onboarding your clients, educate them regarding this misconception. This will reduce the time spent on chasing payments later.

5. Track HMRC Acknowledgements Consistently

HMRC acknowledgements are proof that things are done properly, but they cannot be overlooked.

Tracking these acknowledgements is important and it helps you in the following:

- Confirm submissions were accepted

- Identify failed or rejected filings early

- Resolve issues before payment deadlines pass

Tracking acknowledgements is vital for practices that deal with multiple clients. One missed confirmation means inviting a penalty situation.

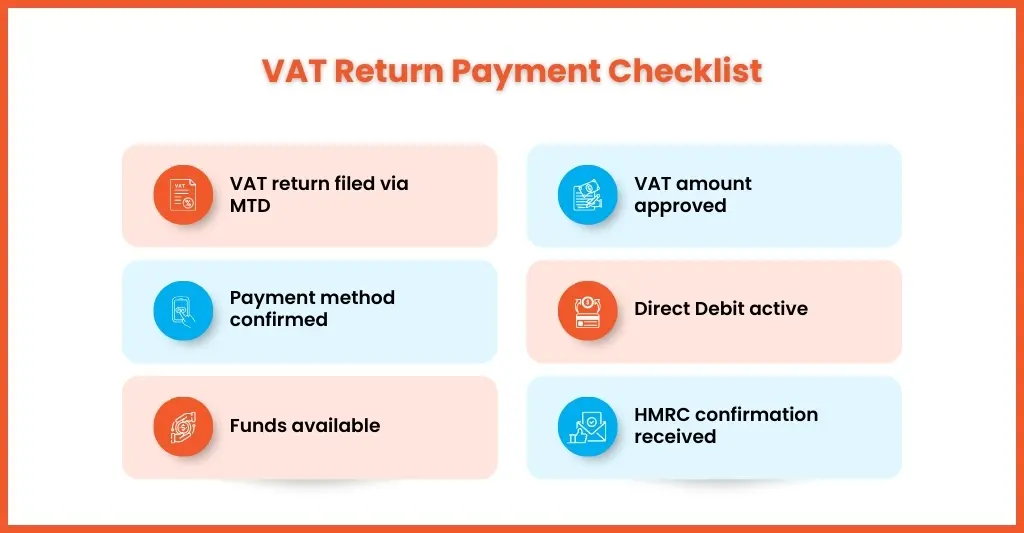

VAT Return Payment Checklist (UK)

Before the deadline, confirm the following:

- VAT return submitted via MTD software

- VAT amount reviewed and approved

- Payment method confirmed

- Direct Debit active (if used)

- Funds available in the client account

- HMRC confirmation received

Following this simple checklist will save hours of follow-up.

FAQs – Quick Answers to Your VAT Queries

How long do I have to pay VAT after submitting my return?

Your clients will have one month and 7 days after the VAT period ends to pay the VAT. The submission and VAT return payment deadlines are the same.

Can I pay my VAT bill with a credit card?

Yes, but only corporate credit cards are accepted. Personal credit cards are not permitted for VAT payments.

Can I pay my VAT bill in monthly instalments?

Yes, through a Time to Pay arrangement or the Annual Accounting Scheme, which allows businesses to spread VAT payments.

What happens if I don’t submit my VAT return on time?

For each VAT Return sent late, a penalty point gets added. This includes nil returns (where you have nothing to declare). Once the penalty point threshold is breached, your client will get a £200 penalty.

When to start paying VAT in the UK?

You must register your clients if their total taxable turnover for the last 12 months goes over £90,000 (the VAT threshold) or if the taxable turnover is expected to go over £90,000 in the next 30 days.

Conclusion

If proper precautions are taken, VAT return payments will be a simple task; if mishandled, be ready to face significant risks. You can handle VAT return payments; it’s the time, volume, and consistency that are required. Managing deadlines, client expectations, HMRC systems, and cash-flow conversations every quarter takes effort, which your small accounting practice will find difficult to manage.

Equallto can perfectly fill that capability gap. We have designed our VAT outsourcing services to support practices with clearer visibility and fewer last-minute surprises. Our services ensure VAT return payment become predictable, not panic-driven.

Are you facing any issues related to VAT return payment? It’s time to use our contact form to streamline the entire process.