Are you worried about the pace of changes that are changing the face of accounting in the UK? We respect your worries, but change is constant, and even the UK accounting industry cannot escape it. You must have noticed how Artificial intelligence, automation, and cloud platforms are already influencing the work of accounting practices. The good news is that it has delivered good results for accounting practices that were proactive in adopting it.

According to ACCA, over 75% of finance professionals believe technology will significantly change their role within the next five years. Hence, it is important to understand that this is going to be the future of accounting and must be adopted for your own relevance in the UK accounting market.

In this blog, we are going to do just that.

How AI Accounting Is Reshaping the Accounting Profession

Many considered accounting jobs to be immune to technological advances in the UK accounting industry, but that’s not the case. According to the Future of Jobs Report 2025 by the World Economic Forum (WEF), accounting, bookkeeping, and payroll clerks are among the fastest-declining roles globally.

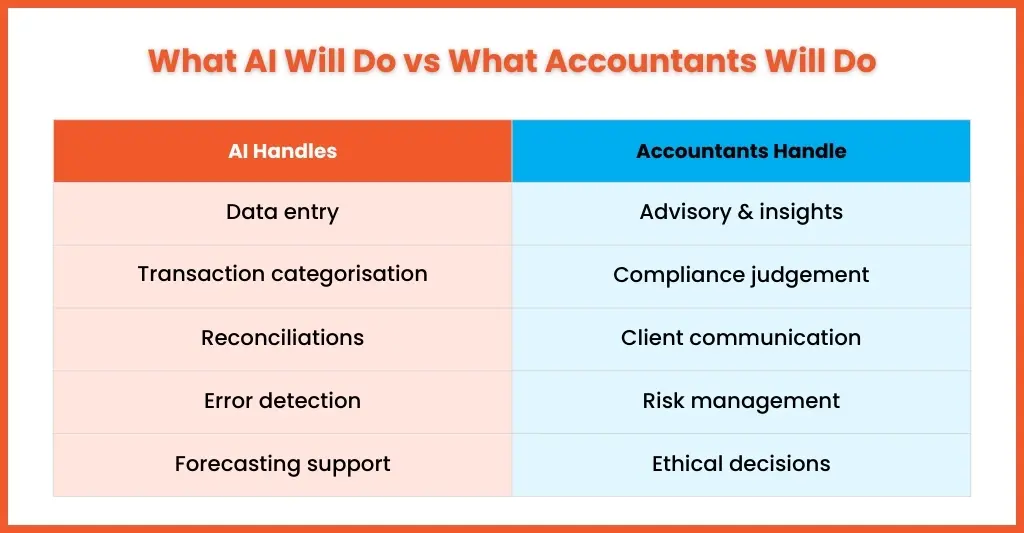

Among the primary reasons for this decline is the impact of AI, which automates repetitive tasks such as data entry and transaction processing. However, it also presents an opportunity.

According to ICAEW research, repetitive accounting tasks take up 40% of an accountant’s time. AI can take over that burden, saving time and giving your accountants the opportunity to explore strategic advisory and client consultations.

The future of accounting, AI will more likely work as your assistant, handling huge volumes, while your accountants will only need to apply their judgment.

The Role of Automation and Cloud Platforms in Modern Firms

Cloud accounting software and AI are going to be an integral part of every accounting firm in the UK. And the incorporation of automation has helped practices in speeding up the processing time by 30 to 50%

Through cloud accounting software, real-time collaboration with your clients, remote working and scaling of your services is possible. On the other hand, automation reduces manual errors and keeps up with the deadlines. In short, we can say both cloud platforms and automation have made life better for accountants.

Future Roles for Accountants in an AI-Driven World

AI in accounting has fundamentally changed the working roles of accountants based in the UK and will continue to influence them in the future. That does not mean accountants are going out of a job; it just means they are getting re-assigned.

In the future of accounting, accountants will become:

- Business advisers

- Compliance navigators

- Data interpreters

- Risk managers

- Trusted partners to business owners

ACCA has noted that clients value practices that provide them with insights and guidance. This has opened new business avenues for accounting practices that are willing to go beyond accounting work.

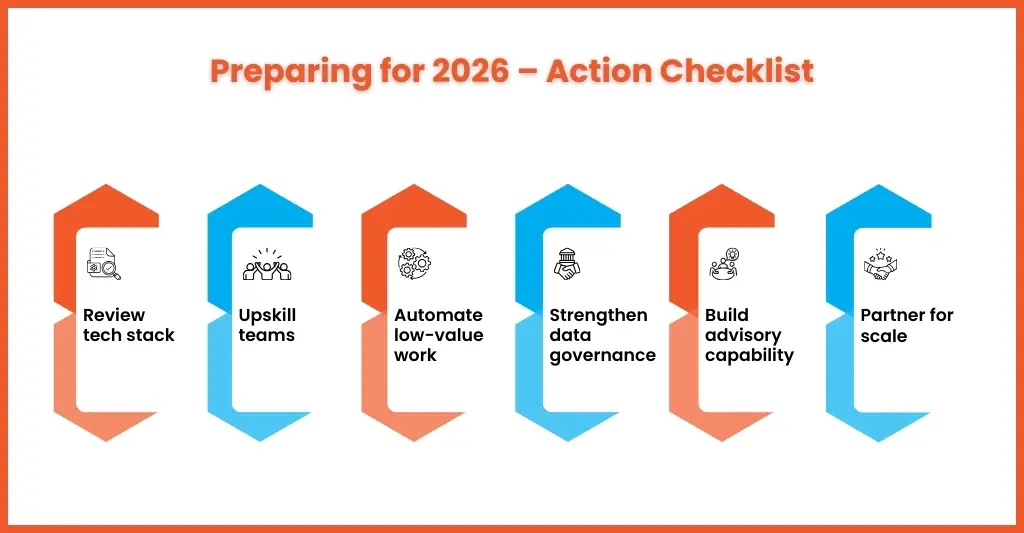

New Skills and Training Accountants Need for 2030

Accountants need technical knowledge to do their jobs, but to remain relevant in the future of accounting, that won’t be enough. With automation, AI and accounting software becoming the standard, you will need to train your accountants with digital, advisory and governance skills.

Here’s how the skill set of UK accountants is evolving as we move towards 2030.

Digital and Data Literacy

Your accountants will have to handle a large volume of real-time financial data and interpret trends, identify risks early, and help clients make informed decisions. Also, HMRC will accelerate the implementation of MTD, making it important for your accountants to be digital and data-literate.

Confidence Using AI and Cloud Platforms

You will have to make your accountants comfortable in using AI tools, which are essential for handling transaction categorisation, reconciliations, error detection and forecasting. Plus, cloud accounting platforms are already helping multiple practices in real-time collaboration with clients and remote teams. Using these tools will help in work getting faster, reduce errors, and deliver better client experience.

Strong Communication and Advisory Skills

Need routine accounting work automated; your accountants will be expected to add value through their advisory skills. They will be needed to interpret complex financial data and communicate those insights with your clients in an easy way.

Understanding of Automation Workflows

Automation is not just about tools, it’s about processes. Future-ready accountants will understand how workflows move from data capture to review, approval and submission, including where human checks add the most value. This process-led mindset helps practices scale efficiently, manage deadlines more effectively, and reduce dependency on individual team members, especially important as regulatory demands increase.

Cybersecurity and Data Governance Awareness

With more data getting stored digitally, you will be handling huge volumes of sensitive financial data of your clients. Therefore, a thorough understanding of UK GDPR and the Data Protection Act 2018 is essential, and it must be reflected in your practice. It will place your practice among the professionals.

Continuous Learning as a Competitive Advantage

In future, the advent of new technologies will influence accounting, and to stay ahead of the curve, you will need to incorporate a continuous learning culture in your practice. When you invest in upskilling your accountants with new tools and processes, you will be far better positioned for the decade ahead.

Ethical, Security & Regulatory Considerations for the Future

With AI, automation, and cloud platforms taking the centre stage in your practice’s daily accounting tasks, it’s time to get more responsible. In the future of accounting, ethical judgment, data security, and regulatory compliance will matter just as much as efficiency and innovation.

Here are the key considerations UK accounting practices must keep firmly in focus.

Data Protection and GDPR Compliance

You will be handling the most sensitive financial and personal data of your clients, and it will be used in AI tools and accounting software. This makes GDPR compliance non-negotiable.

Future-ready firms must ensure:

- Client data is stored securely within compliant jurisdictions

- Access controls are tightly managed

- Data is encrypted both in transit and at rest

- Clear policies exist for data retention and deletion

As per the UK Information Commissioner’s Office, data breaches happen due to human error, highlighting the importance of training. Greater data security will lead to greater client trust.

Transparency in AI Decision-Making

AI in accounting is being used to identify errors and categorise transactions. However, when it comes to decision-making, it still lags.

Accountants must be able to:

- Explain how AI-generated outputs are produced

- Understand the assumptions behind automated recommendations

- Challenge results that do not align with professional judgement

AI will assist in your decision-making, not in making decisions, and neither will it be held responsible.

HMRC Compliance and Audit Trails

MTD for Income Tax is going to be a reality in 2026, with an emphasis on digital audit trails and traceability.

Your accounting systems must:

- Maintain clear links between source records and submissions

- Log changes, reviews, and approvals

- Support real-time compliance checks

Any negligence in this will risk increased scrutiny from HMRC.

Cybersecurity and Risk Management

Cybercrime is on the rise and accounting practices are its favourite target, thanks to sensitive financial data in its possession. Regular security reviews, staff awareness training, and vendor due diligence will become standard practice.

What This Means for UK Accounting Practices Today

For your accounting practices, the future has already arrived. We say this because practices have to deal now with certain realities:

- Increasing compliance demands (MTD, quarterly reporting)

- Ongoing talent shortages across the profession

- Rising client expectations for speed and insight

According to ICAEW, over 70% of UK firms expect technology to change their operating model by 2030 significantly. Firms that plan adopting the right technology and support structures will be better positioned to manage workload and protect margins.

The Future Outlook for Accounting Firms in the UK

The future of accounting in the UK is digital, advisory-led, and technology-enabled, but still deeply human.

Successful firms will:

- Use technology to reduce low-value work

- Focus internal teams on high-impact services

- Build scalable, flexible operating models

- Partner strategically rather than hiring endlessly

This shift favours practices that are open to collaboration and new ways of working.

Frequently Asked Questions (FAQ)

Will AI accounting replace accountants in the UK?

Not at all; AI will only take over recurring accounting tasks, while the responsibility for compliance, judgment-making, and maintaining client relationships will remain the accountant’s domain.

What types of accounting work will still require human expertise?

Multiple accounting tasks require an accountant’s expertise, including advisory services, complex compliance, tax planning, client communication, and ethical judgment.

Is AI accounting compliant with HMRC regulations?

An MTD-compliant accounting software will create accurate records and audit trails, as required by HMRC under the MTD initiative.

Are accountants in demand in the UK?

Yes, accountants are in high demand in the UK accounting market, but are facing a shortage in getting accountants with specialised AI skills and expertise in complex regulations.

Conclusion: Preparing for the Future of Accounting with Equallto

The future of accounting in 2026 is very interesting due to the increasing influence of AI and cloud accounting software and tools. The changes that are about to come in 2026 are not a sudden affair. The challenge for the accounting practices is to get ready for those changes brought by AI and cloud tools without disrupting control, the functioning of your teams, and without increasing the risks.

Here’s where Equalto comes into the picture, providing much-needed support for forward-thinking practices. By combining AI-enabled processes with experienced accountants, we have enabled accounting practices to embrace the future of accounting with scale, high quality, and compliance.

Place your trust in us by using our contact form and share your accounting challenges.