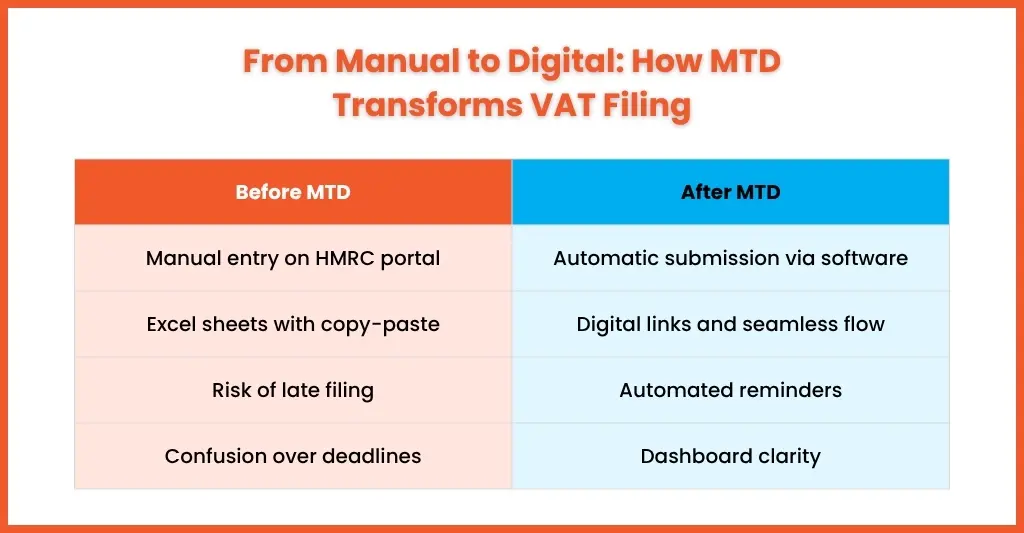

Making Tax Digital for VAT is one of the biggest changes to how UK businesses manage their taxes. Introduced by HMRC it’s meant to make the tax system more efficient, more effective and easier for taxpayers to get it right.

For accountants, bookkeepers and small business owners this means moving from manual processes and spreadsheets to approved digital tools that record, calculate and submit VAT returns to HMRC.

If your business is VAT-registered in the UK, compliance with Making Tax Digital (MTD) is no longer optional, it’s mandatory. Whether you do your own accounts or handle clients VAT returns understanding how to register, file and stay compliant is key to avoiding penalties and keeping things running smoothly.

Understanding Making Tax Digital (MTD) for VAT in the UK

Making Tax Digital for VAT is an HMRC initiative requiring all VAT-registered businesses to keep digital records and use compatible software to submit VAT returns.

Initially, only businesses with a taxable turnover above £85,000 were required to follow MTD rules. However, since April 2022, all VAT-registered businesses, regardless of turnover, must comply with MTD VAT regulations.

Key HMRC Requirements under MTD VAT

Digital Record-Keeping:

Businesses must maintain VAT records digitally. This includes sales, purchases, and VAT amounts charged or paid. These records must be stored using MTD-compatible software or digitally linked systems.

Digital Filing through Compatible Software:

You can no longer log into the HMRC portal and type VAT figures manually. Returns must be submitted through HMRC-recognised software that connects via a secure API.

Digital Links (No Manual Copy-Paste):

HMRC expects data to flow automatically between your systems. Copy-pasting VAT figures from one spreadsheet to another breaks digital-link rules unless properly integrated.

Penalties for Non-Compliance:

Missing registration deadlines, filing VAT manually, or using non-compliant methods may result in financial penalties, interest charges, or even audit investigations.

Making Tax Digital for VAT is more than just a compliance exercise. It’s part of a wider move toward digital bookkeeping and transparent, real-time tax management across the UK.

How to Register for MTD VAT (Step-by-Step for UK Practices)

Registering for Making Tax Digital for VAT is easy but must be done correctly to avoid your next VAT filing being disrupted. Here’s how UK practices and accountants can register:

Step 1: Check You’re Eligible

Make sure your business is VAT registered. If not, register for VAT through the HMRC VAT Registration UK portal. You’ll get a VAT number which is required for MTD enrolment.

Step 2: Choose MTD Compliant Software

Before you register, choose an MTD compliant digital tax software such as Xero, QuickBooks, Sage or Equallto-integrated solutions. This software must connect directly with HMRC’s MTD system to submit VAT returns:

Step 3: Sign into the Government Gateway

Use your Government Gateway user ID and password to sign into the HMRC MTD VAT service. You’ll need:

- VAT registration number

- Business email address

- Latest VAT return details

- Company registration details

Step 4: Authorise Your Software

Once registered, you’ll receive a confirmation email from HMRC. You must then link your MTD-compatible software with your Government Gateway account. This allows automatic submission of VAT returns via the HMRC MTD API.

Step 5: File Your VAT Return Digitally

After setup, use your chosen software to record transactions, calculate VAT liability, and submit returns digitally. Most software platforms, including Equallto-connected tools, provide built-in guidance to avoid filing errors.

VAT MTD Deadlines in the UK — Don’t Miss These Dates

Keeping up with HMRC digital filing deadlines is crucial for compliance. Late submissions can attract interest charges and penalty points under HMRC’s points-based penalty system.

Key VAT MTD Deadlines

Quarterly VAT Returns:

Most VAT-registered businesses send their VAT returns every three months. You get one month and seven days after the end of your VAT period to file it.

Example: If your VAT period finishes on 31 March, you’ll need to submit your digital VAT return to HMRC by 7 May. It’s a good idea to set a reminder so you’re not rushing at the last minute.

Monthly VAT Returns:

Some businesses (usually exporters or reclaimers) may file monthly. The same 1 month + 7 days rule applies.

Annual VAT Returns:

If you’re under the Annual Accounting Scheme, the deadline is 2 months after your VAT year ends.

Grace Periods

When transitioning to MTD VAT, HMRC may allow a short grace period for software setup or integration. However, this does not exempt businesses from filing on time — only from certain digital record-keeping penalties if there’s a valid reason. To stay compliant, set automated reminders or use Equallto’s built-in VAT alerts to receive notifications before your deadlines.

Benefits of Going Digital with MTD VAT

Complying with Making Tax Digital for VAT isn’t just about following rules — it’s about transforming how you manage finances. Here are the biggest benefits UK businesses and accountants experience:

1. Greater Accuracy

Digital filing eliminates manual errors, ensuring VAT calculations are correct and aligned with HMRC records.

2. Time-Saving Automation

Automated data entry, reconciliations, and filing reduce hours of repetitive work for both firms and clients.

3. Real-Time Financial Insights

MTD software gives an up-to-date view of sales, expenses, and tax liabilities, helping firms make smarter decisions.

4. Improved Cash Flow Management

Accurate, timely VAT submissions support better cash flow forecasting and reduce the risk of HMRC fines.

5. Enhanced Client Service for Accountants

For accounting practices, digital VAT systems mean faster reporting, seamless collaboration, and the ability to focus on higher-value advisory work.

Digital transformation in tax management is not just a trend — it’s becoming the new foundation for financial efficiency.

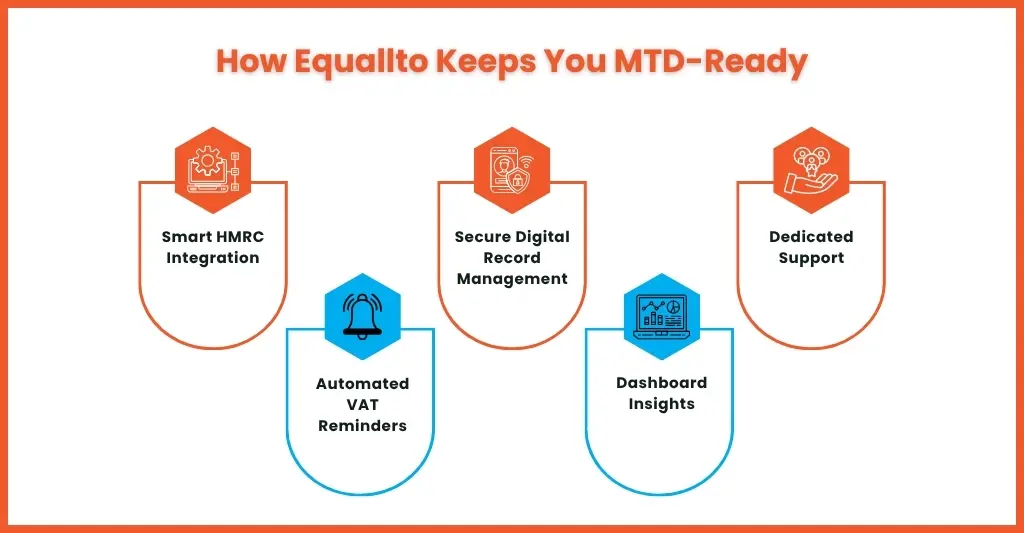

How Equallto™ Helps UK Accountants Stay MTD-Compliant

At Equallto™, we understand that small firms and accountants often juggle multiple client records, filing schedules, and compliance checks. Our mission is to simplify all of it.

Here’s how Equallto helps you stay ahead with Making Tax Digital for VAT:

1. Smart Integration with HMRC

Equallto seamlessly connects with HMRC’s MTD VAT portal, allowing users to file returns directly from within the platform — no manual uploads required.

2. Automated VAT Reminders

Never miss a submission date. Equallto automatically tracks filing deadlines and sends reminders well before each VAT period ends.

3. Secure Digital Record Management

Keep client VAT data, invoices, and ledgers in one secure digital location. Every record is stored safely and retrievable at any time.

4. Dashboard Insights for Accountants

Gain quick access to client filing status, VAT liabilities, and submission history from a single dashboard — ideal for firms managing multiple VAT clients.

5. Dedicated Support

Our UK-based support team assists practices with onboarding, software linking, and compliance questions, ensuring a smooth MTD journey.

Equallto isn’t just another software platform. It’s a digital partner that helps accountants and small firms transition confidently into the era of digital tax management.

Common Challenges in Making Tax Digital for VAT

While the benefits are clear, the shift to digital VAT management can still bring challenges — especially for smaller firms or first-time users. Here are the most common hurdles and how to overcome them.

1. Software Compatibility

Not all accounting tools meet HMRC’s MTD VAT requirements. Before committing to a system, check the list of HMRC-recognised software or use a trusted integration through Equallto.

2. Data Migration Issues

Transferring records from spreadsheets or legacy systems into new software can cause data errors. Run test submissions and keep backups during migration.

3. Late Registration

Businesses that forget to register on time may miss their first MTD VAT filing window. Register as soon as possible after receiving your VAT number.

4. Lack of Digital Skills

Some small business owners or solo practitioners feel unprepared for digital systems. Partnering with an MTD-ready accountant or using Equallto’s user-friendly interface makes compliance easier.

5. Connectivity Problems

Internet interruptions can delay digital submissions. Always save local copies and plan your submissions a few days before the HMRC deadline.

People Also Ask

1. How do I register for MTD VAT in the UK?

Visit the HMRC MTD VAT registration page, log in with your Government Gateway ID, provide your VAT registration number, and connect your digital tax software. Once confirmed, you’ll file your next VAT return through MTD software only.

2. Can I still file VAT manually under MTD?

No. Manual VAT submissions (such as typing figures into the HMRC portal) are no longer accepted. Only businesses granted digital-exemption status by HMRC — for reasons like disability, remote location, or religious grounds — can file manually.

3. How does Equallto™ support small practices with Making Tax Digital for VAT?

Equallto helps small practices handle VAT filing, record-keeping, and compliance in one place. It automates reminders, supports digital links, and integrates directly with HMRC — saving firms time and reducing compliance risks.

4. What software do I need for Making Tax Digital for VAT?

You’ll need MTD-compatible software recognised by HMRC. Tools like Xero, Sage, and QuickBooks are popular options, but Equallto also integrates with these systems — letting you manage MTD VAT through a single digital platform.

5. What happens if I don’t register for MTD VAT on time?

HMRC may issue penalties and apply interest on overdue VAT returns. Under the new points-based penalty system, repeated missed deadlines can result in escalating fines. Register early and use automated filing tools to stay compliant.

Conclusion

Making Tax Digital for VAT is not just about meeting HMRC’s compliance rules. It’s about modernising how businesses manage tax, improve accuracy, and free up time for growth. For UK accountants and small firms, adopting digital systems now will make future compliance smoother and less stressful.

With platforms like Equallto™, you can manage your VAT records, file returns digitally, and stay on top of every deadline — all in one place. Whether you’re guiding clients through their first MTD registration or looking to streamline your own processes, Equallto™ is your partner in building a smarter, more digital accounting future.

Start your MTD journey today. Go digital, stay compliant, and take control of your VAT with Equallto™.