Nearly 4 million taxpayers will shift to digital tax submission in 2026. The question many small accounting firms are asking is simple: Will we be ready?

With Making Tax Digital (MTD) now approaching its biggest rollout, accountants across the UK are rethinking how they manage Self-Assessment replacement rules, quarterly tax updates, and digital record keeping.

This transition affects more than compliance. It changes how clients work, how small to mid-sized accounting firms manage capacity, and how reliably tax data flows through each system. From self-employed individuals struggling with tax return deadlines UK wide, to small landlords unsure about digital tax submission, the pressure falls on accountants to guide, educate, and prepare them.

Ignoring MTD is no longer an option. It affects your workload, your staffing needs, and the expectations clients have as filing becomes more frequent and digital.

This guide explains who must comply, how the process works, which deadlines are important, common challenges, and how small accounting firms can remain efficient. You’ll also discover how Making Tax Digital tools, cloud-based accounting software, and tax compliance automation can lower errors and help you prepare clients confidently.

What Is Making Tax Digital and Who Must Comply

The purpose of MTD for UK tax administration

Making Tax Digital is designed to make the tax system more accurate, reduce mistakes, and provide quicker, clearer updates. Instead of relying on manual filing and paper records, HMRC wants to reduce late submissions and avoid errors caused by missing receipts, old spreadsheets, or incomplete information.

Who must follow Making Tax Digital in 2026

From April 2026, anyone earning over £50,000 from self-employment or property will need to follow the new digital income tax filing rules.

- Sole traders

- Landlords

- Individuals with combined property and trading income above the threshold

In April 2027, the requirement extends to those earning £30,000–£50,000.

Partnerships are expected to come in later phases, with exact dates yet to be confirmed.

How MTD changes traditional Self-Assessment

For many taxpayers, MTD becomes a Self-Assessment replacement.

Instead of one yearly return, they will upload digital records and send quarterly updates, then a final declaration. This results in more frequent contact with clients, and more ongoing support from accountants as data must stay accurate throughout the year.

How does it work?

Digital record keeping requirements

Under MTD, clients must maintain digital records through approved software. This includes income, expenses, invoices, receipts, and any transactions relevant to tax.

The aim is to reduce manual errors and keep all details secure in one place. These records must stay complete and be updated regularly to meet VAT record compliance and income tax rules.

Quarterly tax updates instead of annual returns

Instead of waiting for one yearly deadline, clients must submit updates every three months.

These quarterly tax updates show HMRC an estimate of the tax owed, creating a clearer picture of liabilities throughout the year. It also reduces last-minute pressure during the traditional tax season.

The role of digital tax submission software

Approved tools are essential for MTD. These may include:

- Cloud-based accounting software

- Bridging software that links spreadsheets to HMRC

- Tools that support automated VAT returns and digital tax submission

While bridging software works as a temporary solution, many small accounting firms prefer to switch to full accounting platforms, especially when managing multiple clients.

How real time tax reporting improves accuracy

Real time tax reporting reduces the chances of mistakes that come from annual data entry.

When transactions flow directly from banks or bookkeeping tools, the tax audit trail becomes clearer, and tax error reduction becomes easier. This also helps accountants create more accurate projections throughout the year.

MTD Deadlines – What You Need to Know for 2026 and Beyond

Key dates for income tax digital filing

- April 2026: MTD applies to self-employed individuals and landlords earning over £50,000.

- April 2027: Threshold expands to £30,000; £50,000.

Those earning below £30,000 are not yet included. This may change in future phases.

VAT registered business obligations under existing MTD rules

VAT registered businesses already follow MTD rules for VAT record compliance, automated VAT returns, and digital record keeping. These requirements remain in place for all VAT-registered businesses, including those below the threshold.

Future expansion of Making Tax Digital

HMRC has hinted at including partnerships, more categories of taxpayers, and broader tax return digitalisation beyond 2027. Small accounting firms should prepare for ongoing change as digital tax systems continue to evolve.

How do I register for MTD?

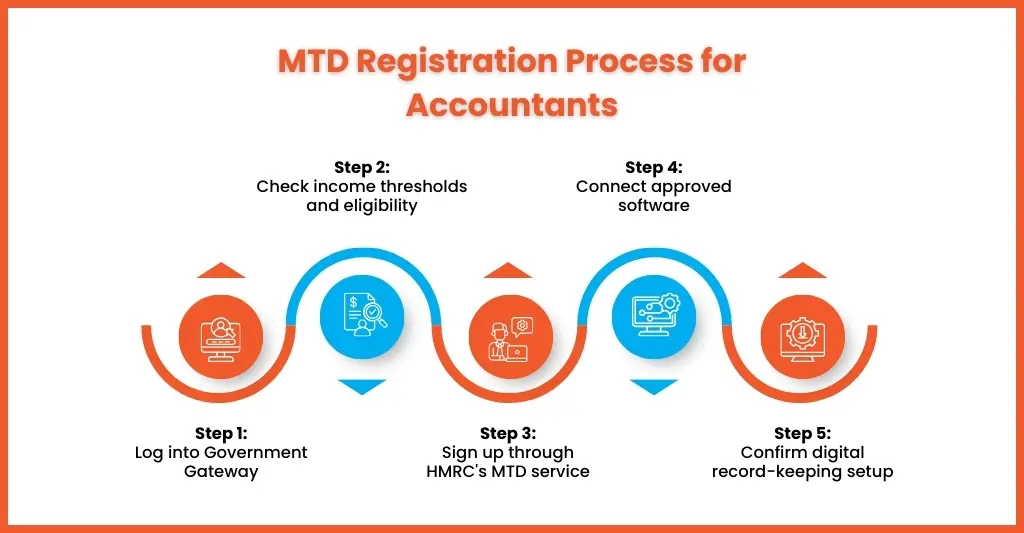

Steps to register clients for MTD

- Log into the client’s Government Gateway account.

- Check income thresholds and eligibility.

- Sign the client up through HMRC’s MTD service.

- Connect approved software for digital tax submission.

- Confirm that digital record-keeping is in place before the first quarterly update.

Choosing the right digital software

When comparing tools, look at:

- Compatibility with HMRC

- Ease of onboarding for clients

- Automation features that eliminate manual tax filing

- Cost-effectiveness for small and mid-sized accounting firms

- Availability of real time tax reporting

Preparing clients for the shift

A simple checklist can help:

- Review current bookkeeping habits.

- Identify clients who still depend on paper.

- Introduce cloud-based accounting software early.

- Provide guidance on digital record keeping.

- Schedule quarterly reminders.

- Set up automated data feeds where possible.

Common Challenges Practices Face with MTD & How to Overcome Them

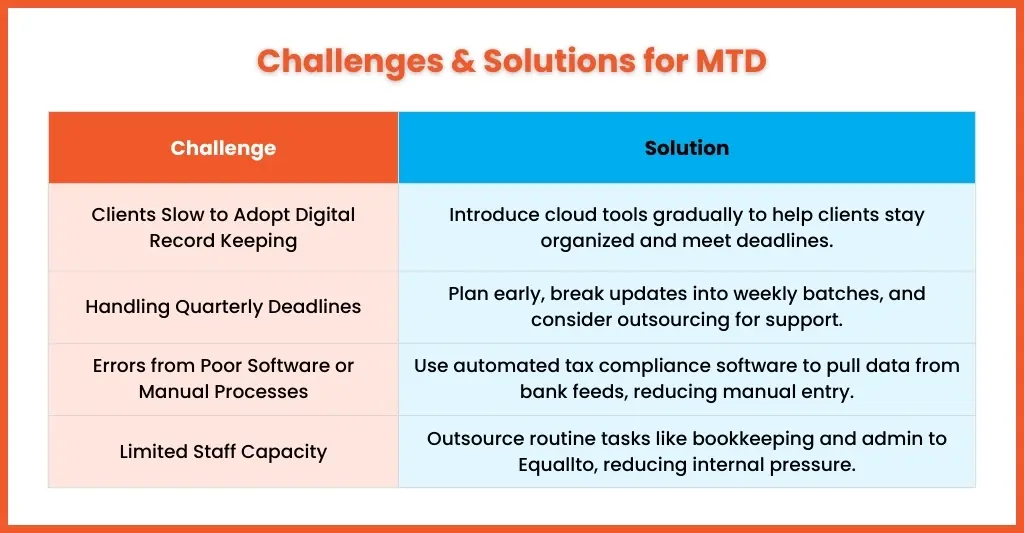

Clients who are slow to adopt digital record keeping

Some clients still rely on paper receipts or handwritten notes. Guide them gradually by showing how cloud tools keep records organised and reduce stress around tax return deadlines UK small accounting practices deal with every year.

Handling quarterly deadlines for multiple clients

Quarterly updates create more frequent peaks in workload. Mid-sized accounting practices can prepare by assigning responsibilities early, breaking updates into weekly batches, or using external support for bookkeeping and admin.

Errors caused by poor software or manual processes

Using multiple tools or outdated spreadsheets can cause mismatched figures, missing entries, and lost data. Tax compliance automation solves these issues by pulling data directly from bank feeds and reducing manual entry.

Limited staff capacity in small and mid-sized firms

Not all accounting practices have the resources to handle extra submissions.

This is where Equallto supports accountants. We provide help with bookkeeping, digital uploads, admin, and routine tasks so small accounting firms stay compliant without increasing internal pressure.

How Making Tax Digital Software Simplifies Compliance (and Why It Matters)

Automated VAT returns and reduced manual entry

Making Tax Digital -compatible software prepares VAT calculations and updates automatically, which helps small accounting firms avoid common mistakes and improves accuracy across all records.

Cloud-based tools that keep everything organised

Cloud systems keep documents, receipts, and transaction records in one place. This creates clean data, easier checks, and a solid tax audit trail when HMRC reviews submissions.

Real time tax reporting for accurate projections

When tax figures update instantly, accountants can give clients accurate projections throughout the year. This supports better planning and reduces tax error reduction issues from outdated records.

Why bridging software may or may not be a long-term solution

Bridging software works for clients who still use spreadsheets, but it can become limiting as requirements grow.

It is helpful for a transition period, though many small accounting firms eventually move to full digital platforms for smoother income tax digital filing and quarterly updates.

Best Practices for Accounting Firms to Stay MTD Compliant and Efficient

Create a digital-first workflow

- Update all client records in digital format.

- Use tools that integrate bookkeeping, invoices, and tax submissions.

- Keep internal processes aligned with quarterly cycles.

Train clients on digital record-keeping habits

- Offer short walkthroughs on how to upload receipts.

- Encourage consistent updates instead of last-minute uploads.

- Share templates and guides for smoother onboarding.

Standardise processes around quarterly tax updates

- Create clear deadlines for internal review.

- Assign responsibilities to team members.

- Set reminders for clients at least one month before updates are due.

Outsource routine work to free internal time

Outsourcing bookkeeping or admin tasks can keep your team focused on tax planning, advisory work, and higher-value client support. Equallto can help by taking on routine compliance tasks so your team stays efficient.

FAQ — Making Tax Digital: Common Questions

What if my business isn’t VAT registered — do I still need to follow Making Tax Digital now?

Only VAT registered businesses follow MTD for VAT today. For income tax, Making Tax Digital starts in 2026 based on earnings. If clients earn above £50,000, they must follow the rules from April 2026 even if they are not VAT registered.

What happens if I miss an MTD deadline or submit late?

HMRC applies late submission points and financial penalties. Missing quarterly updates may also affect the accuracy of a client’s annual position.

Is Making Tax Digital suitable for small practices or solo accountants?

Yes. In fact, smaller practices benefit most from digital tax submission because it reduces manual steps and helps manage multiple clients more efficiently.

Do I still need to keep paper copies of my records?

MTD requires digital records. You can keep paper copies if you prefer, but they don’t count as your official records for compliance.

Can I use Excel with bridging software to stay compliant?

Yes, you can for now. Bridging software works as a temporary solution, but full digital tools are more accurate and reduce errors.

Conclusion

MTD in 2026 introduces quarterly tax updates, digital tax submission, structured digital record keeping, and new income thresholds. It marks a shift away from manual tax filing and brings more regular reporting throughout the year.

Equallto supports accountants with bookkeeping, uploads, admin tasks, automated processes, and digital record maintenance. This helps small to mid-sized accounting firms stay on track with MTD requirements without stretching internal teams.

If you need help with digital records or getting ready for MTD, our team is here for you. Speak with us, ask questions, or book a quick consultation before the 2026 deadline.