If there is any one compliance task that has the capability to spook even the most experienced small accounting practice in the UK, then VAT Return can claim to be one. At every quarter, it brings familiar but formidable challenges: incomplete records, last-minute client queries, software issues, and pressure of getting things right.

To top it all, HMRC will not be lenient when it comes to enforcement and with over 2 million VAT-registered businesses in the UK, comes the volume, leaving you with less room for correcting any error.

To streamline the process, we have prepared this guide, which will cut the clutter associated with VAT returns. We will guide you through what a VAT Return is, how to do a VAT Return properly, and how practices can avoid common pitfalls, without turning VAT into a time drain.

What Is VAT Return?

VAT returns are reports that every VAT-registered business has to send to HMRC every quarter. It contains details of the VAT they have charged on the sales and the VAT they have paid on the purchases.

The business has to pay the difference between the VAT on sales (output VAT) and the VAT on purchases (input VAT). If the output VAT exceeds the input VAT, the business will be liable for paying to the HMRC.

Under MTD for VAT rules, VAT returns are required to be submitted digitally using MTD-compliant accounting software. Due to the complex nature, businesses have handed over the responsibility of handling VAT returns to professional and experienced accounting practices. To know more, check out our guide on MTD for VAT.

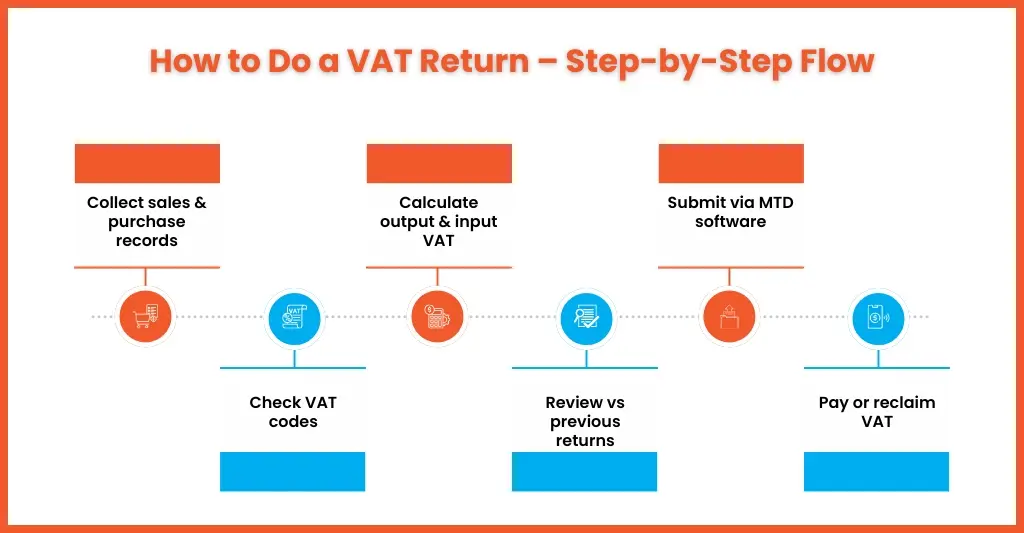

How to Do a VAT Return (Step-by-Step)

Preparing a VAT Return accurately and smoothly demands more than just pressing a submit button. You will need to have a set of steps that you follow to quicken your VAT Return process. Let’s go through those steps:

Step 1: Gather Accurate Financial Records

Connect with your clients and collect all the sales and purchase data for the quarterly VAT period, and get it verified. Missing invoices or unreconciled transactions are one of the biggest causes of errors.

Step 2: Check VAT Codes Carefully

Mistakes in VAT coding leads to overpayments, underpayments, and HMRC queries. This mistake is common with mixed-rate supplies or partially exempt clients.

Step 3: Calculate Output and Input VAT

Once you have collected all the data and verified its accuracy, the output and input VAT must be calculated.

- Output VAT: VAT charged to customers

- Input VAT: VAT reclaimable on allowable expenses

Step 4: Review Before Submission

Review the figures you have arrived at with your clients’ previous VAT Returns. Any large fluctuations will generate interest from HMRC, and you must ask about it from your clients so that you can explain it to HMRC on their behalf.

Step 5: Submit the VAT Return via MTD Software

As mandated by MTD rules for VAT, all VAT Returns must be submitted digitally to HMRC using an MTD-compliant accounting software.

Step 6: Confirm VAT Payment or Refund

Submission of the VAT return is half the job done. Ensure the VAT amount is paid or refunded correctly and on time.

Components of a VAT Return

A VAT return contains some key components, and understanding them is essential for accurate and compliant reporting. These components are:

- Total sales

- Total purchases

- VAT due on sales (Output tax)

- VAT reclaimable on purchases (Input tax)

- Net VAT payable or refundable

Among them, let’s focus on the important ones:

- Output tax: Adds up all the VAT charged on the sales made.

- Input tax: Adds up all the VAT paid on the purchases made.

- Net VAT due: That’s what you get when you subtract total input tax from total output tax. When your output tax is more than your input tax, your clients owe the difference to the HMRC. If it’s vice versa, then your clients can claim it from the HMRC.

Types of VAT Returns and Schemes

Some of the typical UK VAT Return schemes are:

VAT Flat Rate Scheme

This scheme lets you work out what your client owes HMRC in VAT as a percentage of your gross turnover. This scheme can be used only if your client is a small business owner with an annual taxable turnover of £150,000 or less excluding VAT. The amount of VAT will depend on the industry and type of business.

If your client’s annual VAT taxable turnover is £1.35 million or less, then they are eligible for the:

- VAT Annual Accounting Scheme: Complete one VAT return each year instead of 4

- VAT Cash Accounting Scheme: Pay VAT to HMRC when your customer pays you rather than when you invoice them

VAT Return Example

Making it simple through an example:

- Sales: £10,000 (20% VAT)

- Purchases: £4,000 (20% VAT)

Output Tax Calculation

- Total sales: £10,000

- Output tax: £10,000 * 0.20 = £2,000

Input Tax Calculation

- Total purchases: £4,000

- Output tax: £4,000 * 0.20 = £800

Net VAT Calculation

- Output tax: £2,000

- Input tax: £800

- Net VAT: £2,000-800 = £1,200

Your client owes HMRC £1,200

Who needs to submit a VAT Return?

Making an MTD-compliant VAT return is compulsory for all businesses in the UK if they fulfil the following points.

- VAT-registered businesses

- Businesses whose taxable turnover goes over £90,000 in a 12-month rolling period

- Businesses with zero activity during the period

- Businesses registered voluntarily

Failing to submit even a nil VAT Return will be taken by HMRC as non-compliance.

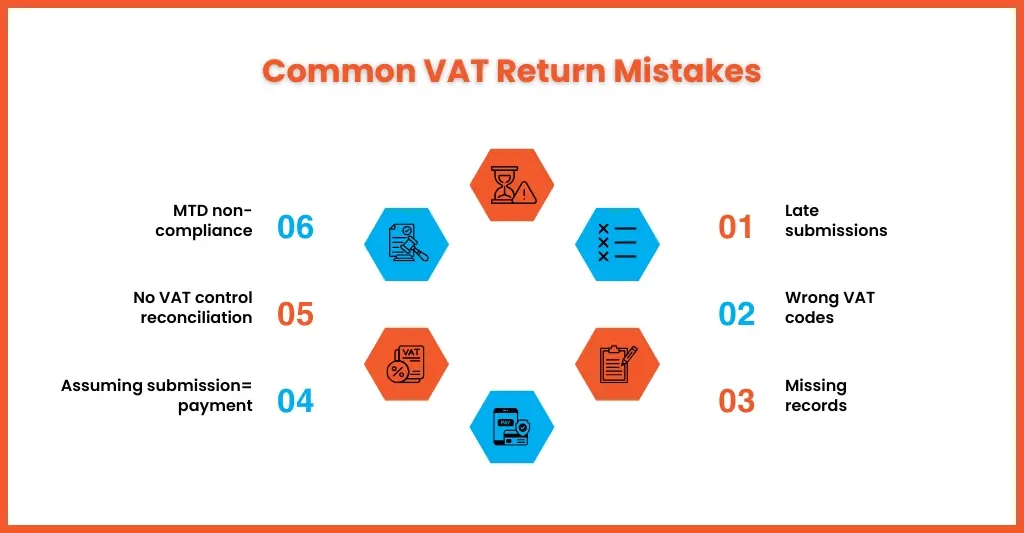

Common VAT Return Mistakes to Avoid

For an experienced small accounting practice, handling VAT returns should not be a problem, from a technical knowledge point of view. The problem starts due to timing issues and gaps in the processes. These same issues keep coming up quarter after quarter.

Let’s understand those common VAT Return mistakes and why they matter.

Submitting Late Due to Missing Information

One of the primary reasons for late VAT returns is the result of incomplete records.

Common causes include:

- Clients submitting invoices late

- Missing expense receipts

- Unreconciled bank transactions

- Delay from the client’s end to answer your queries

Often, we have noticed the clients send the requested information or answers close to the deadline, leading to rushed verification and increasing the chances of errors. Therefore, encourage your clients to provide information at the earliest, so that proper review can be done without resorting to rushing it.

Incorrect VAT Coding

Another mistake that keeps coming up is the errors made in VAT coding.

These often arise from:

- Zero-rated vs exempt confusion

- Incorrect treatment of mixed-rate supplies

- Wrong VAT treatment on imports or reverse charge transactions

Manual Coding By Clients Without VAT Knowledge

Errors in VAT coding will lead to over- or underpayment of VAT, triggering HMRC scrutiny. Such errors can reduce your clients’ trust in your practice. To avoid such mistakes, conduct regular reviews and clear coding rules before submission. Focus on automating through MTD-compliant accounting software, which is the future of accounting.

Assuming Submission Means Payment Is Complete

We have increasingly noticed clients considering that VAT return submission to payment will be sorted automatically, which is incorrect. Submission of the VAT Return must be regarded as half a job done.

It must be noted that:

- Submission and payment are separate actions

- Direct Debits require advance setup

- Manual payments can get delayed or missed

Such assumptions by clients lead to delayed VAT payments, even when VAT returns have been filed. For your practice, it means more follow-ups, client explanations, and potential penalties. Therefore, clear the confusion with your clients from the start to avoid this scenario.

Not Reconciling VAT Control Accounts

Skipping VAT control account reconciliation is a hidden but serious risk.

Without reconciliation:

- Differences between accounting records and HMRC figures go unnoticed

- Errors compound over multiple VAT periods

- Refunds or liabilities may be misstated

With time, it contributes towards confusing adjustments and challenging conversations with your clients. Hence, conduct regular VAT control reviews to ensure every VAT return aligns with the accounting records, thus reducing corrections in future.

Missing Making Tax Digital (MTD) Compliance Requirements

Compliance with MTD for VAT rules is compulsory, but it has still become a stumbling block for many.

Mistakes include:

- Using non-MTD-compatible software for submissions

- Doing manual data entry where digital records are required

Non-compliance with MTD rules will lead to HMRC rejections or penalties, even if the VAT return figures are correct. Therefore, compliance is met.

Best Practices and Tools for Easier VAT Returns

The best way to handle VAT returns is to treat them like a process and not a task which comes every quarter in a year.

Some of the best practices to follow while filing VAT returns are:

- Filing VAT Returns early and not close to or on the deadline day

- Using checklists for submission and payment

- Creating awareness among your clients that filing is not payment

- Reviewing VAT data monthly, not quarterly

Start using VAT outsourcing services to handle your clients’ VAT returns through experienced accountants using MTD-compliant software. Compared with in-house accounting, outsourcing will reduce your reliance on memory and manual follow-ups, especially during busy periods.

People Also Ask

What is the minimum turnover to register for VAT?

VAT rules in the UK require a business to become VAT registered if its taxable turnover hits the £90,000 threshold in any rolling 12-month period.

How to do a VAT return online using my tax authority portal?

VAT Returns must be submitted digitally via MTD-compatible software that connects to HMRC. Direct portal entry is no longer available for most businesses.

Can I do a VAT return myself, or should I use an accountant?

Simple cases can be handled in-house, but accountants add value by reducing errors, ensuring compliance, and managing HMRC interactions.

What happens if I make a mistake when doing a VAT return?

Mistakes can often be corrected on the next VAT Return or via a formal disclosure, depending on the size of the error.

Conclusion

VAT return looks simple, but it actually has many layers, making it complex. Some of those layers are tight deadlines, multiple clients, evolving rules, and zero tolerance for errors. Innovative accounting practices understand these complexities and are tackling them by investing in transparent processes, better visibility, and systems that reduce last-minute pressure. But that needs investments, which small accounting practices lack. In such situations we consider outsourcing is a better bet than in-house accounting.

Enter Equallto, which is making a name by supporting small accounting practices in their endeavor to offer the best VAT services to their clients. Our services are designed to bring clarity to VAT workflows, so that you have less firefighting and more high-value client advisory work.

If you need any assistance with your VAT-related work, use our contact form and see the difference.