Are you considering outsourcing your bookkeeping tasks to a professional outsourcing provider but worried whether it will work or be necessary for your small accounting practice? We understand your concern and can assure you that countless small accounting practices in the UK are already outsourcing their accounting tasks to professional service providers. It has worked wonders for all of them.

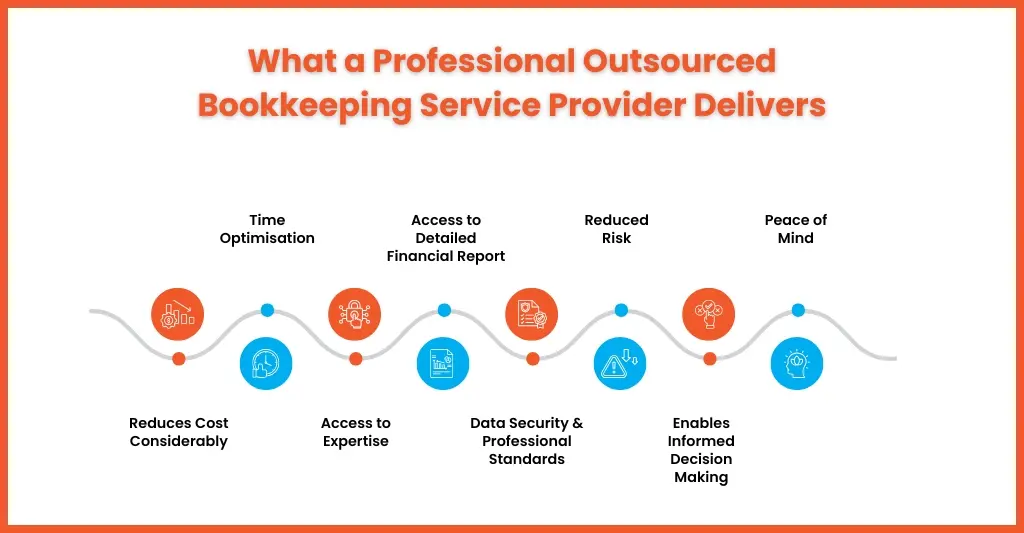

Wondering what to expect from a professional outsourcing bookkeeping service. Here’s what you must realistically expect.

Reduces Cost Considerably

There is a misconception that outsourcing bookkeeping costs more. However, it reduces costs compared to operating an in-house bookkeeping team. When you outsource bookkeeping, you will pay only for the services you want, without incurring the costs of full-time or part-time staff, supporting infrastructure, or recruitment and training.

Time Optimisation

Yes, even for a small accounting practice, bookkeeping can be time-consuming, especially when handling large clients with limited staff. There was a time when bookkeeping was the core responsibility of an accounting practice. But now it is contributing more stress due to HMRC’s complex regulatory requirements.

Using bookkeeping outsourcing services will save your precious time, which can be diverted toward value-adding services like consultancy.

Access to Expertise

Professional outsourcing service provider will give you access to bookkeepers who are experienced in handling bookkeeping tasks and well-versed with UK accounting regulations and standards. There by, reducing the need for bearing training or recruitment cost.

Access to Detailed Financial Report

Professional bookkeeping service providers offer dashboards through which you can have real-time access to the financial reports of your clients. These reports can then be forwarded to your clients or their stakeholders for transparency, thereby contributing to informed decision-making.

Data Security & Professional Standards

A reputable service provider will always place emphasis on strong data security, measured through encryption and related measures. By complying with UK GDPR, the Data Protection Act 2018, and adopting the best accounting software such as Xero and QuickBooks, professional providers have gained the trust of many small accounting practices regarding the data security of sensitive client information.

Reduced Risk

When a professional provider handles your bookkeeping, you can be assured that it will save you from costly mistakes and tax penalties. Thanks to its experienced accountants and stronger internal checks that identify and rectify errors.

Enables Informed Decision Making

A professional outsourcing provider will present you with refined data using easy-to-understand financial reports (with graphs, pie charts, and diagrams). Such detailed reports will enable you and your clients to make informed decisions without any confusion.

Peace of Mind

When you hand over bookkeeping to a professional service provider, you can be assured that experts will handle it. Thus, reducing your stress around deadlines, VAT, and other compliance. The onboarding process will also be smooth without disrupting your daily accounting operations.

People Also Ask

Can I Manage My Own Bookkeeping?

Yes, it is possible, but it will be time-consuming and complex due to HMRC regulations and UK accounting standards. Therefore, if you are going to handle bookkeeping on your own, then you should have a good understanding of UK accounting standards. Using accounting software will ease your workload and make tracking easier.

Is it a good idea to outsource bookkeeping?

Outsourced bookkeeping services are cost-effective and more accurate than in-house bookkeeping. Also, you will be saving a lot on overhead costs.

How Do I Choose the Right Bookkeeping Service?

Gather information about an outsourcing service provider before selection. These information are about staff experience, certification, and reputation to deliver timely and accurate reports. Also, check their reviews and case studies for deeper analysis.

How much does it cost to outsource bookkeeping services?

Costs vary depending on the level of service, but outsourcing is generally more cost-effective than hiring an in-house bookkeeper.

Conclusion

It’s a fact that outsourcing will open the gates of benefits for your small accounting firm; you will only need to choose the right bookkeeping outsourcing provider. And how will you find it, by knowing its expertise in UK accounting standards, compliance, use of the latest accounting software, and services that match your requirements.

Equallto can match your requirements and meet your future needs, keeping your practice ahead of the curve through its bookkeeping outsourcing services. If you have any special requirements for the bookkeeping, then state them on the contact form. Looking forward to interacting with you soon.